Clean Harbors, Inc. Share Price Analysis: Strong Growth and Potential Opportunity

Introduction

Clean Harbors, Inc. (NYSE:CLH), a commercial services company, has experienced impressive share price growth over the past five years, soaring by 190%. This remarkable performance has caught the attention of investors, as reflected in the recent 2.0% increase in the share price. In this analysis, we will explore not only the company’s stock performance but also examine its fundamentals to determine if it aligns with the long-term growth of the underlying business.

Assessing Share Price and Earnings Per Share (EPS) Growth

In his renowned essay “The Superinvestors of Graham-and-Doddsville,” Warren Buffett highlights that share prices do not always accurately reflect a company’s value. By comparing the earnings per share (EPS) with the share price, we can evaluate the sentiment surrounding a company and how it has evolved.

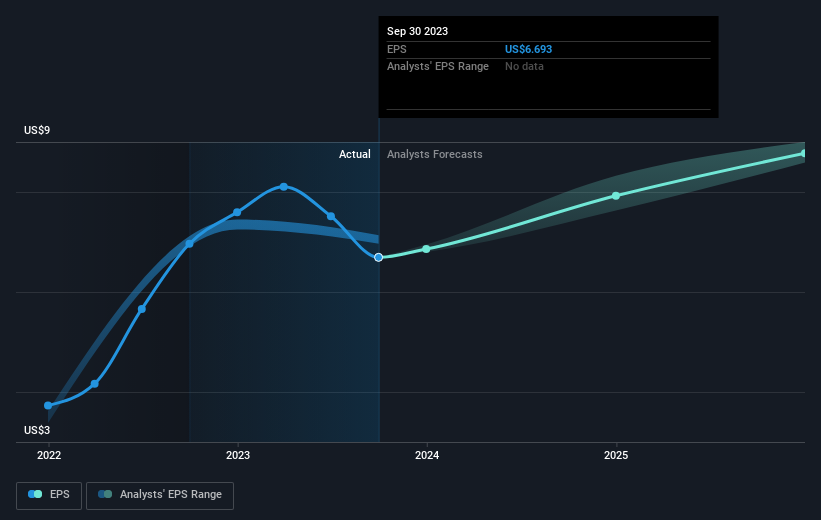

Over the past five years, Clean Harbors has achieved an impressive compound earnings per share (EPS) growth rate of 23% annually, closely matching the yearly share price growth of 24%. This correlation indicates that investor sentiment has remained consistent, with the share price tracking the company’s earnings growth closely. To visually represent this growth, refer to the image below.

CEO Compensation and Growth Prospects

Clean Harbors has earned praise on CEO remuneration, with the CEO receiving more modest compensation compared to peers in similarly capitalized companies. While monitoring executive pay is essential, a crucial question remains: will the company continue to grow its earnings in the future? To gain deeper insight, we recommend reviewing our free report on Clean Harbors’ earnings, revenue, and cash flow.

A Different Perspective: Shareholder Return and Rising Momentum

Clean Harbors’ shareholders have enjoyed a total return of 36% over the past year, outperforming the annualized return of 24% over the last half-decade. This suggests that the company’s recent performance has been robust, making it a stock worthy of closer examination. While share price analysis provides insight into business performance, it is imperative to consider other relevant factors. Notably, investors must be aware of the ever-present specter of investment risk. We have identified two warning signs with Clean Harbors that should be part of your investment process.

Don’t Miss Out on Insider Buying Opportunities

If you are eager to explore investing opportunities, we recommend perusing our list of growing companies that insiders are currently buying. Insider transactions can provide valuable insight into a company’s future prospects and growth potential.

Conclusion

Clean Harbors, Inc. has demonstrated exceptional share price growth, along with steady earnings per share (EPS) growth over the past five years. Shareholders have enjoyed solid returns, with recent momentum propelling the company forward. While caution is necessary in all investment decisions, exploring opportunities like insider buying can offer a unique perspective. For a comprehensive analysis, including fair value estimates, risks, and warnings, dividends, insider transactions, and financial health, we invite you to view our free analysis.

Have feedback or concerns about this article? Feel free to get in touch with us directly via email: editorial-team (at) simplywallst.com. Please note that this general analysis by Simply Wall St is based on historical data and analyst forecasts. It is not intended to be financial advice, nor does it take into account individual objectives or financial situations. Our focus is on delivering long-term, data-driven analysis. Kindly note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. Simply Wall St holds no position in any stocks mentioned.

Valuation Disclaimer: Valuation is complex, but we aim to simplify it for you. To assess whether Clean Harbors is potentially over or undervalued, we recommend referring to our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions, and financial health. Access the free analysis here.

If you have any feedback or concerns about the content of this article, please get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is based on commentary derived from historical data and analyst forecasts, deploying an unbiased methodology. It does not constitute financial advice and is not a recommendation to buy or sell any stock. Individual objectives and financial situations have not been considered. The analysis provided aims to present long-term focused insights driven by fundamental data. It is essential to note that the analysis may fall short of incorporating the latest price-sensitive company announcements or qualitative material. Simply Wall St holds no position in any stocks mentioned.

Please note that the market returns mentioned in this article reflect the market-weighted average returns of stocks currently traded on American exchanges[1].

Analyst comment

This news can be evaluated as positive. The share price of Clean Harbors, Inc. has experienced strong growth over the past five years, with a 190% increase. The company’s earnings per share (EPS) have also seen significant growth, closely aligned with the share price. Shareholders have enjoyed solid returns, with a total return of 36% over the past year. However, it is important to consider potential investment risks and to analyze other factors before making a decision.