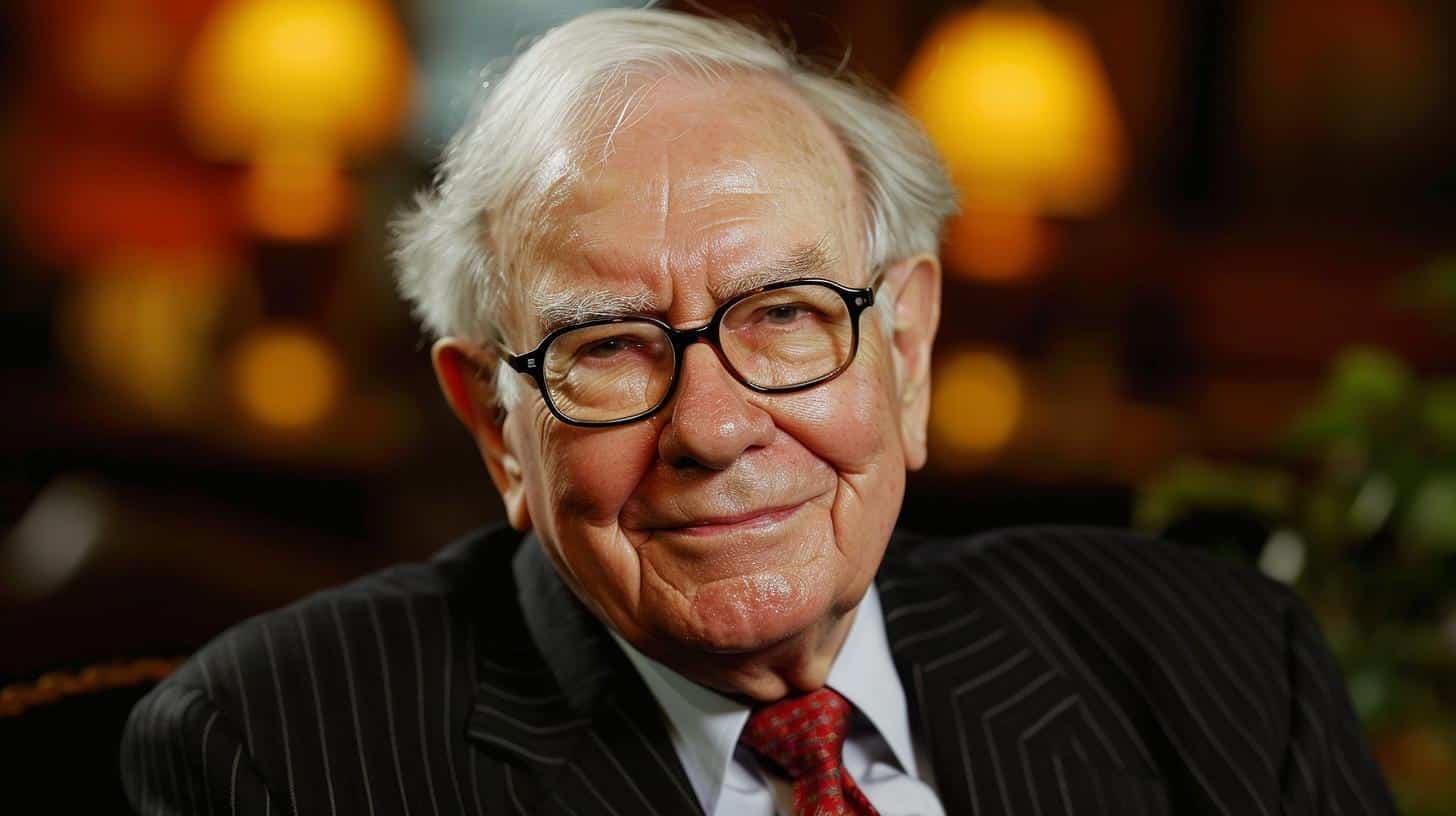

Warren Buffett’s Berkshire Hathaway continues to make strategic moves in the stock market, with the latest investments revealing a bullish stance on the US housing market. In the last quarter, the company established stakes in three major homebuilders: Lennar, NVR, and DR Horton. Despite concerns about the soaring housing prices and affordability issues, Buffett’s portfolio managers, Todd Combs and Ted Weschler, appear to be betting on the long-term growth potential of the sector.

