Understanding the China-US Collaboration on Financial Stress Management

The recent announcement that China and the United States are teaming up to form a contact group focused on managing global financial stress has captured significant attention. This collaboration is not only a testament to the interdependence of the world's two largest economies but also a strategic move to prevent potential financial crises that could have widespread implications.

Why the Collaboration?

The global economy is increasingly interconnected, and financial disturbances in one region can quickly ripple across the world. China and the US, recognizing their pivotal roles in the global financial system, have decided to cooperate to address and mitigate financial stress. This collaboration aims to foster stability by sharing insights, coordinating policies, and implementing swift responses to emerging economic challenges.

Example: Consider a situation where a financial crisis in one country leads to a rapid withdrawal of capital from emerging markets. Such a scenario could destabilize global markets, similar to the 2008 financial crisis. By working together, China and the US can better manage these risks and coordinate their responses to minimize adverse impacts.

Historical Context and Recent Developments

In recent years, both countries have faced their own financial challenges, driven by factors such as trade tensions, economic sanctions, and the ongoing impact of the COVID-19 pandemic. These challenges have highlighted the need for a more collaborative approach to financial stability.

Historical Example: During the 2008 financial crisis, coordinated efforts by major economies under the G20 helped to stabilize global markets. This new contact group can be seen as a continuation of such efforts, tailored to the specific dynamics between China and the US.

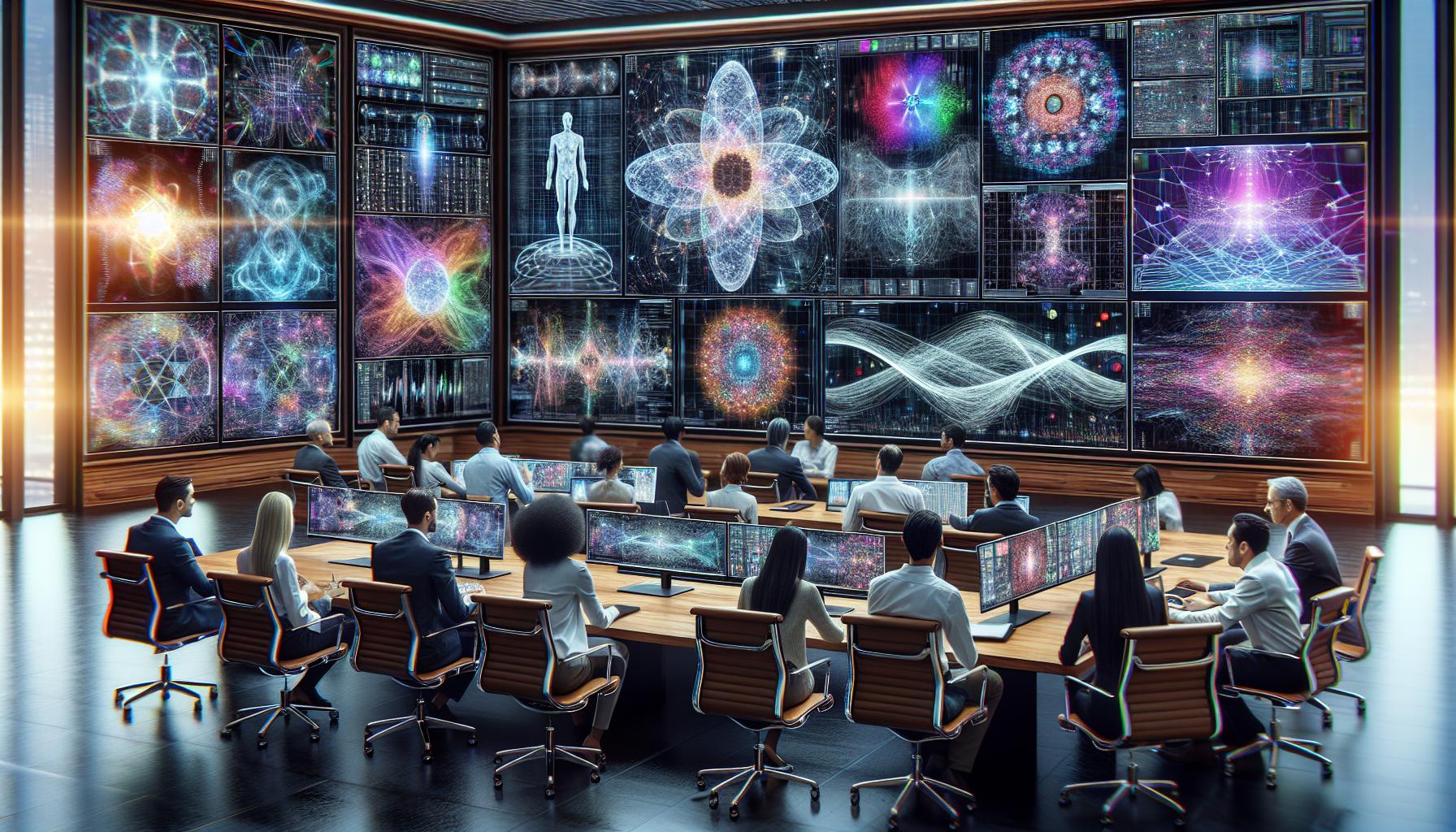

Key Areas of Focus

The contact group will likely address several critical areas:

- Currency Stability: Ensuring stable exchange rates to prevent market volatility.

- Market Regulation: Harmonizing regulations to prevent financial manipulation and enhance transparency.

- Crisis Response: Developing joint strategies for rapid intervention during financial emergencies.

Economic Trends and Implications

This collaboration comes at a time of shifting economic trends, including the rise of digital currencies, geopolitical tensions, and the need for sustainable finance. By working together, China and the US can set a precedent for other nations, encouraging a more cooperative global approach to economic challenges.

Trustworthiness and Authority: This partnership between China and the US is a significant move towards building a more resilient global financial system. By leveraging their combined expertise and resources, they can provide authoritative guidance and support to other countries facing similar challenges.

In conclusion, the formation of a China-US contact group is a proactive step towards ensuring global financial stability. As the global economic landscape continues to evolve, such collaborations will be crucial in navigating future uncertainties and safeguarding economic prosperity for all nations.