AI’s Growing Influence on Stock Market Performance

Artificial intelligence (AI) has become one of the most powerful tools in the modern business landscape. Its impact is not limited to just the tech industry, as it is increasingly playing a crucial role in the stock market. Over the past few years, AI has been revolutionizing the way investors make decisions, analyze data, and predict market trends. As the technology continues to advance, its influence on stock market performance is only set to grow.

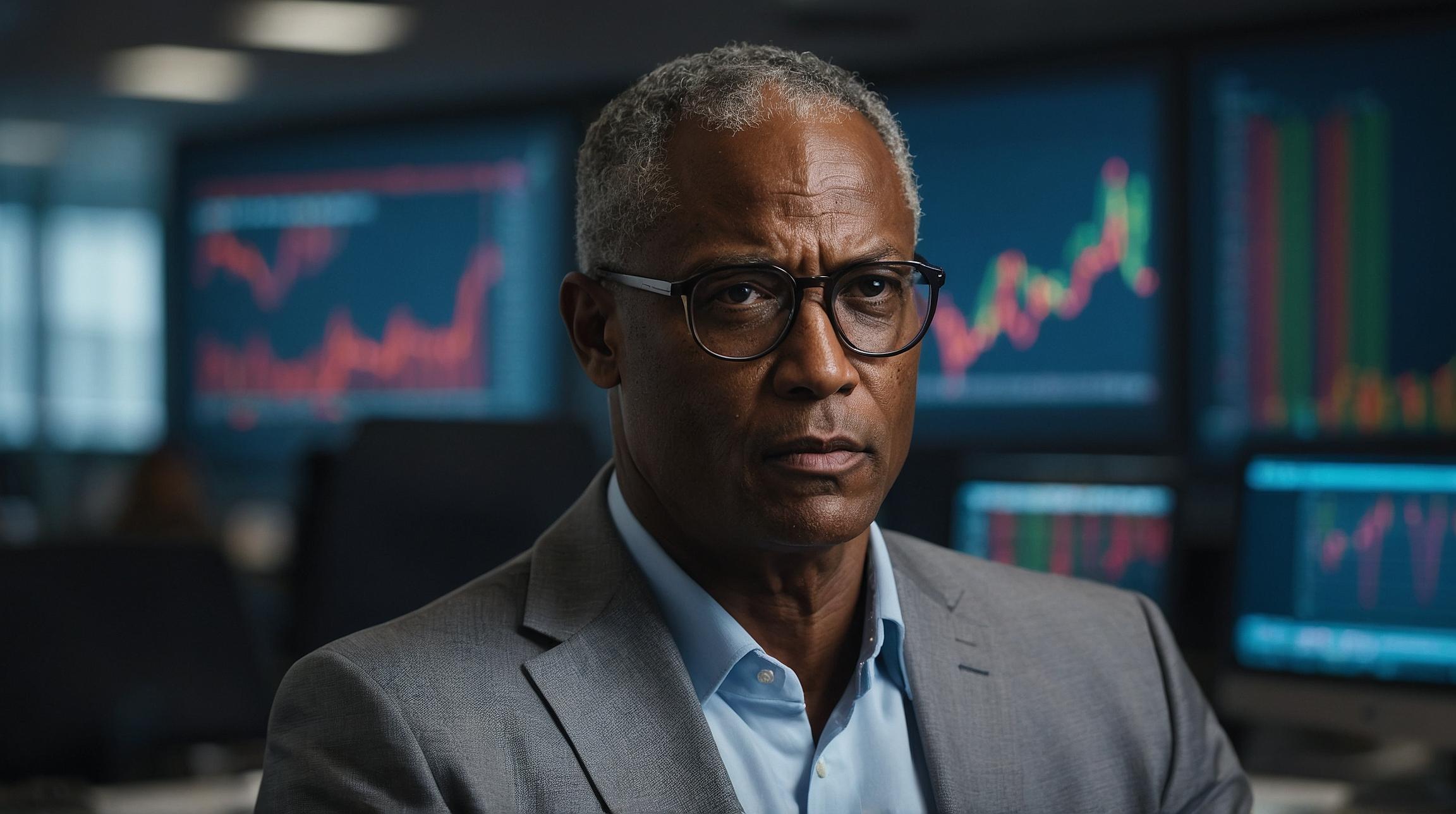

Joe Zhao Explores AI’s Impact on Stock Moves

Joe Zhao, Managing Partner at Millennia Capital, recently shed light on how AI is affecting stock moves. In an interview with Cheddar, he highlighted the growing importance of AI in the market. Zhao emphasized that AI is now a crucial tool for traders, enabling them to process and interpret enormous amounts of market data quickly. With AI algorithms, traders can identify patterns and trends, gaining insights on the best times to buy or sell stocks. Zhao pointed out that the ability of AI to process large volumes of information in real-time allows traders to react swiftly to market changes, increasing their chances of success.

Moreover, Zhao explained that AI algorithms have the capability to understand and incorporate both structured and unstructured data, including news articles, social media sentiment, and company reports. This widens the pool of information available for analysis, providing traders with a more comprehensive view of the market. With this enhanced visibility, investors can make more accurate predictions and respond to market trends effectively.

Unpacking the Role of Artificial Intelligence in Stock Market Trends

Artificial intelligence plays a crucial role in identifying stock market trends. By analyzing vast amounts of historical data, AI systems can recognize patterns and correlations that are often missed or overlooked by human investors. These insights provide valuable guidance to traders, helping them make well-informed decisions. Furthermore, AI’s ability to continuously learn and adapt makes it particularly effective in identifying emerging market trends and adapting investment strategies accordingly.

In addition to analyzing historical data, AI systems can also process real-time market information. They monitor news headlines, social media sentiments, and other relevant sources to identify potential market-moving events. By reacting quickly to breaking news or sudden shifts in sentiment, traders using AI-equipped systems can gain a competitive advantage and capitalize on market opportunities that would otherwise be missed.

The Intersection of AI and Stock Market Strategy

