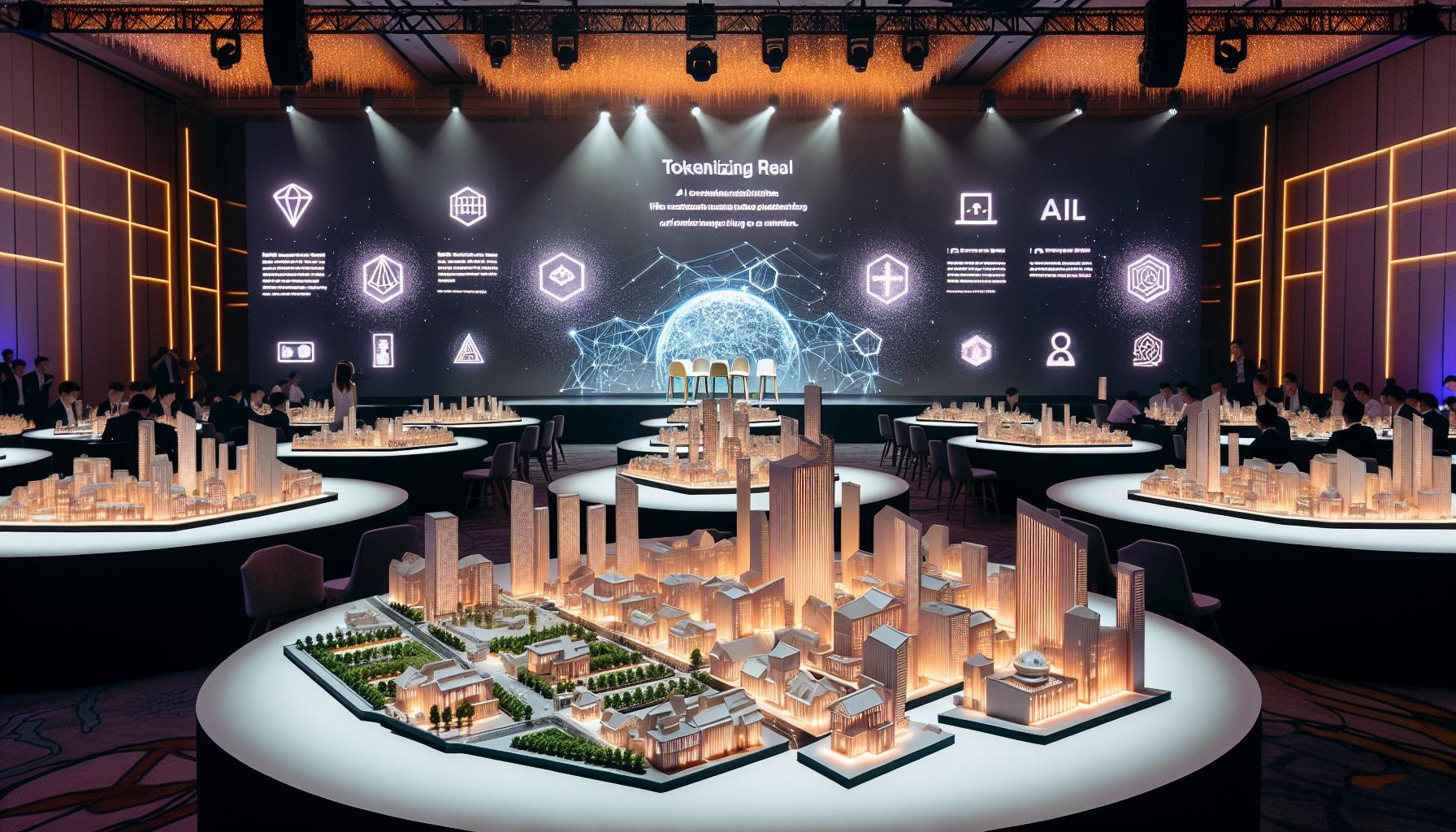

Cogito: The Next Big Disruptor in Tokenized Real World Assets and AI-driven Finance

Worldwide, 29th January 2024 – Cogito, a SingularityNET Ecosystem Partner, has entered the market and is poised to be the next big disruptor with its innovative offerings which hinge on the tokenization of Real World Assets (RWAs) and the leveraging of artificial intelligence (AI).

