The Rising Role of Technology in Reshaping Accounting Practices

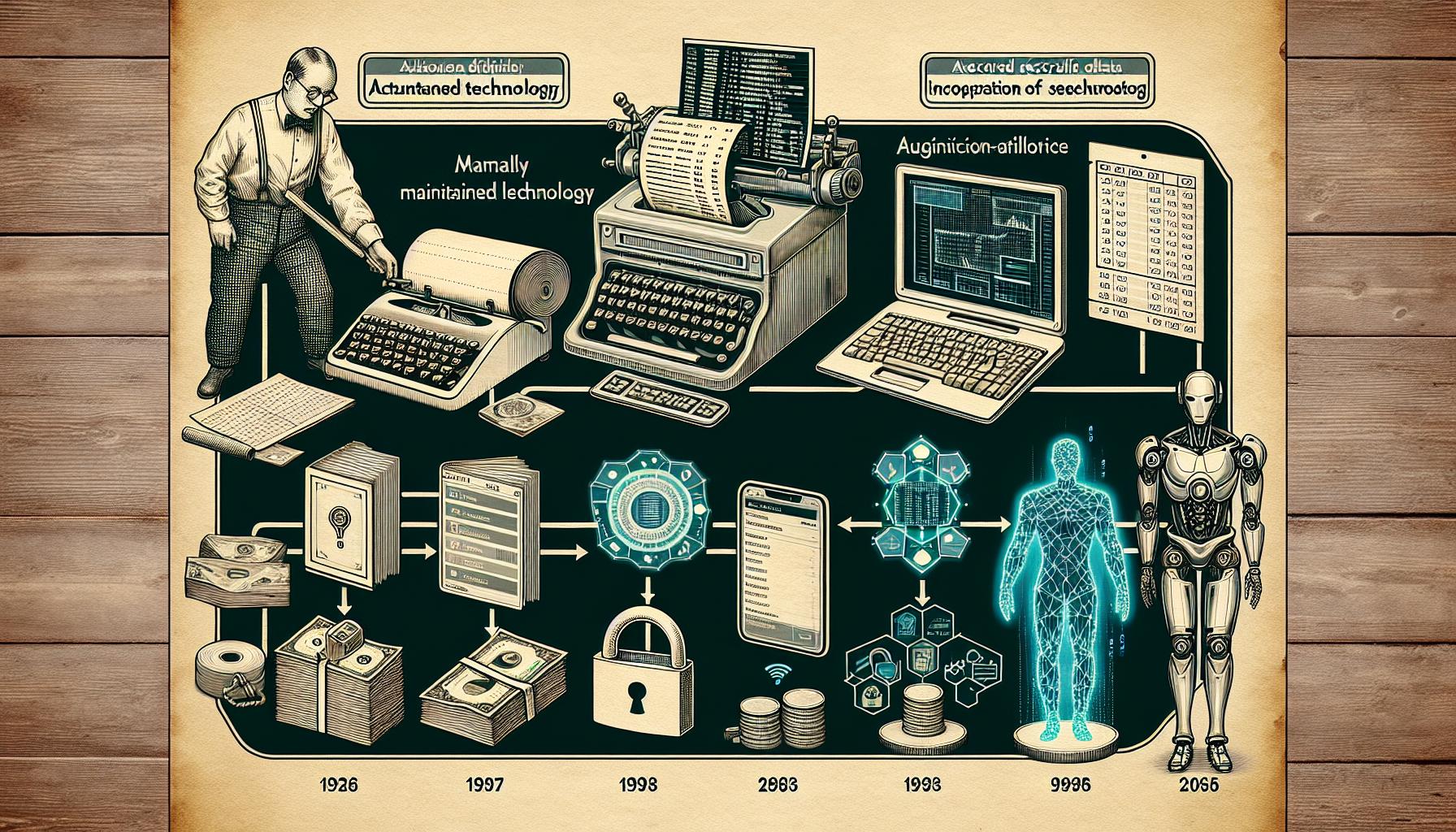

The accounting industry has undergone a profound transformation driven by rapid technological advancements. The shift from manual record-keeping to sophisticated software solutions has revolutionized the accounting landscape, ushering in an era of heightened efficiency and accuracy. In this article, we will delve into the pivotal role of technology in reshaping accounting practices and explore how accountants and businesses of all types can harness these innovations for enhanced outcomes.

