SEC Extends ETH ETF Decision by 45 Days

The U.S. Securities and Exchange Commission (SEC) has recently taken a significant step towards approving or rejecting an Ethereum spot ETF. In a response to Fidelity, the SEC announced that it will extend its decision-making process regarding the Fidelity spot Ethereum ETF application. The application, which was submitted in November 2023, will now undergo an extended resolution period, with the decision expected to be reached around March 5, 2024. Bloomberg analyst James Seyffart suggests that approval may be possible in May. This development is eagerly awaited by market participants who are closely monitoring the SEC’s decision.

ETH Outflows Increase as SEC Deliberates

As the SEC extends its decision-making process on the Ethereum spot ETF, there has been a noticeable increase in ETH outflows from exchanges. The balance between inflow and outflow shifted on January 14, with more ETH leaving exchanges than entering. This trend indicates that a larger volume of ETH is being withdrawn from exchanges compared to the incoming volume, suggesting that market participants are withdrawing their assets from exchange platforms.

SEC Responds to Fidelity’s Ethereum ETF Application

The SEC’s decision to extend the resolution period for the Fidelity spot Ethereum ETF application comes as no surprise. The regulatory body has been cautious in its approach to approving ETFs in the crypto space, with multiple Bitcoin ETF applications also facing delays. However, there is optimism that the SEC may approve the Ethereum spot ETF, especially after the successful approval of the spot Bitcoin ETF. BlackRock’s CEO, Larry Fink, has expressed confidence in the value of a spot Ethereum ETF, further adding to the positive sentiment surrounding its approval.

