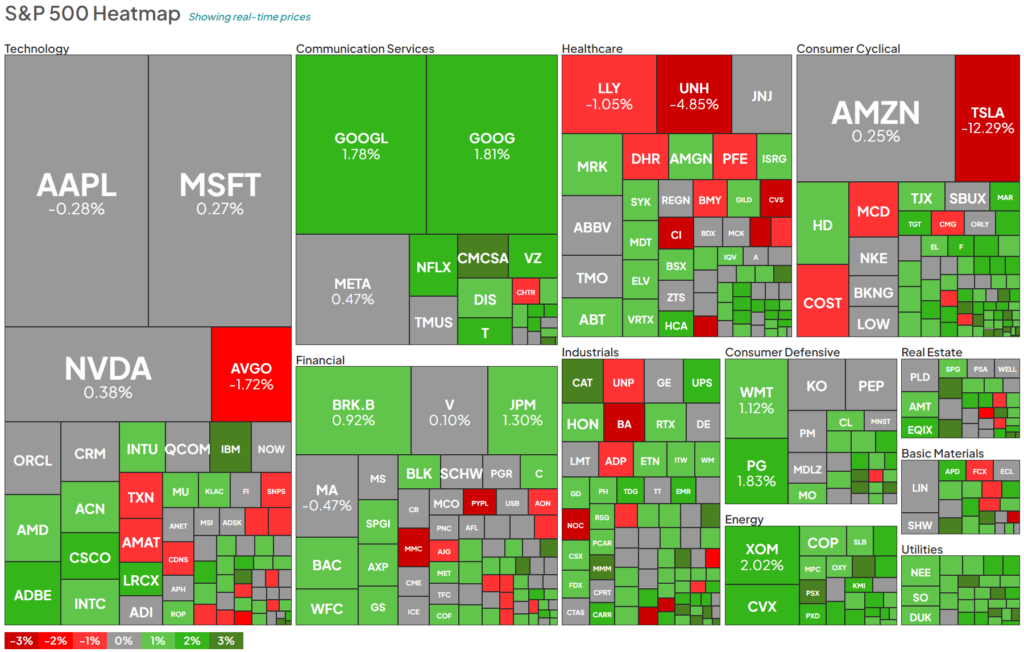

S&P 500 Heatmap: A Visual Representation of Today’s Stock Market Activity

The S&P 500 Heatmap provides a comprehensive view of the stock market, highlighting the performance of major stocks in each sector. This powerful tool allows investors to quickly assess the market and make informed decisions. Here’s a look at today’s heatmap and what it reveals about the market’s activity.

The Heatmap’s Current Snapshot

At the time of writing, the S&P 500 Heatmap showcases the performance of each sector’s major stocks. The heatmap uses scaled boxes to demonstrate the relative size of the stocks within the index. This visual representation allows investors to easily identify sector trends and spot potential opportunities or risks.

Beyond the S&P 500

The S&P 500 Heatmap is not exclusive to this index alone. It is also available for other significant market indices, including the Dow Jones (DJIA), the Nasdaq (NDX), and various ETFs. Investors can use this versatile tool to track the performance of different sectors and indices, expanding their market analysis and decision-making capabilities.

Uncovering Sector Performance Trends

By examining the heatmap, investors can gain valuable insights into sector performance trends. The size and colors of the boxes reflect the relative strength of the stocks within each sector. This information enables investors to identify sectors that are experiencing positive momentum or undergoing challenges. Understanding these trends can help investors adjust their portfolios accordingly and navigate the market effectively.

Identifying Sector Opportunities and Risks

The S&P 500 Heatmap acts as a powerful tool for spotting potential sector opportunities and risks. By analyzing the heatmap, investors can identify sectors that are outperforming or underperforming. This information allows them to allocate their investments strategically, focusing on sectors that show promise while reducing exposure to sectors facing challenges. Being able to accurately assess sector conditions is crucial for building a resilient portfolio.

Making Informed Investment Decisions

Ultimately, the S&P 500 Heatmap empowers investors to make more informed investment decisions. By visualizing the performance of major stocks within each sector, this tool provides a comprehensive snapshot of the market. Armed with this knowledge, investors can better understand market dynamics, identify potential investment opportunities, and make decisions that align with their financial goals.

With the S&P 500 Heatmap and its availability across various indices and ETFs, investors have a valuable tool at their disposal for analyzing the market and staying ahead in the ever-changing landscape of stock trading. Utilizing this tool effectively can lead to more successful investment outcomes and better overall portfolio performance.

Analyst comment

Neutral news.

As an analyst, the market is expected to react to the information displayed on the S&P 500 Heatmap. Investors will utilize the heatmap to assess sector performance trends and identify potential opportunities and risks. This analysis will guide investment decisions, potentially leading to adjustments in portfolios and allocation of investments in sectors showing positive momentum while reducing exposure to sectors facing challenges. Ultimately, the heatmap empowers investors to make more informed decisions, potentially resulting in better overall portfolio performance.