Stock indices finished today’s trading session with little change. The S&P 500 (SPX) and the Nasdaq 100 (NDX) slipped 0.01% and 0.14%, respectively. On the other hand, the Dow Jones Industrial Average (DJIA) gained 0.08%.

Stock Indices Show Little Change in Today’s Session

Despite some volatility, stock indices ended the trading session with minimal movement. The S&P 500 and the Nasdaq 100 both saw slight declines, slipping by 0.01% and 0.14% respectively. The Dow Jones Industrial Average, however, managed to eke out a gain of 0.08%. This lackluster performance suggests that investors are still searching for direction amid ongoing concerns about interest rate hikes and inflation.

Communications Sector Falls, Energy Sector Leads in Stock Market

The communications sector (XLC) emerged as the laggard in today’s trading session, falling by 0.6%. On the other hand, the energy sector (XLE) led the way with a gain of 0.99%. This divergence in performance reflects the ongoing market rotation and investors’ shifting focus towards sectors that are expected to benefit from a potential economic recovery.

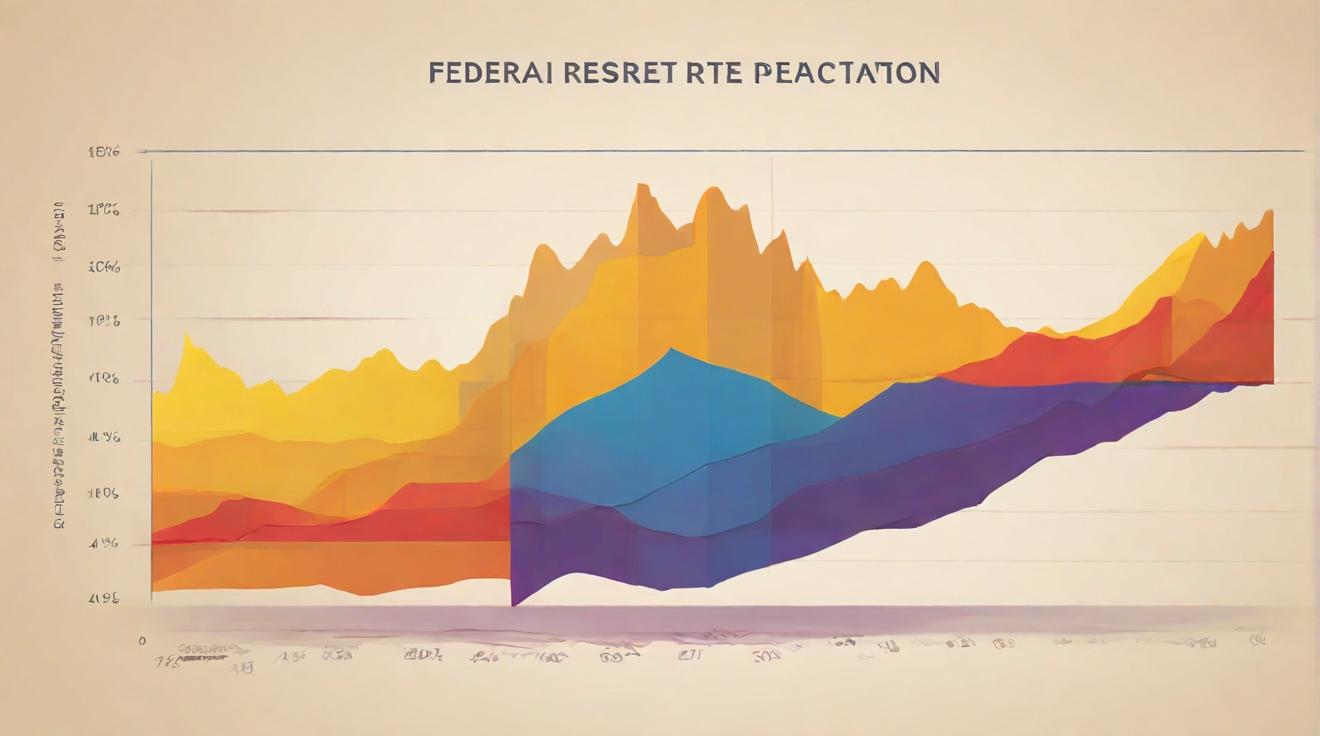

U.S. Treasury Yields Decrease, Market Pricing in Fed Funds Rate for December 2023

The U.S. 10-Year Treasury yield decreased to 4.25%, while the Two-Year Treasury yield increased to 4.94%, resulting in a spread of -69 basis points. This decline in long-term yields suggests that investors are becoming slightly more cautious about the economic outlook and the potential impact of future interest rate hikes. However, the market still appears to be pricing in a fed funds rate in the range of 5.25% to 5.5% for December 2023, with a 63.15% probability.

Stocks near Flatline, Oil Price Rises Above $81 per Barrel

At the time of writing, stocks were hovering near the flatline, showing little movement. Meanwhile, the price of oil continued to rise, with Brent crude prices surpassing $81 per barrel. This upward trajectory in oil prices is likely to have a ripple effect on the broader economy, leading to higher prices at the pump for consumers.

Stocks Mixed in Today’s Trading, Concerns Remain About Rate Hikes

Stocks opened lower today as investors continued to be concerned about potential interest rate hikes. The Nasdaq 100, the S&P 500, and the Dow Jones Industrial Average all started the day in negative territory, down by 0.98%, 0.55%, and 0.31% respectively. These declines suggest that investors are wary of the potential impact of tighter monetary policy on the stock market and the broader economy.

As the trading day comes to a close, stock indices showed little change, with the S&P 500 and the Nasdaq 100 slipping slightly while the Dow Jones Industrial Average managed a small gain. The communications sector was the session’s laggard, while the energy sector led the way. U.S. Treasury yields decreased, indicating some caution among investors, but the market is still pricing in a fed funds rate increase for December 2023. Stocks were near the flatline, while oil prices continued to rise. Concerns about rate hikes remained a key factor influencing investor sentiment.

Analyst comment

1. Stock Indices Show Little Change in Today’s Session: Neutral news. The market is expected to remain range-bound with minimal movement as investors search for direction amid concerns about interest rate hikes and inflation.

2. Communications Sector Falls, Energy Sector Leads in Stock Market: Positive news. The market rotation towards sectors expected to benefit from an economic recovery is likely to continue.

3. U.S. Treasury Yields Decrease, Market Pricing in Fed Funds Rate for December 2023: Neutral news. Investors are showing slight caution about the economic outlook and future interest rate hikes but are still pricing in a rate increase for December 2023.

4. Stocks near Flatline, Oil Price Rises Above $81 per Barrel: Neutral news. Stocks are expected to remain stagnant while the rise in oil prices may have a ripple effect on the broader economy.

5. Stocks Mixed in Today’s Trading, Concerns Remain About Rate Hikes: Negative news. Investors are wary of potential interest rate hikes and the impact on the stock market and the broader economy. The market is expected to remain volatile.

Overall, the market is expected to have limited movement with some sectors outperforming others. Concerns about interest rate hikes remain a key factor influencing investor sentiment.