Polygon's MATIC Token at a Critical Juncture: Navigates Price Fluctuations and Upcoming Network Upgrades

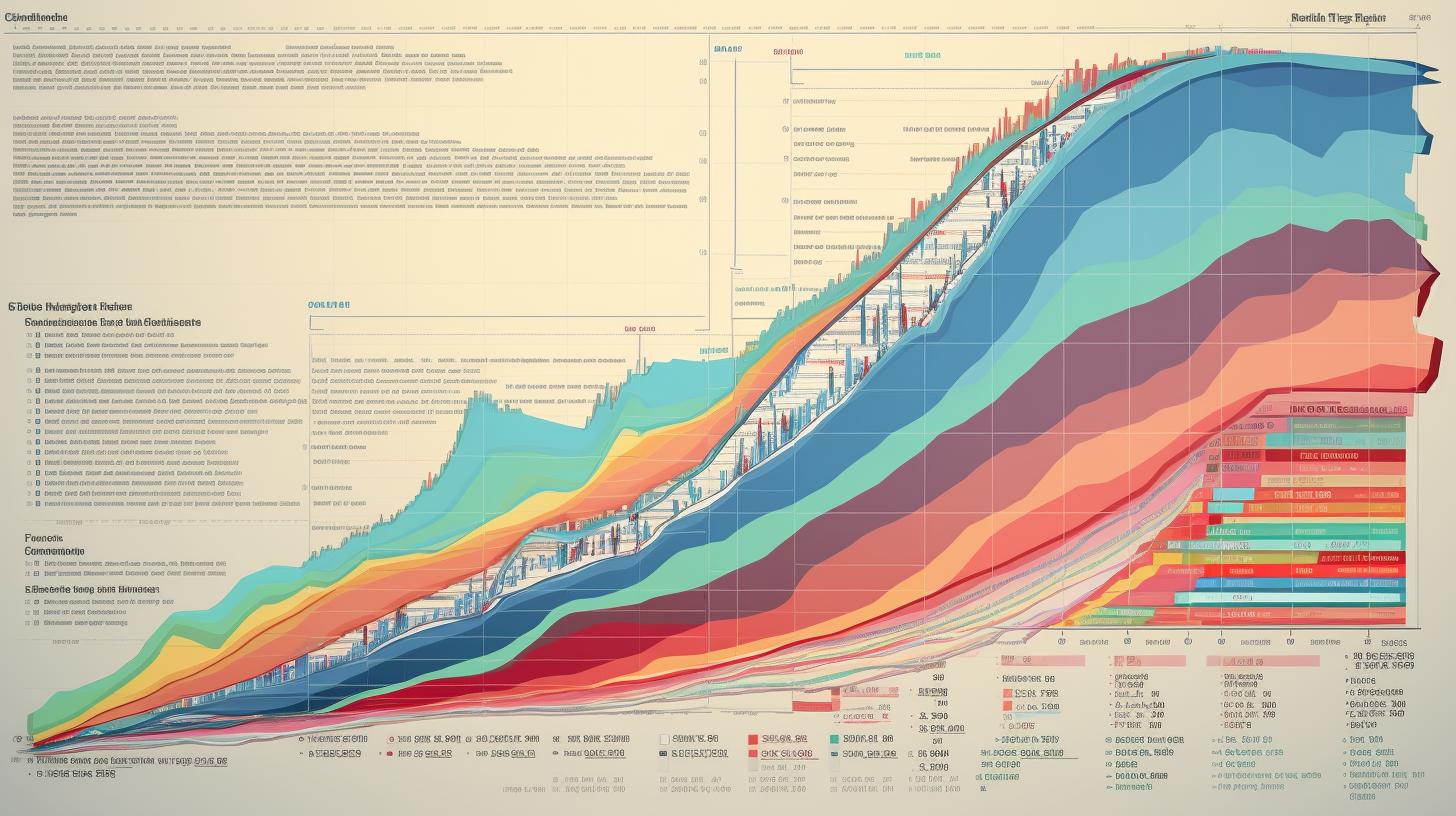

In the volatile realm of cryptocurrency, Polygon's native token, MATIC, stands at a crucial intersection, battling price volatility while gearing up for a significant network upgrade and addressing concerns over its Total Value Locked (TVL). Over the past week, MATIC experienced a downturn, witnessing a 4.44% slip in price as highlighted by CoinMarketCap. Despite a surge of optimism that previously propelled it near the $2 benchmark, it has since faced a hurdle, stabilizing around the $1 level amidst challenging market conditions.

Current data analysis sheds light on a mixed bag for MATIC holders. Approximately 51% find themselves in the red, while 43% have seen gains, leaving a small 5% hovering at break-even. This scenario aptly reflects the high-risk nature attached to cryptocurrency investments.

Nevertheless, amidst these turbulent waters, a beacon of hope shines for MATIC enthusiasts via the forthcoming "Napoli upgrade." Aimed at enhancing the network's consensus mechanisms, this upgrade plans to introduce improvements in parallel execution and add new operational codes for the Ethereum Virtual Machine (EVM). Market analysts speculate that this strategic move might spark a resurgence in buying interest, potentially elevating MATIC's price towards $1.30, conditional on prevailing bullish sentiment.

However, the optimism surrounding the Napoli upgrade is counterbalanced by challenges, most notably a significant drop in **Total Value Locked (TVL)**—from its 2021 peak to a stark $1 billion. This downturn has sparked concerns over reduced liquidity provision and the overall health of the protocol.

Despite these hurdles, Polygon's leadership maintains a confident outlook, emphasizing the protocol's resilience and adaptability. They assert that the confluence of the Napoli upgrade and targeted initiatives to combat issues like TVL will solidify Polygon's foothold in the competitive landscape of cryptocurrency.

As the industry keeps a watchful eye on Polygon's maneuvers, the interplay between the potential uplift from the Napoli upgrade and the drag from dwindling TVL paints a complex picture for MATIC's future. Its capability to bounce back amidst market vagaries and strategic challenges will dictate its path in the short-term market scenario.

The unfolding dynamics of MATIC’s price performance intertwined with the much-anticipated Napoli upgrade and the undercurrents around TVL complexity capture the essence of the cryptocurrency market's intricacies. As Polygon carves its path, its adaptability and innovative strides will be critical in cementing its stance in an ever-shifting domain.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. The views expressed within are not recommendations to buy, sell, or hold any investments. Investing involves risks, and it is recommended to conduct personal research before making any investment choices. The information provided is used at your own risk.

Analyst comment

Overall, this news can be evaluated as neutral.

As an analyst, the market for Polygon’s MATIC token is likely to face continued price volatility in the short-term. The upcoming Napoli upgrade has the potential to drive buying interest and push the price towards $1.30, but concerns over the drop in Total Value Locked (TVL) pose challenges. The market will closely monitor Polygon’s ability to navigate these factors and adapt to the ever-changing cryptocurrency landscape.