The intersection of AI and stock market strategy is where the true power of this technology shines. AI algorithms go beyond just identifying trends and patterns; they can delve into complex market dynamics and optimize investment strategies. By incorporating factors like risk tolerance, investment goals, and market conditions, AI systems can generate personalized investment strategies tailored to individual investors.

Traditional strategies often rely on manual decision-making, which can be prone to biases and emotions. AI, on the other hand, utilizes data-driven algorithms to make objective decisions based on an extensive analysis of market conditions. This removes human biases from the equation and can lead to more consistent and profitable investment strategies. When combined with human expertise, AI becomes a valuable tool for traders, enhancing their decision-making capabilities and improving overall investment outcomes.

How AI is Shaping the Stock Market Landscape

As AI continues to evolve, it is reshaping the stock market landscape. The availability of advanced AI tools has democratized access to sophisticated data analysis and market insights that were once only available to major institutions. Now, individual investors can leverage AI technologies to make smarter investment decisions and better navigate the complex world of the stock market.

AI’s impact on the stock market is not just limited to investors. It also influences how financial institutions operate. With AI algorithms capable of analyzing large datasets quickly, companies are increasingly relying on AI-powered tools to automate trading processes, detect fraud, and optimize risk management strategies. This automation and efficiency increase the speed and accuracy of financial operations, benefiting both the institutions and their clients.

In conclusion, AI’s growing influence on the stock market is undeniable. From data analysis to predicting stock moves and shaping investment strategies, AI is transforming the way investors operate. As the technology continues to advance, its impact on stock market performance will only become more significant, shaping the future of the financial landscape.

Analyst comment

Positive news. AI’s growing influence on the stock market is revolutionizing how investors make decisions, analyze data, and predict market trends. AI algorithms can efficiently analyze vast amounts of financial data, identify investment opportunities, and predict market movements with accuracy. AI’s impact is democratizing access to sophisticated data analysis and market insights, benefiting individual investors. It also automates trading processes, detects fraud, and optimizes risk management strategies for financial institutions. AI’s influence on the stock market will continue to grow and shape the future of the financial landscape.