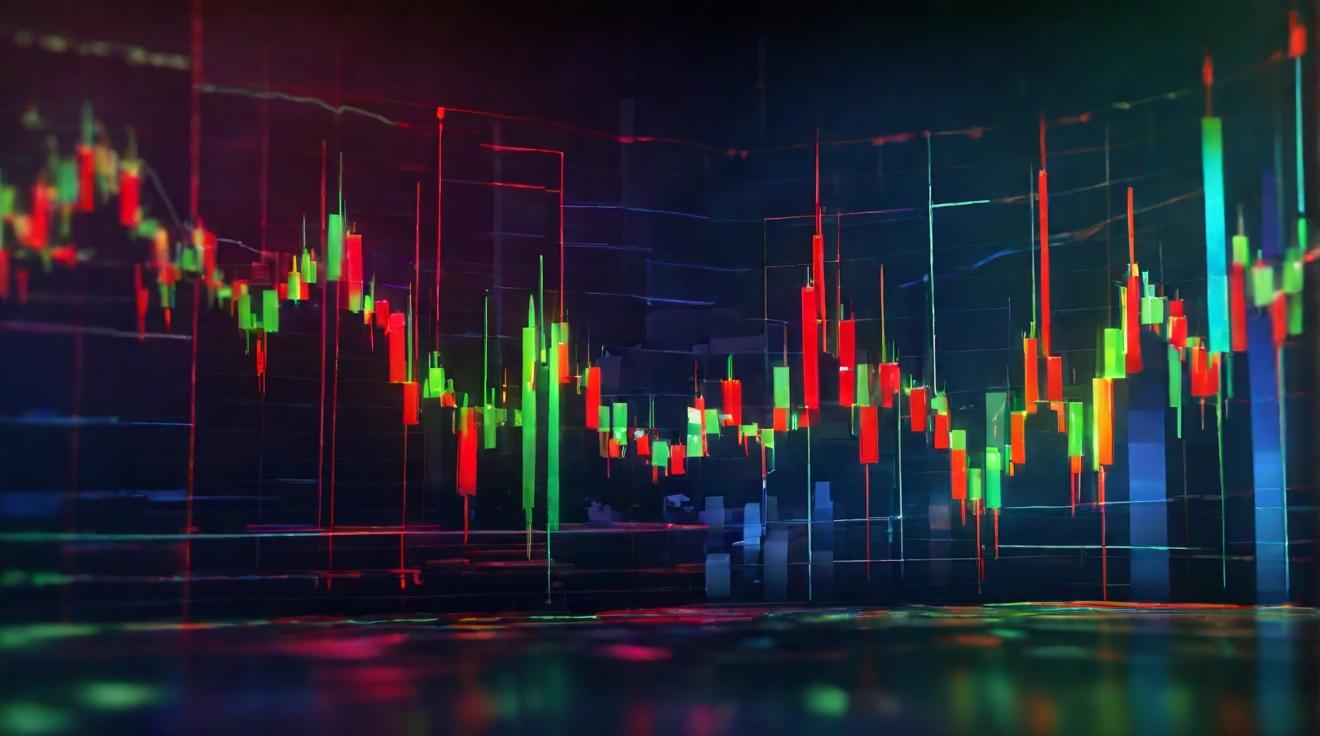

Market Analysis

As of September 24, 2024, Ethereum (ETH) is trading at $2643.97 following a day of moderate fluctuations. Over the past few hours, ETH has shown a low of $2635.03 and a high of $2651.70, reflecting a slight bearish trend after a brief upward momentum earlier in the day. The trading volume has remained robust, indicating continued interest among investors, which is crucial for sustaining price movements.

The Relative Strength Index (RSI) is currently hovering around 50, suggesting that ETH is neither overbought nor oversold. Coupled with a moving average convergence divergence (MACD) indicating a potential short-term consolidation phase, traders should be cautious but optimistic about potential upward movements in the near future.

48-Hour Forecast

For the next 48 hours, we anticipate Ethereum to experience a price range between $2635 and $2665. Key technical indicators suggest potential support at the $2635 level, with resistance around $2665.

Key Points:

- Support Level: $2635

- Resistance Level: $2665

- Expected Trading Range: $2635 – $2665

1-Week Forecast

Looking ahead to the next week, the market dynamics suggest a potential bullish rebound, with ETH possibly testing the $2700 mark if it successfully breaks through the resistance at $2665. A close above this level could trigger more significant buying interest from traders.

Key Points:

- Support Level: $2630

- Resistance Level: $2700

- Expected Trading Range: $2630 – $2700

1-Month Forecast

In the long term, over the next month, Ethereum is poised for a moderate bullish trend, given the increasing institutional interest and the upcoming Ethereum upgrades anticipated to improve scalability and reduce gas fees. If market sentiment remains positive, ETH could potentially reach the $2800 to $2900 range. However, this projection is contingent on market stability and broader cryptocurrency market conditions.

Key Points:

- Support Level: $2600

- Resistance Level: $2900

- Expected Trading Range: $2600 – $2900

Conclusion

Investors should monitor ETH closely in the coming hours, as price movements may be influenced by market sentiment and external factors such as regulatory news. With current technical indicators suggesting a potential upward trend, strategic entry points around $2635 could be considered for those looking to capitalize on short-term gains. Investors are encouraged to stay updated on market movements and adjust their strategies accordingly.

Important Note

The cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Always conduct your own research or consult a financial advisor before making investment decisions.