Embracing Automation

Studies have consistently shown that organizations adopting automation in their accounting processes experience a substantial reduction in errors. That is why automation is one of the most remarkable transformations within the accounting realm. The days of manual data entry into ledgers and journals, a process prone to human error, are long gone. Modern accounting software seamlessly integrates with diverse financial systems, automating tasks such as data entry, bank reconciliation, and invoice processing. For example, McLedger Accounting integrates with many third-party applications, supporting clients by saving valuable time while reducing the risk of errors and leading to more precise financial reporting.

Real-time Data Insights

The advent of cloud-based accounting solutions has turned real-time financial data availability into a reality for businesses of all sizes. Gone are the days of waiting for month-end or quarter-end reports to gauge a company’s financial health. In the present landscape, businesses can access up-to-date financial information at any given moment, empowering them to make well-informed decisions promptly. This instant access to data cultivates agility and adaptability in an ever-evolving economic terrain.

Enhanced Financial Security

The rapid integration of technology has underscored the paramount importance of data security and privacy within the accounting industry. As sensitive financial data is transmitted and stored electronically, robust security measures have become paramount to safeguarding sensitive information. Cloud-based accounting platforms have responded by heavily investing in state-of-the-art encryption protocols and multi-factor authentication to fortify defenses against cyber threats. Notably, data privacy has come a long way, ensuring that only the user retains access to their confidential financial information; stringent measures are in place to ensure that even the accounting software company cannot access this data. This reassurance empowers businesses to confidently entrust the security of their financial information, substantially mitigating the risks of potential breaches.

The Power of Artificial Intelligence (AI)

Artificial Intelligence (AI) is steering a revolution in analyzing data, identifying patterns, and fundamentally altering the landscape of financial analysis. AI-powered algorithms adeptly process extensive financial data, aiding business owners in anomaly detection, trend prediction, and the identification of potential areas for cost optimization. For instance, consider an e-commerce business harnessing AI to navigate the digital marketplace. By analyzing sales data, customer behavior, and market trends, AI can predict which products are likely to be popular in the upcoming season. This insight empowers the e-commerce business to optimize inventory, tailor marketing campaigns, and even adjust pricing strategies to capitalize on projected demand. This kind of predictive analytics can lead to increased sales, reduced surplus inventory, and ultimately improved profitability. By merging human expertise with AI-generated insights, businesses can shift their focus from routine tasks to strategic decision-making and value-added services for their clients.

Adapting to Regulatory Changes

In today’s globalized economy, businesses must keep pace with ever-evolving regulatory requirements. Technology serves as a linchpin for compliance by automating tax calculations, generating precise financial reports, and ensuring adherence to the latest financial reporting standards.

For example, the UAE has a standard Value Added Tax (VAT) rate of 5%. However, some goods and services are not taxable, and VAT is applicable to specific amounts, necessitating accurate tax calculations and reporting. With numerous transactions occurring daily, manual computation is impractical and prone to errors. By integrating automated tax software tailored to the UAE’s VAT regulations, a firm can ensure that each transaction is accurately assessed for VAT. The software automatically applies the appropriate VAT rate and highlights discrepancies or exceptions, streamlining the process and enhancing accuracy. This not only ensures compliance with the UAE’s tax regulations but also frees up valuable time for the firm to focus on providing value-added services for its clients.

Catalyzing Financial Success

The belief in technology as a cornerstone to unlocking a business’s true financial potential is resolute. The evolution of accounting through technology has ushered in a new era of efficiency and accuracy. Automation has replaced error-prone manual processes with seamless software integration, offering significant time savings and improved accuracy in financial reporting. Real-time data accessibility empowers businesses to make informed decisions promptly, while stringent security measures fortify the protection of sensitive financial information. Artificial Intelligence drives pattern recognition and strategic insights, enhancing decision-making, and technology aids compliance with evolving regulations. Across industries and scales, the commitment to harnessing technology’s potential propels businesses toward streamlined operations, data-driven choices, and ultimately, financial success in the modern digital landscape.

Analyst comment

Positive news: The rising role of technology in reshaping accounting practices has led to heightened efficiency, accuracy, and financial success. Automation has reduced errors and saved time. Real-time data insights enable informed decision-making. Enhanced security measures protect sensitive financial information. Artificial intelligence offers predictive analytics for cost optimization. Technology aids compliance with regulatory changes.

As an analyst, the market for accounting software and technology solutions is expected to grow as businesses recognize the value and benefits of incorporating technology into their accounting practices. This will lead to increased demand for automation, real-time data solutions, enhanced security measures, and AI-powered analytics in the accounting industry.