Ethereum Price Prediction Report

In the continually evolving landscape of cryptocurrency markets, Ethereum holds a prominent position due to its innovative blockchain technology and widespread adoption. As financial analysts, our focus today is on dissecting the price movements of Ethereum in the past 24 hours, to predict its trajectory in the next day. Our analysis is anchored in the historical data, which provides a snapshot of Ethereum's performance, offering invaluable insights into potential future trends.

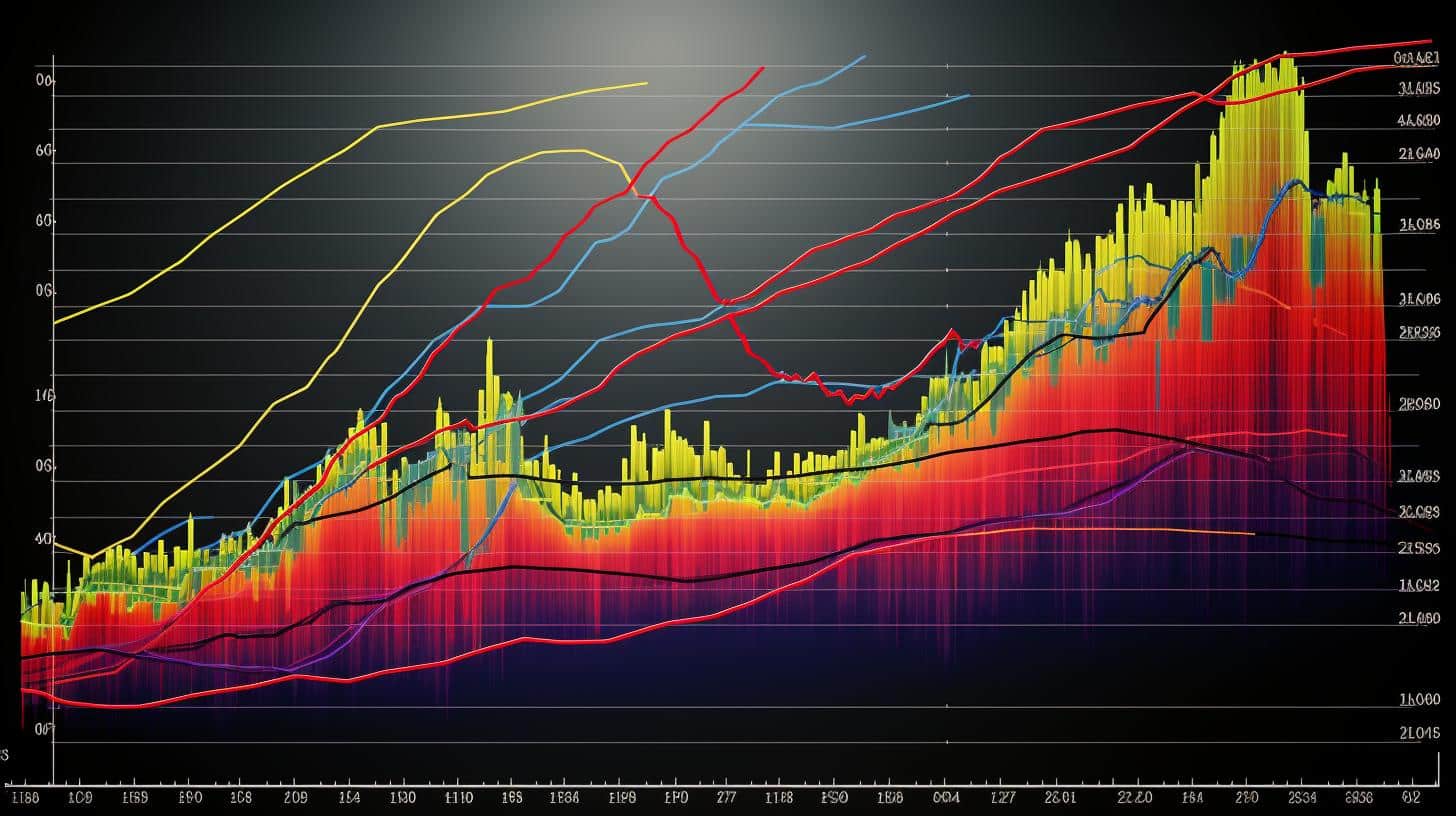

Analyzing the Current State

The opening price of Ethereum at the start of the analyzed period was $3508.79, with a closing price of $3511.1. During this interval, Ethereum experienced a low of $3503.74 and peaked at a high of $3515.1. This fluctuation hints at a volatile market condition, a common characteristic in the crypto world, driven by a multitude of factors ranging from market sentiment to global economic indicators.

Volume as a Key Indicator

A significant aspect to consider in our analysis is the trading volume, which stood at 382572.77988814795 Ethereum traded over the analyzed period. High trading volume often signals a strong interest in the asset, either for buying or selling, and can be an indicator of liquidity and potential price movements.

Historical Context Matters

To provide a grounded prediction, it is vital to contextualize the current price movements within recent historical performance. The data shows a series of fluctuations, with lows and highs suggesting a pattern of consolidation. For instance, Ethereum's price dipped to $3505.68 but also saw a rebound to $3515.1, indicating resilient market interest.

The Prediction

Given the observed data and considering external market factors, such as global cryptocurrency sentiment and technological developments within the Ethereum network, our prediction for the next 24 hours is cautiously optimistic. We anticipate a slight upward trend, with potential resistance around the $3515 mark. However, investors should remain vigilant of possible volatility, which could sway the price in either direction.

Final Thoughts

In conclusion, while the Ethereum market shows signs of potential growth in the near term, it's crucial for investors to stay informed and consider a multitude of factors before making investment decisions. Cryptocurrency markets are notoriously unpredictable, and while historical data can provide insights, it's not a guaranteed forecast of future performance.

Disclaimer: This prediction is based on historical data analysis and should not be taken as financial advice. Investors are encouraged to conduct their research and consider their risk tolerance before investing in cryptocurrencies.