Asian Investors Monitor China’s Economic Revival

Asian investors are closely watching China’s efforts to revive its slowing economy as the country heads into 2024. With China being a key driver of growth in the region, any steps taken to rejuvenate its economy will have a significant impact on investment prospects. China’s policymakers have been implementing various measures to stimulate economic growth, including tax cuts, infrastructure spending, and monetary easing. These efforts are being closely monitored, as investors look for potential opportunities in sectors that are expected to benefit from China’s revival.

Potential Interest Rate Cuts Across Asia

In addition to keeping an eye on China’s economic revival, Asian investors are also monitoring the possibility of interest rate cuts across the region. Central banks in several Asian countries, including South Korea and Thailand, have already cut interest rates in an effort to stimulate their economies. As global growth becomes more uncertain, central banks in Asia may choose to further lower interest rates to support domestic consumption and investment. These potential rate cuts have the potential to boost economic growth and investment sentiment across the region.

Japan Expects High Economic Growth in 2024

Japan, one of Asia’s largest economies, expects high economic growth in 2024. The government has introduced measures to stimulate domestic demand and investment, including increased infrastructure spending and tax incentives. Additionally, Japan’s hosting of the Olympic Games in Tokyo in 2024 is expected to provide a boost to the economy. The construction and tourism sectors are anticipated to benefit significantly from the influx of visitors. The combination of these factors has led to optimism among investors, who are closely watching Japan’s economic performance.

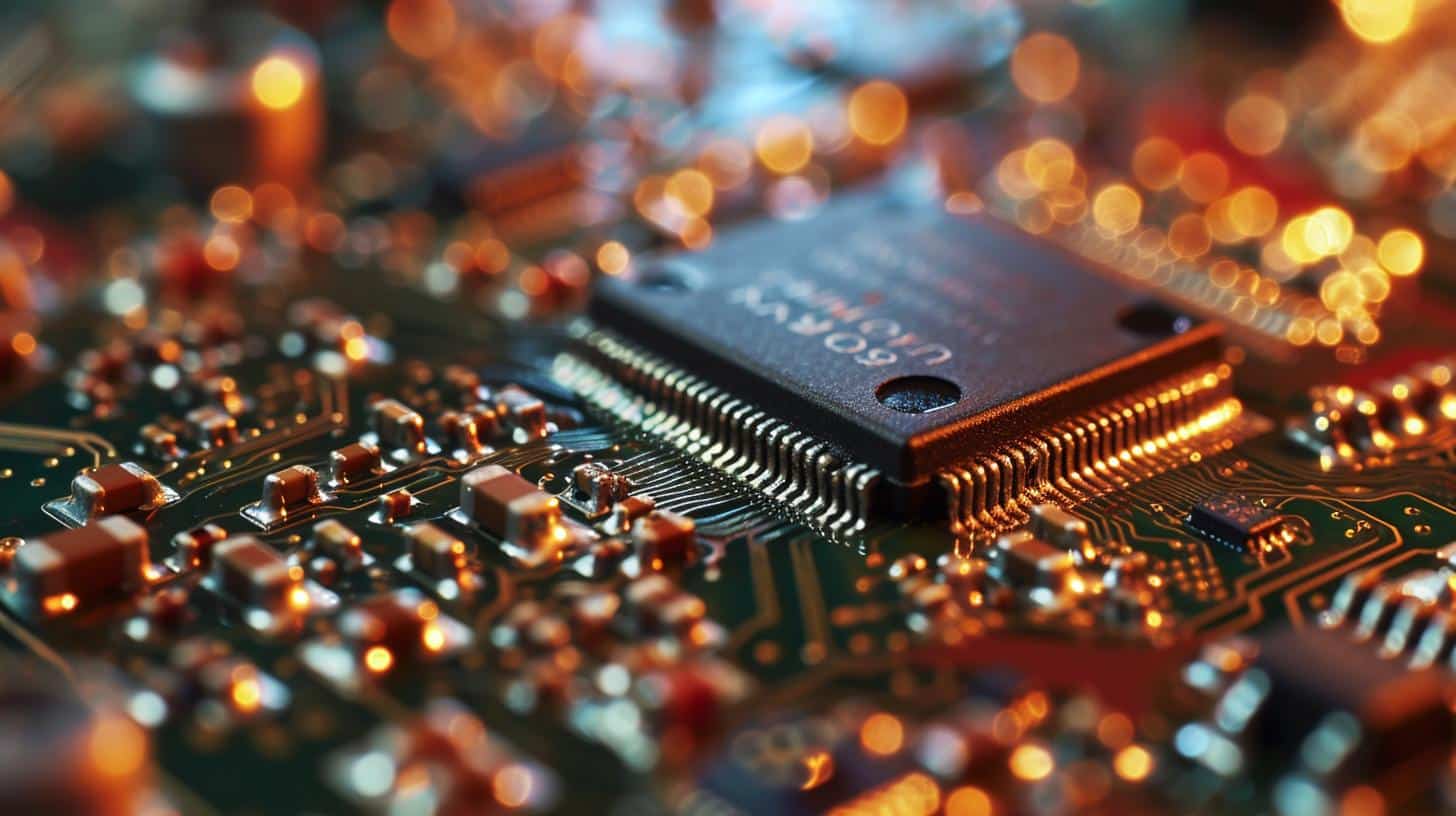

Recovery in Semiconductor Chip Space Benefits Asia

A key area that Asian investors are monitoring is the recovery in the semiconductor chip space. The global shortage of semiconductor chips has had a significant impact on various industries, including automotive and technology. However, as the supply chain disruptions caused by the pandemic are gradually resolved, the semiconductor industry is expected to recover. This recovery is particularly important for Asia, as the region is a major player in the global semiconductor market. The revival of the semiconductor chip space is anticipated to have positive implications for Asian economies, driving growth and investment opportunities.

Asia Set to Outperform Developed Countries in 2024

Asia looks set to enter a “sweet spot” early in 2024, with growth expected to outperform that of developed countries. According to Nomura’s 2024 market outlook, the recovery in the semiconductor chip space is a key factor driving Asia’s outperformance. Additionally, China’s efforts to revive its economy, potential interest rate cuts across the region, and Japan’s high economic growth expectations further contribute to the positive sentiment. Asian investors are keeping a watchful eye on these factors and positioning themselves to take advantage of the potential growth opportunities in the region. As global economic uncertainties persist, Asia’s resilience and growth prospects make it an attractive investment destination for investors seeking higher returns.

Analyst comment

Positive news: Asian Investors Monitor China’s Economic Revival, Japan Expects High Economic Growth in 2024, Recovery in Semiconductor Chip Space Benefits Asia, Asia Set to Outperform Developed Countries in 2024.

Negative news: None

Neutral news: Potential Interest Rate Cuts Across Asia

As an analyst, I predict that the market will experience positive growth, driven by China’s economic revival, interest rate cuts, high economic growth in Japan, recovery in the semiconductor chip space, and Asia’s outperformance compared to developed countries. Investors will likely position themselves to take advantage of growth opportunities in the region.