ZoomInfo (ZI) Q4 Earnings Report Preview: What To Look For

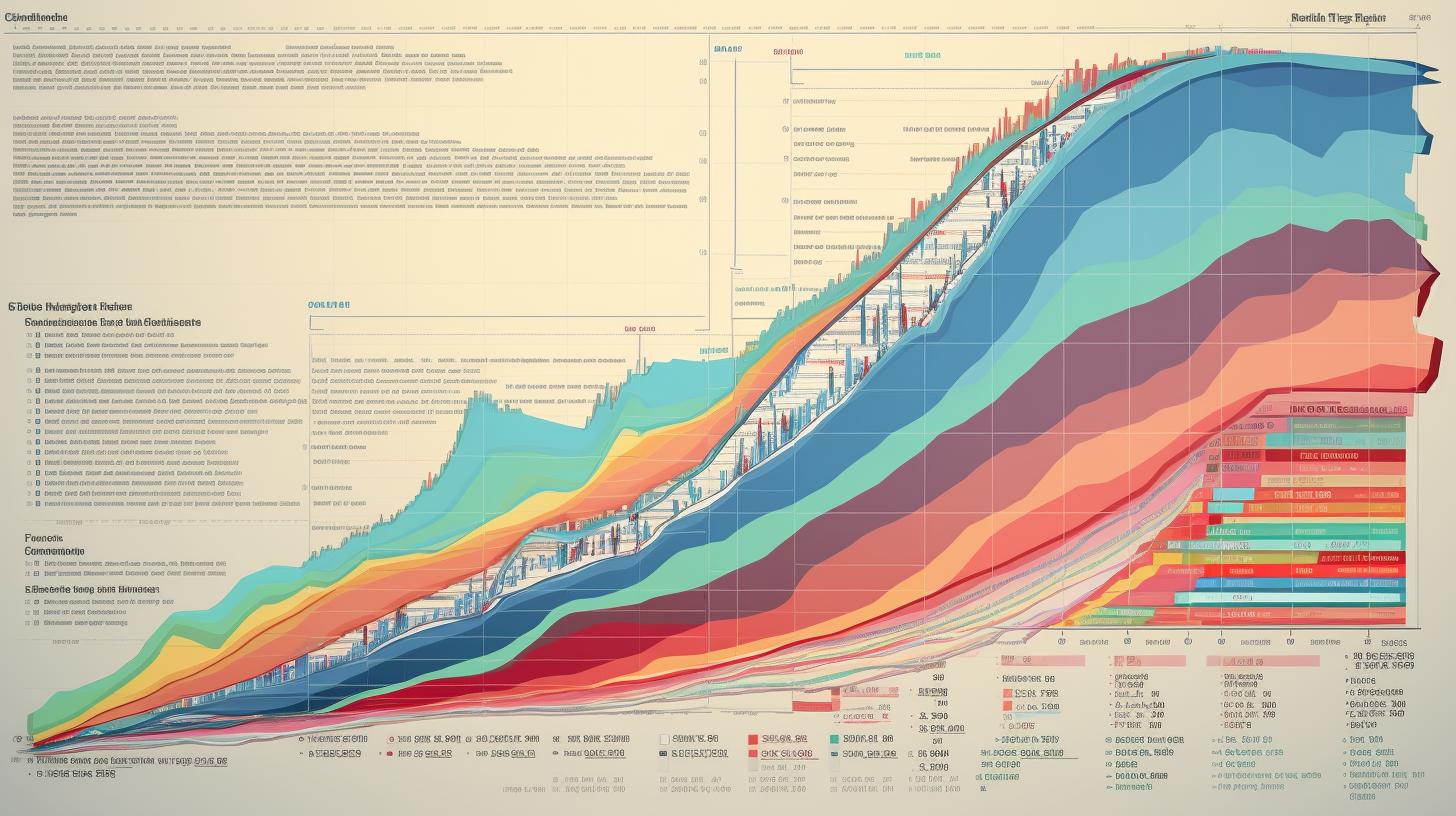

Sales intelligence platform ZoomInfo is set to report its earnings tomorrow after the market closes, and investors are eager to see how the company performed in the fourth quarter of 2024. Last quarter, ZoomInfo’s revenues reached $313.8 million, representing a 9.1% increase year-on-year and surpassing analyst expectations by 1.1%. However, the company faced challenges with slowing growth in larger customers and provided underwhelming revenue guidance for the next quarter. ZoomInfo also experienced a loss of 24 enterprise customers paying more than $100,000 annually, bringing their total customer count to 1,869.

With the upcoming earnings release, investors are wondering whether ZoomInfo is a buy or sell.

Analysts are projecting ZoomInfo’s revenue for the current quarter to grow by 2.9% to reach $310.5 million, a deceleration from the 35.7% increase recorded in the same quarter of the previous year. The company is also expected to report adjusted earnings of $0.25 per share.

Most analysts who cover ZoomInfo have recently reconfirmed their estimates, suggesting that they anticipate the business to remain on its current trajectory heading into the earnings announcement. Over the past two years, the company has only missed Wall Street’s revenue estimates once and has on average exceeded top-line expectations by 2.9%.

To gain some insight into what we can expect from ZoomInfo’s earnings, let’s take a look at the performance of its peers in the sales and marketing software sector. Freshworks recorded a 20.2% year-on-year increase in top-line growth, surpassing analyst estimates by 1%. Meanwhile, LiveRamp reported a 9.6% year-on-year revenue increase, exceeding estimates by 1.2%. Following their earnings releases, Freshworks’ stock declined by 2.9% and LiveRamp’s stock dropped by 2.3%.

Overall, there has been a positive sentiment among investors in the sales and marketing software segment, as stocks within the sector have risen by an average of 8.2% in the past month. In comparison, ZoomInfo’s stock has seen a slight decline of 0.2% during the same period. As the company prepares to announce its earnings, analysts have set a price target of $19.8, whereas the current share price stands at $15.3.

Analyst comment

Positive news: ZoomInfo’s revenues in the previous quarter exceeded expectations and the company has a track record of generally surpassing revenue estimates. The sales and marketing software sector has seen positive performance recently.

Short analysis: ZoomInfo’s earnings are expected to grow by 2.9% this quarter, but at a slower pace than the previous year. Analysts expect the company to stay on its current trajectory. The overall sentiment in the sales and marketing software segment is positive. ZoomInfo’s stock has seen a slight decline, but analysts have set a higher price target.