Warren Buffett’s Berkshire Hathaway invests in homebuilders amid soaring housing prices

Berkshire Hathaway’s recent investment in Lennar, NVR, and DR Horton, valued at a combined $814 million, underscores the company’s confidence in the US housing market. Despite the current challenges, including rising prices and limited affordability due to high mortgage rates, Buffett’s team seems to believe in the resilience of the sector. It is worth noting that Berkshire’s investments in these particular homebuilders were relatively small in the context of its vast stock portfolio, indicating a cautious approach to the housing market.

Buffett’s portfolio managers bet big on US housing market despite affordability concerns

The decision to invest in the US housing market, at a time when affordability is a major concern, suggests that Buffett’s portfolio managers are focusing on the long-term growth potential of the sector. While the current housing market may be challenging for many potential buyers, Combs and Weschler seem to believe that the demand for housing will persist, potentially leading to greater profitability for these homebuilders in the future. Their bet on the housing market indicates a belief that the current affordability issues may be temporary and does not overshadow the long-term viability of the sector.

Berkshire Hathaway increases stakes in Capital One and Occidental Petroleum

In addition to its investments in the housing market, Berkshire Hathaway has also increased its stakes in financial institution Capital One and oil and gas producer Occidental Petroleum. While the details of the investment strategy are not known, the increased stakes suggest that Buffett and his team see potential in these companies. By growing its positions in these sectors, Berkshire Hathaway is positioning itself to benefit from potential future growth and market trends.

Buffett’s company exits bets on McKesson, Marsh & McLennan, and Vitesse Energy

While Berkshire Hathaway made new investments and increased stakes in certain companies, it also made strategic exits from others. The company has decided to exit its wagers on healthcare company McKesson, insurance broker Marsh & McLennan, and energy company Vitesse Energy. These moves may reflect a shift in investment strategy or a lack of confidence in the future prospects of these particular companies. Buffett and his team continuously evaluate their investments and make adjustments to their portfolio based on market dynamics and individual company performance.

Warren Buffett trims positions in Activision Blizzard, Chevron, and General Motors

In addition to exiting some positions, Berkshire Hathaway has also reduced its stakes in gaming company Activision Blizzard, energy company Chevron, and automaker General Motors. The decision to trim these positions could be driven by various factors, including repositioning the portfolio, taking profits, or reducing exposure to certain sectors. It reflects Buffett’s ongoing commitment to actively manage Berkshire Hathaway’s vast stock portfolio and make adjustments based on changing market conditions.

Warren Buffett’s recent investments reflect his team’s outlook on the US housing market, despite concerns about affordability. Berkshire Hathaway’s modest investments in homebuilders indicate a cautious approach, balancing optimism with the challenges currently faced by the sector. By also increasing stakes in companies like Capital One and Occidental Petroleum, Buffett is positioning his company to benefit from potential growth and market trends. As part of its active management strategy, Berkshire Hathaway has also made strategic exits from some investments and reduced positions in others. These moves highlight the company’s flexibility and adaptability in response to changing market dynamics.

Analyst comment

Positive news: Warren Buffett’s Berkshire Hathaway invests in homebuilders, indicating confidence in the US housing market’s long-term growth potential.

Market outlook: The housing market may face challenges due to rising prices and affordability concerns, but Berkshire Hathaway’s cautious approach suggests belief in the sector’s resilience and temporary nature of affordability issues.

Positive news: Berkshire Hathaway increases stakes in Capital One and Occidental Petroleum, positioning itself to benefit from potential future growth and market trends.

Market outlook: Buffett and his team see potential in these companies, indicating optimism about their future prospects and potential for profitability.

Neutral news: Berkshire Hathaway exits bets on McKesson, Marsh & McLennan, and Vitesse Energy, suggesting a shift in investment strategy or lack of confidence in these companies’ future prospects.

Market outlook: The decision to exit these investments reflects ongoing evaluation and adjustments based on market dynamics and individual company performance.

Neutral news: Berkshire Hathaway trims positions in Activision Blizzard, Chevron, and General Motors, possibly driven by portfolio repositioning, profit-taking, or risk reduction.

Market outlook: Buffett’s ongoing commitment to actively manage the portfolio highlights the company’s adaptability and responsiveness to changing market conditions.