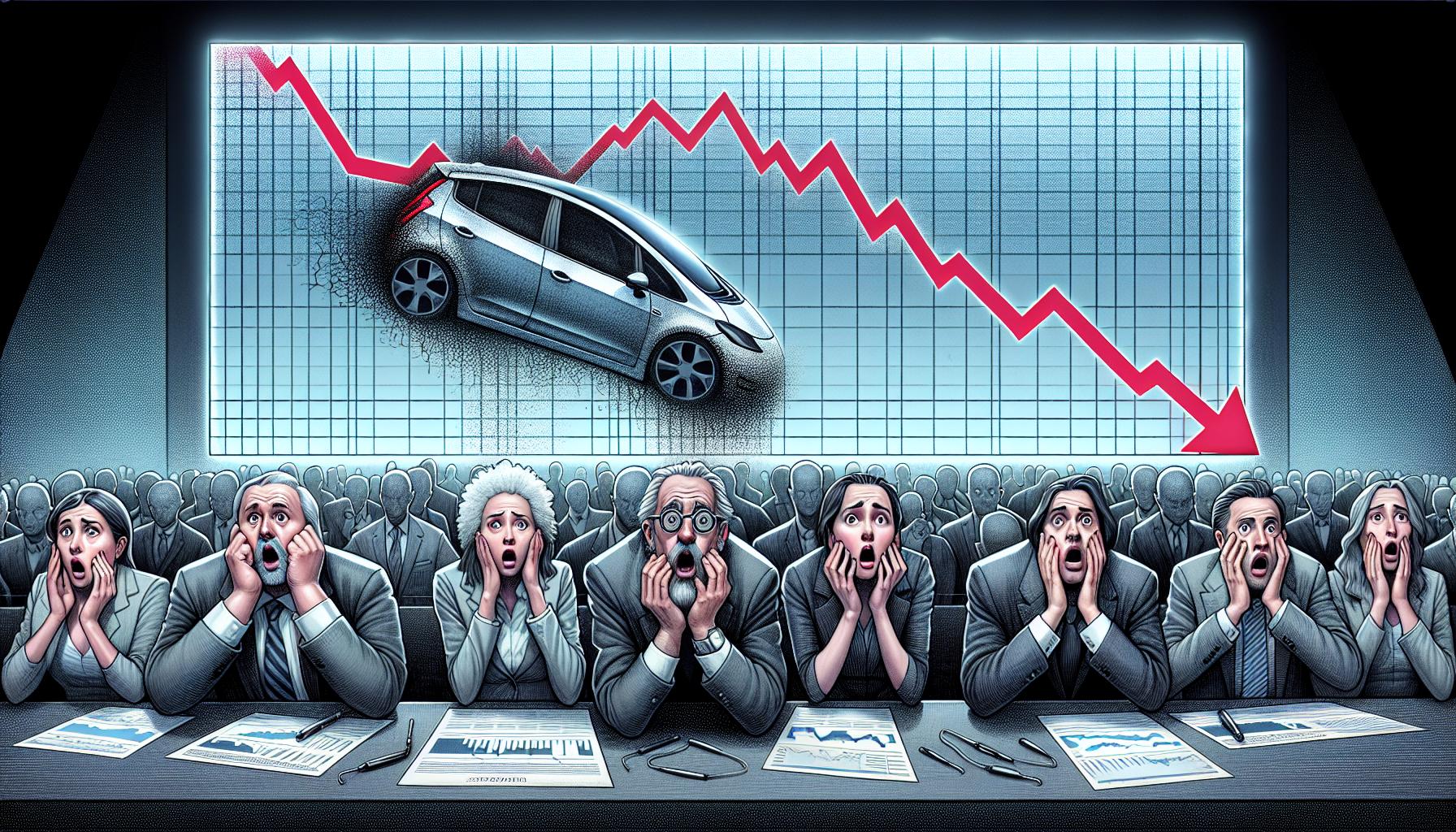

Ethereum Downtrend Persists Amidst ETF Decision

Despite the anticipation surrounding the SEC’s decision on the Ethereum spot ETF, the price of Ethereum remains in a downtrend. At the time of writing, ETH is trading around $2,400, experiencing a slight loss of less than 1% in the past 24 hours. It is worth noting that the news of the ETF proposal submission and the subsequent decision announcement may have a more significant impact on the price of Ethereum than the actual approval. Analysts believe that the approval of a spot Ethereum ETF could potentially drive the price of ETH higher.

Ethereum Exchange Flow Shows Outflows Surge

Data on Ethereum’s exchange flow indicates a significant surge in outflows in recent weeks. As of January 18, over 90,000 ETH has moved out of exchanges, further supporting the notion that market participants are withdrawing their assets from exchange platforms. This trend also implies that fewer Ethereum assets are being offered for sale recently, which could impact the overall liquidity and supply of ETH in the market. It remains to be seen how this outflow trend will continue as the SEC’s decision on the spot Ethereum ETF approaches.

In conclusion, the SEC’s decision to extend the resolution period for the Fidelity spot Ethereum ETF application has sparked both excitement and skepticism among market participants. While the approval of a spot Ethereum ETF could have a positive impact on the price of ETH, the current downtrend suggests that investors are cautious. The surge in outflows from exchanges further adds to the anticipation surrounding the SEC’s decision. As the wait continues, all eyes are on the regulatory body to see how they will shape the future of Ethereum ETFs.

Analyst comment

Positive news:

– Approval of a spot Ethereum ETF could potentially drive the price of ETH higher.

– Optimism surrounding the SEC’s possible approval of the Ethereum spot ETF, given the successful approval of the spot Bitcoin ETF and support from BlackRock’s CEO.

Negative news:

– Ethereum remains in a downtrend, with the price trading around $2,400.

– Surge in outflows from exchanges may indicate cautiousness from market participants.

Neutral news:

– SEC extends the decision-making process for the Fidelity spot Ethereum ETF application.

– Balance between ETH inflows and outflows shifted, with more ETH leaving exchanges than entering.

– Data on Ethereum’s exchange flow shows a significant surge in outflows.

As an analyst, it is expected that market volatility will continue as market participants eagerly await the SEC’s decision on the spot Ethereum ETF. The outcome of the decision could heavily influence the price of ETH, but the current downtrend and cautiousness from investors suggest a mixed market sentiment.