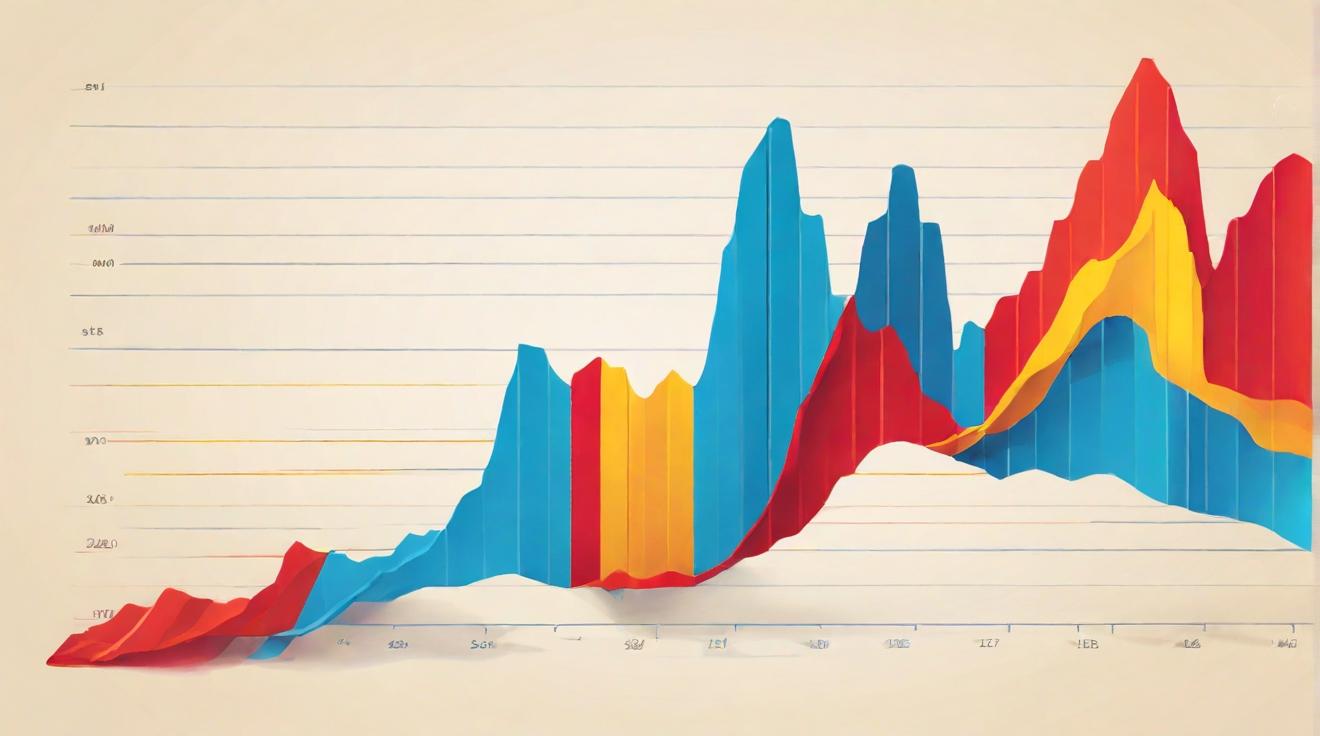

US Economy Faces Pressure Under Record-High Public Debt

The US is grappling with an unprecedented level of public debt, having reached a staggering $34 trillion this year, an amount that continues to raise alarm among economists. With the federal debt balance ballooning at an alarming rate—the government is estimated to add another $1 trillion to its debt every 100 days—there are growing concerns over the economic implications this might entail.

Economists highlight the pressing need to curb the pace of borrowing as crucial for safeguarding the future of the US economy.

The Domino Effect of Soaring Debt

The escalation in debt levels is not without its consequences. It serves as a fertile ground for a host of economic challenges, including higher inflation, a lower quality of life for Americans, and potentially a destabilization of the global financial system. As inflation remains persistently above the Federal Reserve's 2% target, hitting a 3.5% year-on-year increase in March, the immediate impact on consumer prices is unmistakable.

The Stakes of Selling US Debt

The US Treasury's ability to sell its debt through government bonds is fundamental to managing the debt. However, recent weak demand at Treasury auctions signals a declining confidence among investors, exacerbated by anticipations of 'higher for longer' interest rates and sustained inflation. A significant $385 billion in new bonds is set to hit the market in May, putting additional pressure on the Treasury's capacity to attract buyers.

Quality of Life and Financial Stability at Risk

The quality of life for Americans could further decline as the government diverts more funds to service its debt interest payments, which last year amounted to $429 billion. This reduction in available resources for critical social safety net provisions could have long-term repercussions for social security and other vital services.

Moreover, a widespread loss of faith in the safety of US government debt could precipitate financial market turmoil. A scenario where markets crash due to fears the US might default on its obligations presents a real, albeit worst-case, risk.

A Call for Sustainable Economic Growth

While robust economic growth has the potential to mitigate the implications of rising debt, the stark reality is that the national debt has grown significantly faster than the economy. Over the last decade, the debt balance surged by 86% against a 63% growth in GDP.

The path to a sustainable economic future lies in the government's ability to rein in its borrowing habits.

The Uncertain Horizon

The timeline when the US's escalating debt might spiral into a full-blown crisis is unclear, yet economists warn that without a deceleration in borrowing, a crisis could emerge within the next decade. The need for immediate action to address this growing economic threat has never been more urgent.

Analyst comment

Negative news. The market could face challenges due to the escalating public debt. There may be higher inflation, lower quality of life for Americans, and potential destabilization of the global financial system. Weak demand for government bonds and declining investor confidence could put pressure on the Treasury’s ability to sell debt. A reduction in funds for critical social safety net provisions could have long-term repercussions. Loss of faith in US government debt could lead to financial market turmoil. The government must rein in borrowing to ensure sustainable economic growth and prevent a crisis within the next decade.