Mastering Market Timing: The Key to Buying Low and Selling High

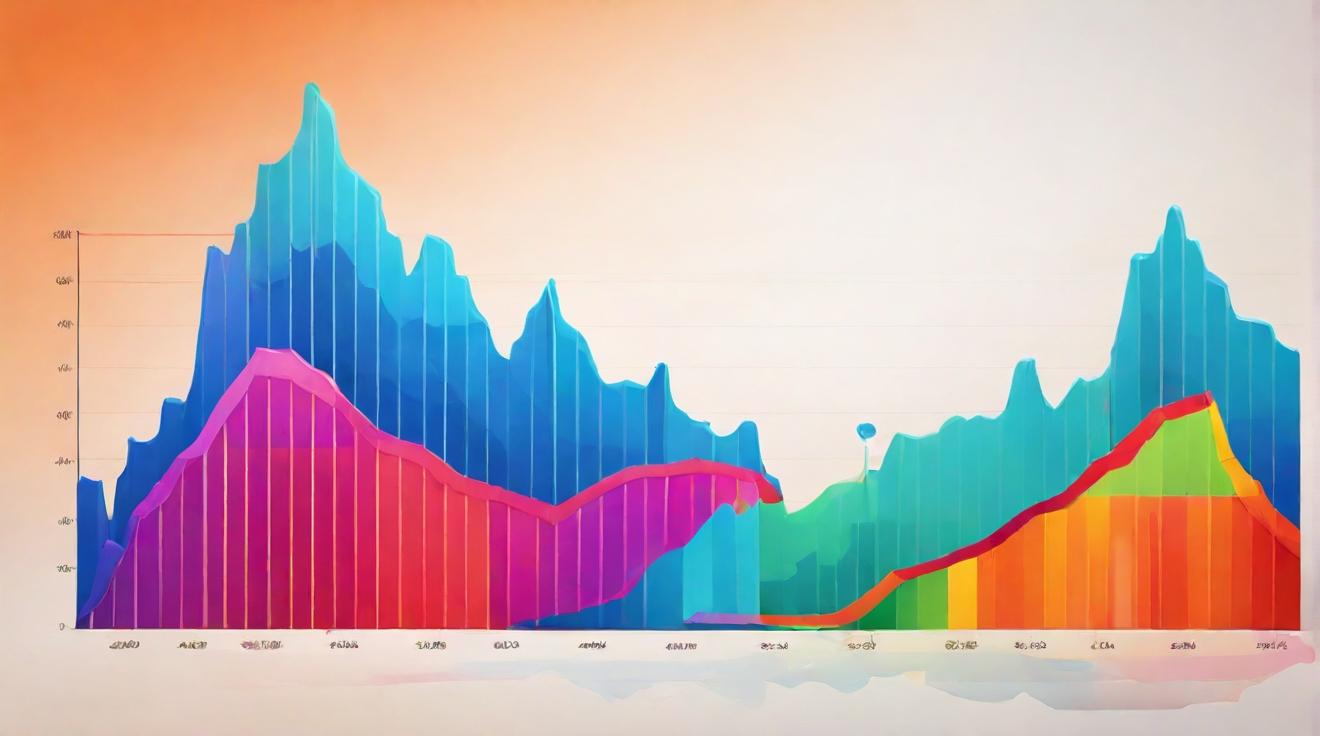

In the ever-evolving landscape of the financial markets, savvy investors are constantly seeking strategies to maximize their returns. One of the most sought-after yet elusive strategies is the art of timing the market. The goal is simple: buy low and sell high. However, the execution of this strategy is anything but straightforward. It requires a deep understanding of market trends, economic indicators, and investor psychology.

Unveiling the Mystery of Market Timing

The concept of market timing revolves around making investment decisions based on predictions of future market movements. It's a strategy that can significantly amplify gains but also increases the risk of losses. The key lies in identifying the opportune moments to enter and exit the market, a task that many investment professionals and financial analysts devote their careers to mastering.

Strategies for Success

Several strategies have emerged as effective tools for those looking to master the art of market timing. These include:

Technical Analysis: This involves studying historical data and charts to predict future price movements. Investors use indicators like moving averages, relative strength index (RSI), and Bollinger Bands to identify potential buy or sell signals.

Fundamental Analysis: This strategy focuses on evaluating a company's financial health and the overall state of the economy to make investment decisions. Key metrics include earnings reports, price-to-earnings ratios, and economic indicators like GDP growth and unemployment rates.

Sentiment Analysis: Understanding the mood of the market can provide critical insights into potential movements. Tools like news analysis and social media monitoring help gauge investor sentiment, potentially indicating turning points in market trends.

Navigating the Risks

Despite the potential rewards, market timing is not without its risks. Volatility can lead to significant losses, and the unpredictability of market movements makes timing efforts challenging. Additionally, the costs associated with frequent buying and selling can erode profits.

To mitigate these risks, many experts recommend a diversified investment approach. Combining long-term investment strategies with selective market timing can balance the potential for high returns with the need for risk management.

The Future of Market Timing

As technology continues to advance, tools like artificial intelligence (AI) and machine learning are becoming increasingly sophisticated in predicting market trends. These technologies have the potential to revolutionize market timing strategies, offering more accurate predictions and enabling investors to make more informed decisions.

In conclusion, while the art of timing the market offers the tantalizing prospect of buying low and selling high, it requires a nuanced understanding of various strategies and the risks involved. By leveraging technical, fundamental, and sentiment analysis, investors can improve their chances of success. However, the unpredictable nature of the markets means that a diversified investment strategy may still be the best path to achieving long-term financial goals.