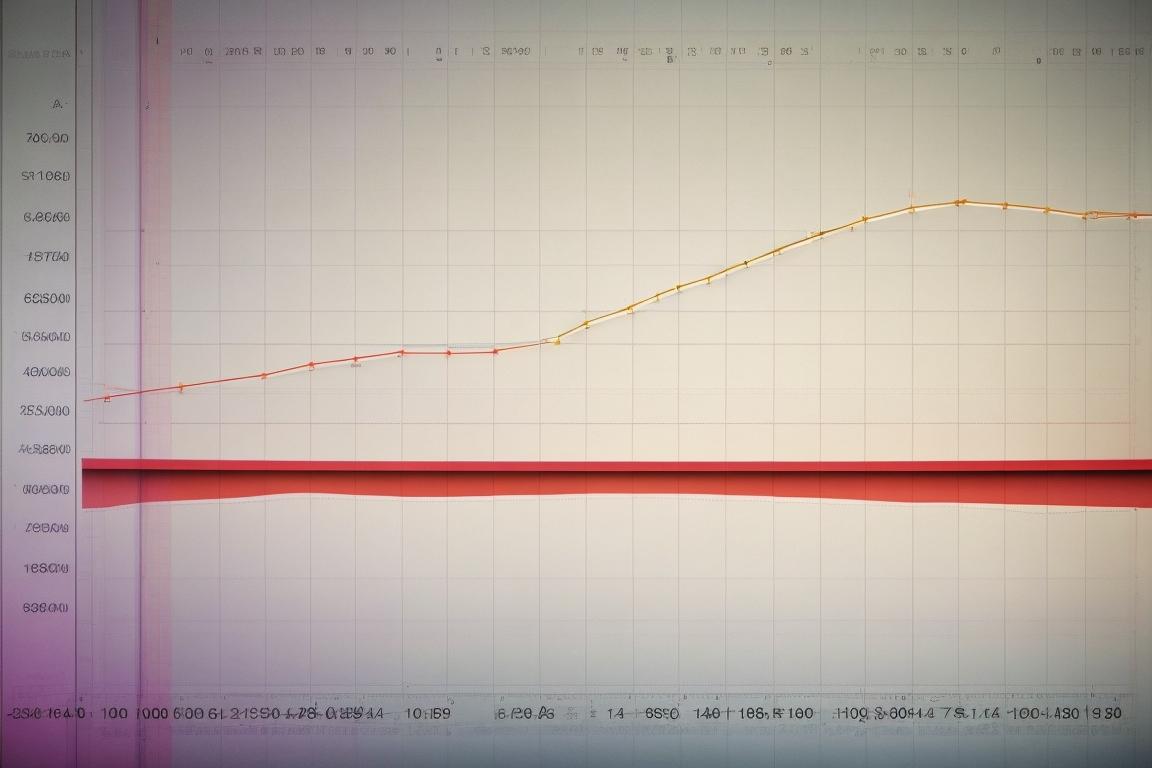

Ethereum Wallet Profitability Amid Market Downturn

The recent downturn in the cryptocurrency markets has placed Ethereum (ETH) holders in a precarious position. According to data from IntoTheBlock, only 66% of Ethereum addresses are currently profitable. This substantial drop is reminiscent of the market scenario in October 2023, when Ethereum was trading around $1,800. The decline has underscored the volatility of the crypto market, leaving many holders at a loss as Ethereum's value decreased.

ETH ETFs: Strong Start, Early Outflows

Despite the overall gloomy sentiment, ETH exchange-traded funds (ETFs) began with a robust trading volume of $5.8 billion. However, the initial excitement was short-lived as these ETFs recorded net outflows of $484 million in the first week. This mixed performance highlights the intricate dynamics within the crypto markets, where investor euphoria can quickly fade in the face of broader market trends.

Institutional Interest and Spot ETFs

Ethereum remains a leader in institutional interest, with a $155 million inflow, the largest this year, as reported by CNF. This surge was largely driven by the introduction of spot ETFs in the United States, which have captured significant interest.

Traditional Meets Decentralized Finance

Franklin Templeton's decision to build a tokenization fund on Ethereum emphasizes the growing convergence of traditional and decentralized finance (DeFi), indicating a stronger commitment from established financial organizations to blockchain technology.

Blockchain Innovations and Updates

In addition to these developments, Ethereum co-founder Vitalik Buterin has announced important updates to the blockchain's structure. He highlighted the necessity for different participants to contribute transactions to a single block, enhancing Ethereum's decentralized nature. Buterin also mentioned ongoing discussions about potentially removing the "last-mover advantage" in transaction ordering, which could have significant implications for transaction processing within the network.

Current Market Position

Ethereum continues to lead in innovation within the crypto industry, despite hurdles posed by market fluctuations. At the time of writing, the ETH price stands at approximately $2,720.18, marking a 1.89% increase over the past 24 hours, with a daily trading volume of $15.08 billion.