Led by industry experts in banking, compliance, and blockchain infrastructure, Cogito sets out to bridge TradFi with DeFi by bringing assets such as bonds, treasury bills, and stocks onchain for both individual and institutional investors alike.

A SingularityNET ecosystem partner

Cogito was born as a spinoff of SingularityNET, the decentralized AI marketplace running on blockchain founded by Dr. Ben Goertzel, a pioneer in the robotics and artificial intelligence fields.

Dr. Ben Goertzel co-founded Cogito, and now acts as an advisor to the company. His wealth of experience in the AI and technology sector supports Cogito as it endeavors to bridge the gap between TradFi and DeFi by offering investments in tokenized financial assets, some of which are poised to leverage AI technology for intelligent portfolio management.

Cogito leverages SingularityNET’s advisory, industry expertise, and ecosystem partnership to provide a practical, future-focused pathway for individuals and institutions to confidently adopt AI-driven management solutions for tokenized RWAs. This relationship has been strengthened and expanded following Cogito’s official recognition by regulators.

Regulatory approval

As of 9th January 2024, Cogito obtained the tokenized fund licence from the Cayman Islands Monetary Authority regulation (CIMA), highlighting its pledge to compliance and transparency. This achievement does not only reflect Cogito’s dedication to operating within legal frameworks but also paves the way for broader market acceptance and trust.

Cogito’s key differentiators

Cogito stands out from its competitors through a combination of key differentiators that underscore its strength in the market.

The most distinguishing feature lies in Cogito’s diverse product offering – TFUND, GFUND, and XFUND – by appealing to different risk appetites.

TFUND: the first institutional-grade offering

TFUND offers a diversified basket of government treasury bonds, including U.S. T-Bills, with a safe annual yield ranging from 5% to 5.5%.

These assets, known for their high liquidity and low risk, present an attractive option for crypto-native and traditional investors seeking secure and regulated investment avenues.

GFUND: the green alternative

GFUND tokenized the BlackRock iShares Green Bond ETF, giving investors exposure to U.S. dollar-denominated, investment-grade green bonds whose proceeds are exclusively applied to projects or activities that promote climate or other environmental sustainability purposes.

XFUND: Innovative Tech and AI Equities Basket

Building on SingularityNET’s AI expertise, Cogito is actively developing XFUND: a cutting-edge financial product representing a basket of tech and AI equities managed and rebalanced by harnessing the power of artificial intelligence.

APAC expertise

Cogito’s unparalleled expertise in the Asia Pacific region stems from its deep understanding of financial markets, regulatory landscapes, and prevalent challenges in the area. This is underscored by the well-established connections with stakeholders in Hong Kong and ASEAN countries.

Unmatched legal structure

From an operational standpoint, Cogito sports a legal structure that ensures the highest level of investor protection through a widely-accepted fund structure fully regulated by CIMA, the Cayman Island Monetary Authority.

This regulatory adherence extends to a reputable custodian and a Hong Kong-regulated investment manager and fund administrator.

Flexibility

Cogito provides flexible subscriptions: it accepts both stablecoins and fiat for both subscriptions and redemptions, thereby serving as a fiat on/off-ramp for individuals and institutions.

A bright future ahead

With tokenized RWAs emerging as the next killer use case in the financial system, and with artificial intelligence booming as it propels the world into a new technological era, Cogito is strategically positioned to harness these trends and revolutionize the financial landscape.

Moreover, its recent achievements and upcoming product launches signify a dynamic period of growth and innovation. As it continues to push the boundaries of what’s possible in blockchain-based finance, Cogito presents itself as a leader in the RWA and AI intersection.

Analyst comment

Positive news: Cogito, a SingularityNET Ecosystem Partner, is entering the market and is poised to disrupt by offering tokenized real-world assets and AI-driven finance solutions. With regulatory approval, diverse product offerings, APAC expertise, and unmatched legal structure, Cogito is well-positioned for growth and innovation in the financial landscape. As tokenized RWAs and AI technology gain traction, Cogito is set to lead the way in bridging traditional finance with decentralized finance.