Solana Price Soars: A New Contender for Ethereum's Crown?

The Solana (SOL) network has been a hot topic among cryptocurrency enthusiasts and analysts alike. This high-speed blockchain platform has attracted both attention and criticism for its ambitious goal to topple Ethereum (ETH) from its leading position in the Web3 ecosystem. Recently, Solana's market performance has been impressive, surpassing Binance-backed BNB to become the fourth most valuable digital asset by market capitalization. But what does this mean for Ethereum? Let's delve deeper.

Solana vs. Ethereum: The Race Intensifies

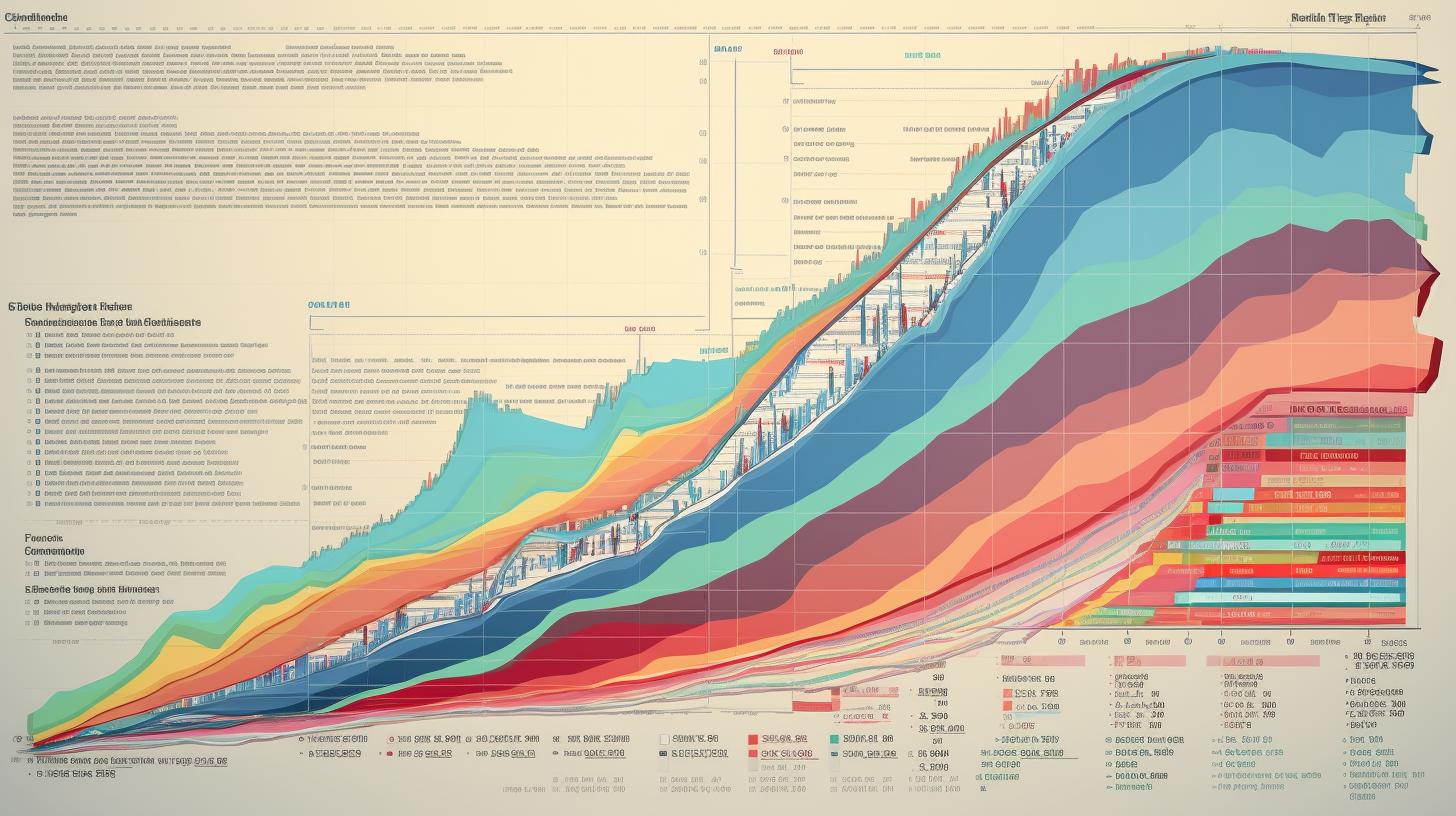

In terms of market data, the Solana network currently holds a Total Value Locked (TVL) of about $4.8 billion and boasts a stablecoins market cap of around $3.68 billion. On the other hand, Ethereum dwarfs these figures with over $46 billion in TVL and a stablecoins market cap approaching $80 billion. Despite this, some influential voices in the crypto space, like veteran trader Peter Brandt, believe that Solana may eventually outshine Ethereum. This contrasts with the views of Ethereum’s co-founder Vitalik Buterin, who argues that Ethereum's layer two solutions provide fast, affordable, and secure transactions.

Ethereum's Path Forward

While Vitalik Buterin has emphasized Ethereum's efficiency, Peter Brandt criticizes the network as overly complex and not as decentralized as it claims to be. With the recent surge in the SOL/ETH trading pair, reaching new heights, Brandt suggests that Solana might be on the brink of a substantial rally, potentially doubling its performance against Ethereum in the foreseeable future.

Solana's Strategic Gains

Boosting Solana's outlook, Brazil has approved the first spot SOL ETF (Exchange-Traded Fund), signaling growing acceptance and institutional interest. This comes as VanEck pushes for a similar product in the United States. Such moves, coupled with a possible altseason—a period characterized by rising altcoin values outpacing Bitcoin—could lead to significant crypto cash flow favoring Solana over Ethereum.

Conclusion: A Shift in Dynamics?

The question remains: Is Solana's ascendancy inevitable, or will Ethereum retain its dominance? As Solana continues to gain momentum and investor confidence, the cryptocurrency market landscape could see a shift. However, Ethereum's established infrastructure and massive user base remain formidable barriers.

In essence, the unfolding battle between Solana and Ethereum is a significant narrative in the evolving world of blockchain technology and cryptocurrency markets. Only time will tell how these dynamics will play out, but one thing is certain: the competition is heating up.