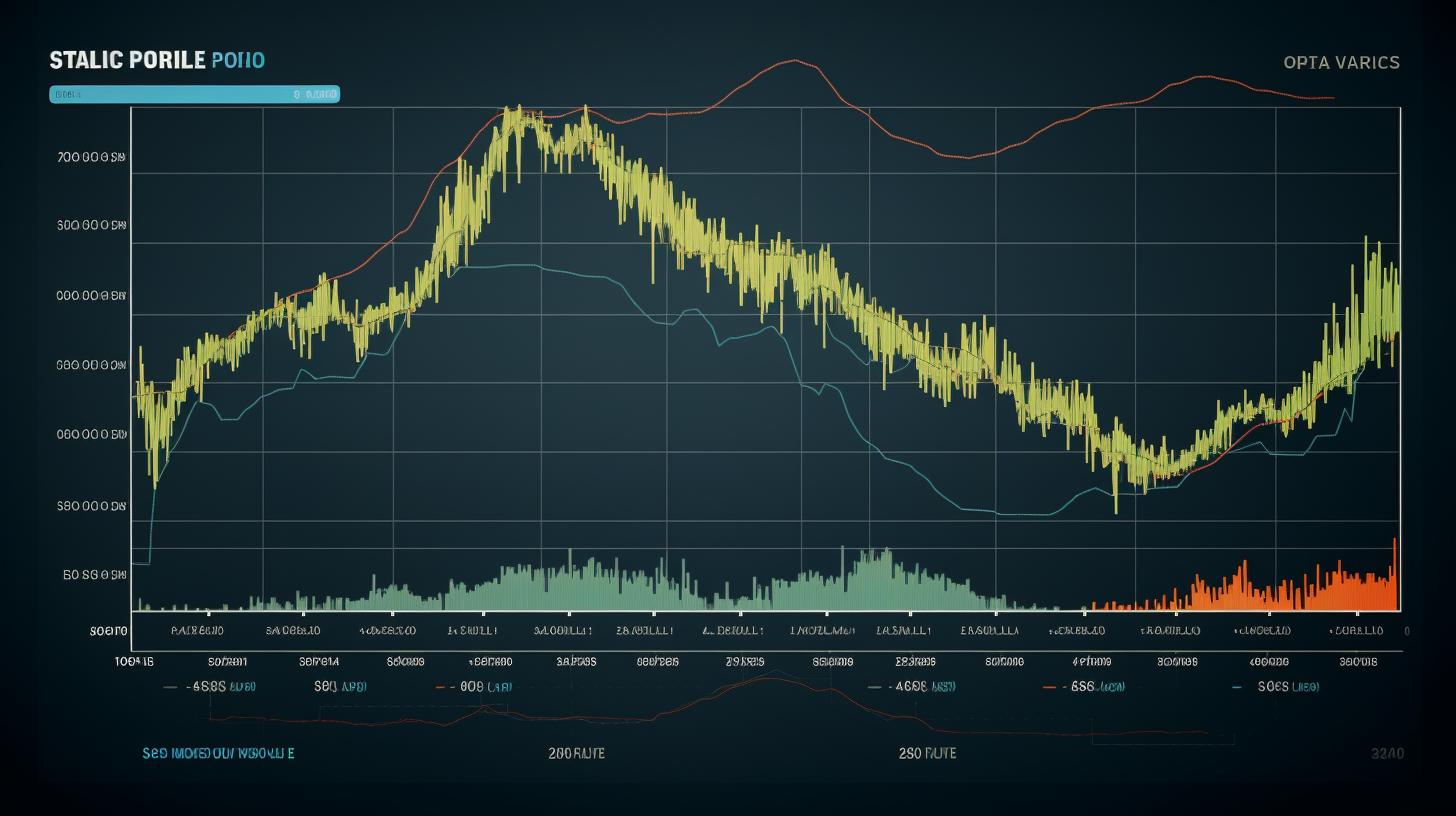

Market Trends

The global financial landscape is in a state of flux as we approach the end of September 2024. Recent data indicates a significant shift in investment patterns, particularly in the cryptocurrency space. Reports reveal that 70% of U.S. financial advisors now hold crypto assets, reflecting a growing acceptance of digital currencies in traditional finance. This shift is further bolstered by the upcoming Bitcoin ETF developments, which are anticipated to further drive institutional investments.

In the stock market, companies such as PC Jeweller have seen their shares surge to the highest levels since April 2019, as the board considers a stock split. This move has sparked investor interest and confidence, pushing the stock to a bullish position. Similarly, ADANIENT and APOLLOTYRE share bullish patterns, indicating strong intraday trading signals.

Social Media Insights

Social media platforms are buzzing with discussions surrounding upcoming strikes affecting major ports, which could lead to supply chain disruptions. Posts highlighting the need for consumers to stock up on essentials have gained traction, showing public concern over potential shortages.

Additionally, discussions about SAMSUNG stocks indicate a wave of short-selling activity by major financial institutions like Morgan Stanley, which is a critical indicator of investor sentiment. Tweets reflecting skepticism regarding certain stocks hint at a broader narrative of distrust among retail investors.

Key Signals

- Increased Interest in Crypto: With 70% of financial advisors investing in crypto, there is a clear bullish signal for Bitcoin and Ethereum. The net inflows into Bitcoin and Ethereum funds were $136 million and $62.5 million, respectively, indicating strong institutional interest.

- Stock Performance: The recent performance of stocks like PC Jeweller and others trending positively signals a potential recovery phase in certain sectors.

- Port Strike Warnings: The anticipated strike at major ports adds a layer of risk for logistics and supply chains, suggesting a potential spike in prices for consumer goods.

- Short Selling Patterns: The reports of increased short positions in SAMSUNG suggest a potential downturn, cautioning investors to tread carefully.

Actionable Strategies

- Diversify into Crypto: Given the increasing acceptance of cryptocurrencies, consider diversifying your portfolio to include Bitcoin and Ethereum, especially ahead of the upcoming ETF announcements.

- Monitor Stock News: Keep a close eye on stocks showing bullish patterns such as PC Jeweller, ADANIENT, and APOLLOTYRE, and consider them for short-term gains. Utilize technical analysis for entry points.

- Prepare for Supply Chain Disruptions: Anticipate possible stock shortages due to port strikes and consider investing in companies that may benefit from increased demand for essentials.

- Stay Updated on Market Sentiment: Use social media platforms to gauge market sentiment and stay informed about retail investor concerns, especially regarding short-selling trends.

By blending traditional market analysis with social media intelligence, investors can gain a competitive edge and make more informed decisions in this rapidly evolving market environment.