Electronic Arts Agrees to $55 Billion Take-Private Deal

Electronic Arts (EA) announced on Monday its agreement to be acquired in an all-cash transaction valued at $55 billion. The deal, involving the Public Investment Fund (PIF) of Saudi Arabia, private equity firm Silver Lake, and Affinity Partners, will take the gaming giant private, offering shareholders $210 per share in cash. EA’s stock responded positively to the news, rising 4.5% on Monday following a 15% gain on Friday after reports surfaced that the company was nearing a privatization agreement.Investment Structure and Financing

The Public Investment Fund will maintain its existing 9.9% stake by rolling it over into the new ownership structure, becoming the majority investor. The consortium is committing $36 billion in equity capital, complemented by $20 billion in debt financing arranged by JPMorgan. Sources indicate JPMorgan was engaged in the deal process a few weeks prior to the announcement.Strategic Significance for Saudi Arabia’s Gaming Ambitions

This acquisition represents the largest move by the Saudi PIF into the gaming sector, which has seen increased activity since 2022. Analysts at Raymond James highlight PIF’s prior investments via its gaming arm, Savvy Gaming, including stakes in public game publishers and purchases of ESL, FACEIT, and Scopely. The EA deal marks a significant escalation in scale and ambition.“EA’s bold vision for the future aligns with our commitment to the gaming and entertainment sectors,” said Affinity CEO Jared Kushner, emphasizing his personal connection to the company’s iconic franchises.

Company Outlook and Leadership Comments

EA CEO Andrew Wilson expressed enthusiasm about the new partnership, affirming his intention to remain at the helm. He highlighted the partners’ extensive experience across sports, gaming, and entertainment, underscoring their belief in EA’s leadership and long-term strategy. The deal is expected to finalize in the first quarter of fiscal 2027. A 45-day window will allow for competing proposals, reflecting typical protocols in large-scale buyouts. Negotiations reportedly commenced in the spring of 2025.Record-Breaking Leveraged Buyout

The transaction is set to become the largest leveraged buyout in Wall Street history, surpassing previous records. EA’s portfolio includes flagship franchises such as Battlefield, The Sims, and the Madden NFL series, underscoring the strategic value of the acquisition.FinOracleAI — Market View

This landmark acquisition signals strong confidence in the long-term growth prospects of the video gaming industry, particularly as private investment fuels innovation and expansion. The involvement of sovereign wealth funds and strategic investors emphasizes gaming’s evolving role as a key entertainment and technology sector.- Opportunities: Enhanced capital resources for EA to innovate and expand franchises without public market pressures.

- Risks: High leverage introduces financial risk; integration of diverse investor interests may present governance challenges.

- Strategic impact: Saudi Arabia’s PIF strengthens its position as a major global player in gaming investments.

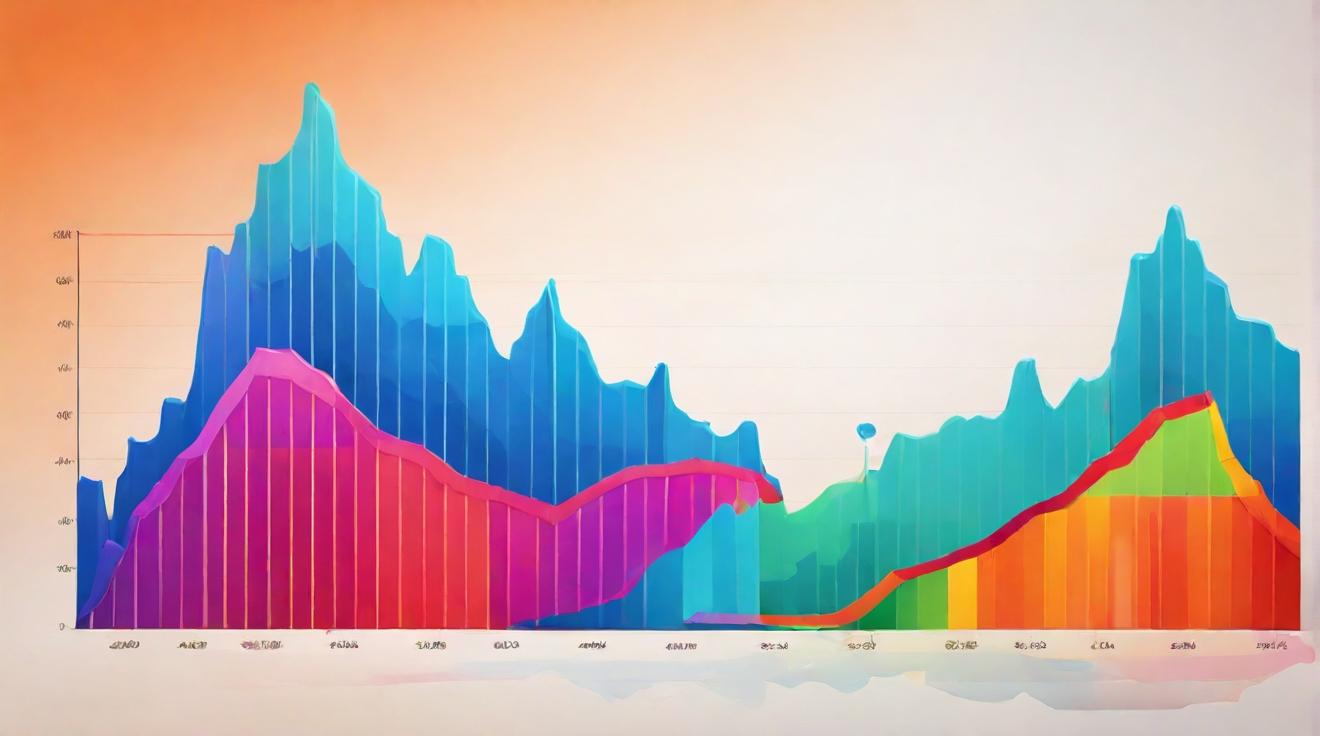

- Market reaction: Short-term share price appreciation reflects investor approval of premium offer.