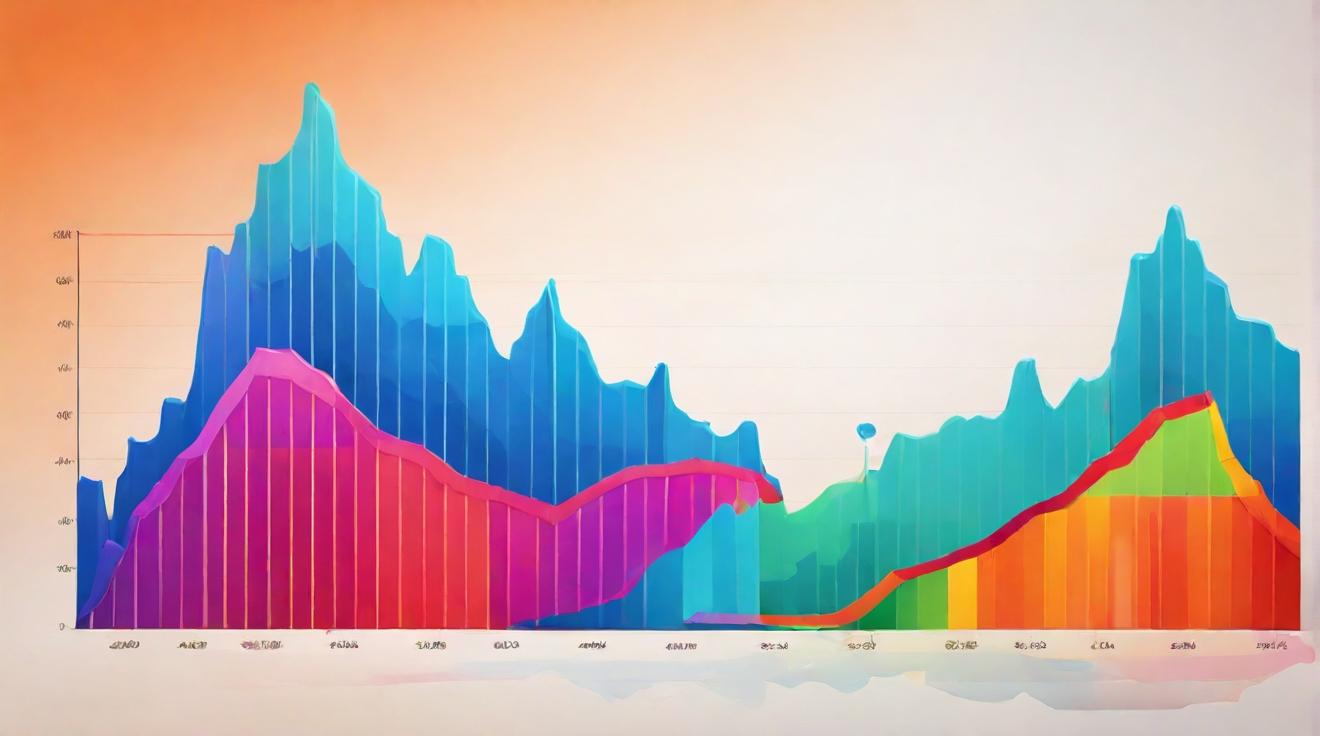

New Home Sales Surge 20.5% in August

Sales of newly built homes in the United States soared by 20.5% in August compared to July, reaching the highest level since January 2022, according to data from the U.S. Census Bureau. This marks the largest one-month increase in new home sales since August 2022 and represents a 15.4% rise from August 2024. This surge occurred despite mortgage rates remaining relatively stable throughout August. The average rate on a 30-year fixed mortgage started the month at 6.63% and showed little movement during the period, according to Mortgage News Daily.Stable Mortgage Rates Amid Rising Sales

Mortgage rates only began to decline sharply in September, dropping to a three-year low of 6.13% just prior to the Federal Reserve’s lending rate cut. Rates subsequently ticked back up to 6.37%. Given that rates were higher during August, the significant increase in home sales is unexpected.“We were expecting a gain but not that large,” said Robert Dietz, chief economist at the National Association of Home Builders. “Always important to remember the margin of error for new home sales is large. We’ll need to wait for revisions next month and the September data point to see if this is smoothed out.”

Builder Insights and Market Dynamics

Homebuilder analyst Ivy Zelman of Zelman & Associates noted the direction of the data was accurate but cautioned the magnitude was overstated. Her own survey, which covers a larger sample of builders, indicated a more modest 6% year-over-year increase in sales. Despite ongoing discussions about price reductions and incentives, the median price for a new home sold in August increased 1.9% year-over-year, reaching $413,500. Meanwhile, a National Association of Home Builders survey showed that 39% of builders reported cutting prices in September, up from 37% in August — the highest proportion since the post-Covid period began.Regional Variations in Sales Performance

New home sales were strongest in the Northeast, where overall new construction remains low, resulting in more pronounced swings. The South, the nation’s busiest homebuilding region, also experienced robust sales growth. Conversely, sales in the West—the region with the highest home prices—were the weakest despite the overall increase.“The elevated level of home builder incentives was the main catalyst for the large upside surprise to new home sales,” said Peter Boockvar, chief investment officer at One Point BFG Wealth Partner. “Lower mortgage rates in September will influence upcoming figures, but builders may reduce incentives, potentially offsetting the benefit of falling rates.”

Inventory Tightens as Construction Slows

The surge in sales reduced housing inventory from a nine-month supply in July to 7.4 months in August, an 18% decline. However, single-family housing starts and permits slowed in August compared to both July and the previous year, signaling that builders may anticipate a deceleration in future sales.FinOracleAI — Market View

August’s unexpected surge in new home sales highlights the complexity of the current housing market where mortgage rate movements and builder incentives interplay significantly. While the strong sales point to resilient demand, the slowing construction and tightening inventory suggest cautious builder sentiment amid economic uncertainties.- Opportunities: Elevated builder incentives may continue to stimulate demand in the near term, especially if mortgage rates remain favorable.

- Risks: Potential reduction in builder incentives as rates decline could temper sales momentum.

- Regional disparities: Strong sales in the Northeast and South contrast with weaker activity in the West, influenced by price sensitivity.

- Inventory constraints: Reduced supply may put upward pressure on prices, impacting affordability.