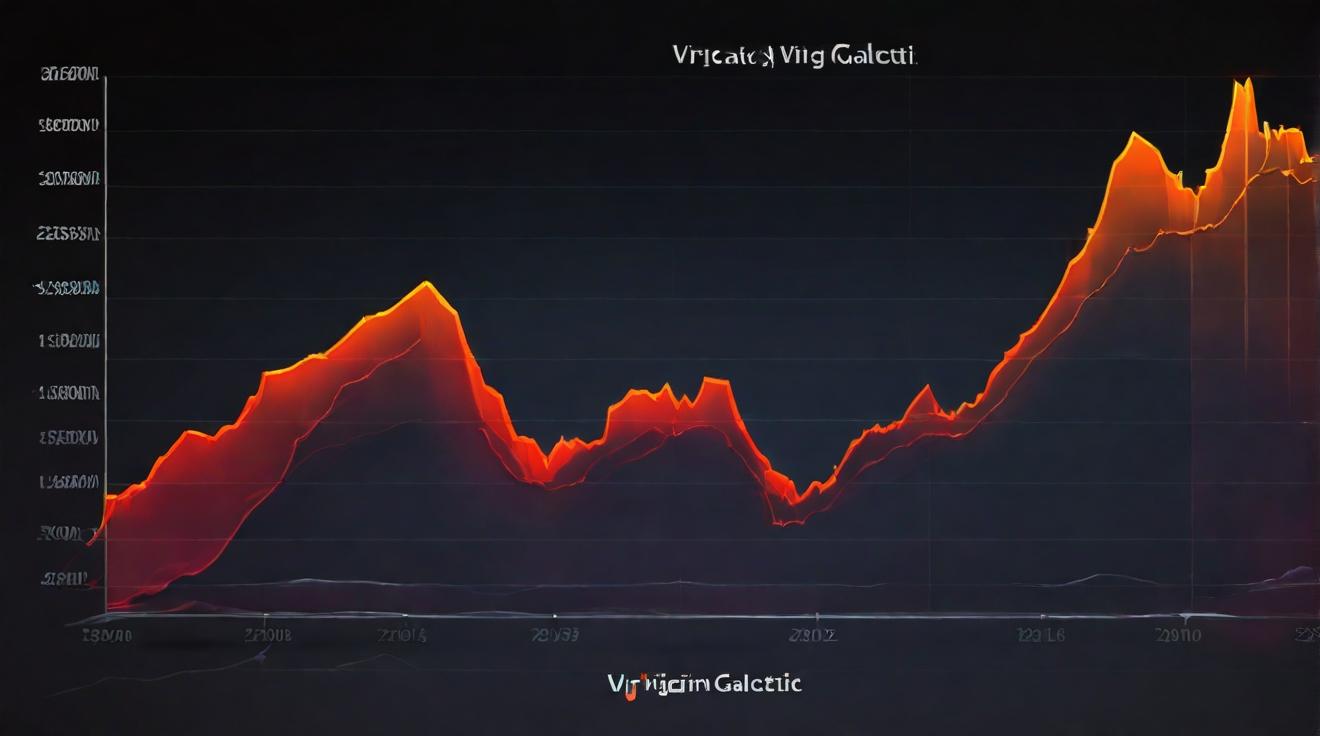

Virgin Galactic Proposes Reverse Stock Split Sending Shares Tumbling

Virgin Galactic (NYSE: SPCE) witnessed a significant decline in its stock value, plummeting by 16.5% by the morning trading hours on a day expected to carry routine corporate announcements. The aerospace company announced its intention to host the annual stockholders meeting on June 12, primarily to address standard procedural matters such as the election of directors, appointment of an auditor, and the determination of executive salaries. However, a notable inclusion in the agenda has caught the market by surprise: the proposal for a reverse stock split.

What does a Reverse Split entail for Virgin Galactic?

The proposed reverse stock split, ranging from a 2-for-1 to a 20-for-1 ratio, stands as a pivotal move for the company. This maneuver is set to drastically reduce the number of shares held by investors, converting, for instance, 1,000 shares into possibly as few as 50 shares. Despite the immediate negative reaction from investors, the intrinsic value of their holdings remains unaffected. The restructured share distribution aims not to dilute, but to elevate the nominal value per share, irrespective of the volatile stock price seen in the aftermath of the announcement.

Strategic Timing for the Reverse Split

The timing and the strategy behind Virgin Galactic’s reverse split can be attributed to the company’s shares lingering below the $1 mark over recent sessions, an alarming trend that puts the firm in jeopardy of non-compliance with NYSE’s minimum average closing price requirement. By contemplating a reverse split, Virgin Galactic is proactively addressing the potential delisting risk, aiming to bolster the share value well above the precarious $1 threshold.

This move, although unwelcome by many in the investment community due to the sudden dip in share value, is fundamentally a pragmatic approach by Virgin Galactic’s management. It serves as a strategic endeavor to stabilize the company's standing in the stock market and safeguard its future on the New York Stock Exchange.

Virgin Galactic’s decision to announce a reverse split underlines a critical juncture for the company, as it seeks to fortify its market valuation and reassure its stakeholders. Despite the immediate backlash reflected in the stock’s downturn, this bold measure could potentially steer the company towards a more secure and stable financial trajectory.

Analyst comment

Negative news. The proposal for a reverse stock split caused a significant decline in Virgin Galactic’s stock value. The reverse split aims to elevate the nominal value per share but was met with immediate negative reaction from investors. However, this move is a pragmatic approach to address potential delisting risk and stabilize the company’s standing in the stock market. The market’s reaction will depend on investors’ perception of the company’s future prospects.