Rigetti's Quantum Computing Progress and Financial Overview

Rigetti Computing, a leader in quantum computing, is on track with its 84-qubit Ankaa-3 system development, aiming for a 99% fidelity in 2-qubit gates by the end of 2024. Despite mixed financial results in Q2 2024, Rigetti is making strides in quantum technologies.

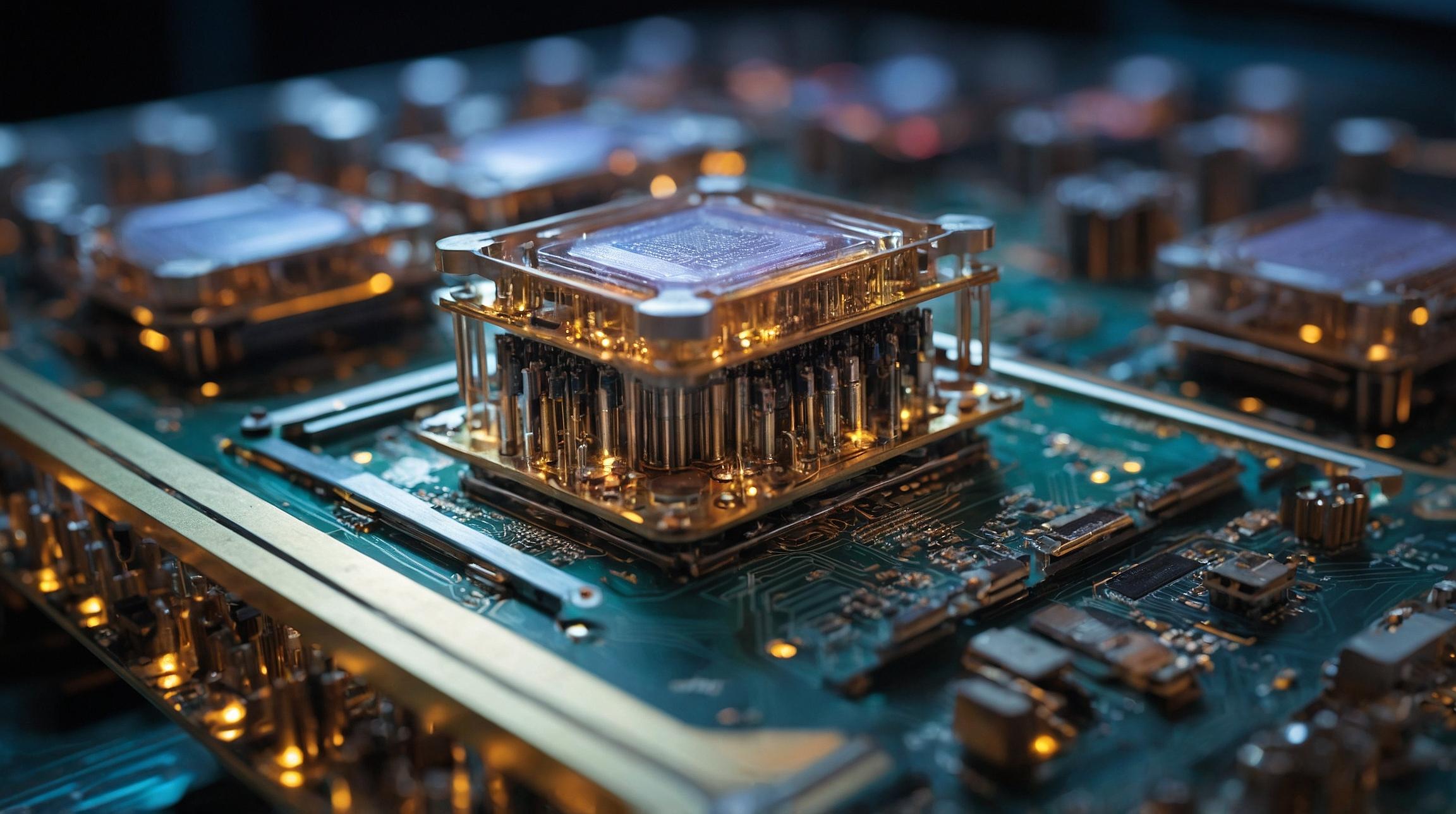

Key Developments in Quantum Technology

Rigetti's 24-qubit system showed impressive results with 99% 2-qubit gate fidelity and gate speeds of 60-80 nanoseconds. The company is using innovative multi-chip twin-level couplers and a modular chip architecture to enhance scalability. Additionally, Rigetti has introduced methods for solving complex problems efficiently with fewer qubits, marking significant research progress.

Financial Performance Snapshot

Rigetti reported Q2 2024 revenues of $3.1 million, a slight decrease from $3.3 million the previous year. Their gross margins fell to 64% from 82% the year before, but they managed to reduce operating expenses slightly. The net loss improved to $12.4 million, down from $17 million in Q2 2023. Notably, the company raised $27.8 million through its ATM program and holds $100.5 million in cash and investments.

Company Outlook and Market Position

The company is progressing with its 24-qubit system despite lower gross margins and expects revenue fluctuations due to project nature. Increasing government funding for quantum computing is expected to support revenues in the coming years. Rigetti aims to maintain stable operating expenses without significant staff increases.

Challenges and Opportunities

Bearish Highlights: The decrease in gross margins and revenues poses challenges. However, Rigetti's focus on advancing quantum technology, like the upcoming 84-qubit Ankaa-3 system, and innovative R&D efforts bolster its market position.

Potential for Growth

With government contracts anticipated to grow, Rigetti's focus on quantum computing and its strategic initiatives place it as a significant future player. Despite financial headwinds, Rigetti's strong research developments and industry positioning provide a promising outlook.

Financial Insights for Investors

In terms of market capitalization, Rigetti stands at $142.78 million. The company holds more cash than debt, suggesting financial stability, but is quickly using its cash reserves. This burn rate is a concern for long-term sustainability. The stock's volatility and proximity to a 52-week low may deter stability-seeking investors.

These insights highlight Rigetti's potential and challenges, emphasizing the importance of financial health alongside technological advancements for investors.