Ether (ETH) Price Prediction – Next Leg Up Starting Soon?

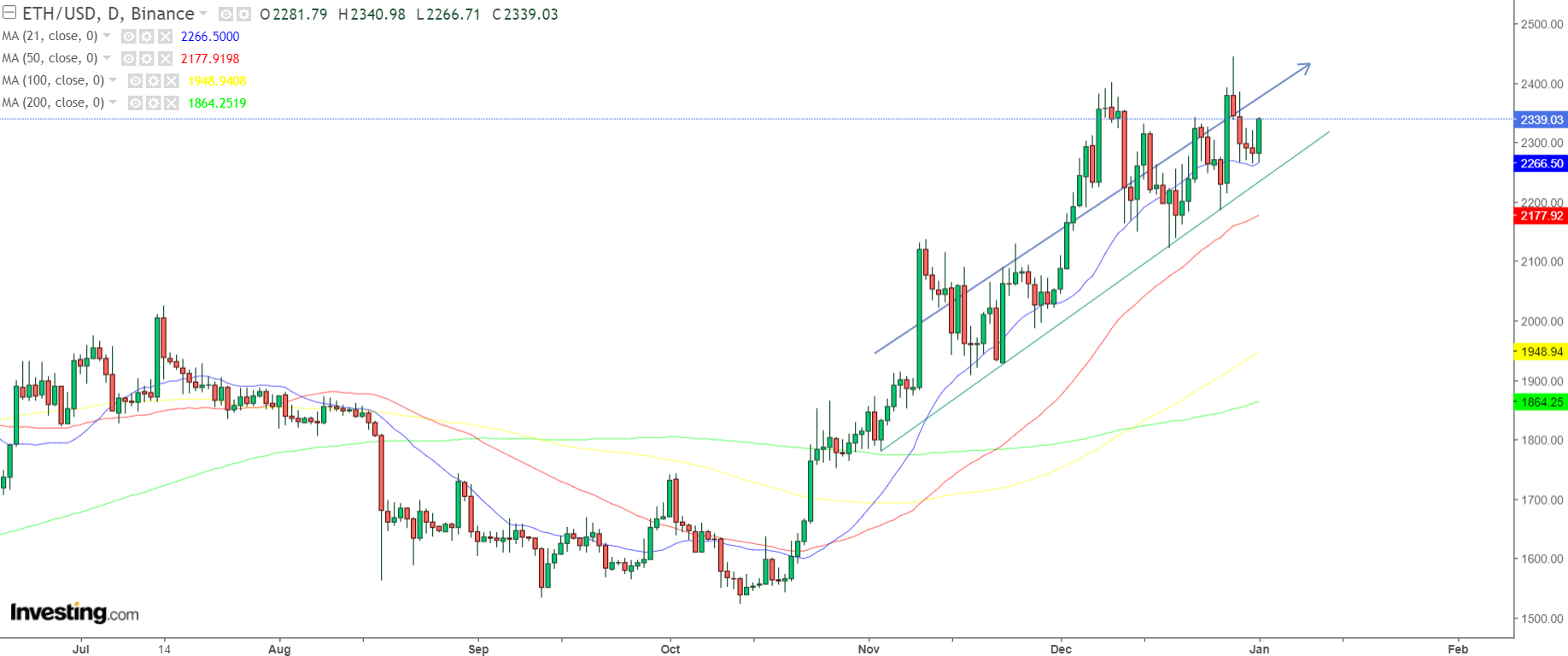

Ether remains very much in a medium-term uptrend, with the latest bounce from its 21DMA further strengthening this notion.

Whilst some have been warning of a “sell the news” event across crypto markets once the spot Bitcoin ETFs gain approval, price risks remain tilted to the upside following ETH’s bounce from the key long-term support level in the $2,100s in December.

The next major bullish target for the coming months is long-term support-turned-resistance in the $3,500s, an area that hasn’t been tested going all the way back to April 2022.

ETH gained “only” around 100% in 2023, well below Bitcoin’s 160% gain.

2024 could well be a year of catch-up for Ether versus Bitcoin, and a 50% rally to the $3,500s in the next few months could be the first stage in Ether’s catch-up play.

The next major leg up in the cryptocurrency may well have already started.

ETH Alternative – Sponge V2 ($SPONGEV2)

Sponge V2 ($SPONGEV2) is the reincarnation of the legendary Spongebob Squarepants-themed $SPONGE token, which reached a market cap of nearly $100 million earlier in 2023 and delivered gains to its earlier investors in the region of 100x.

$SPONGE token holders will be able to stake their tokens to receive an equivalent amount of $SPONGEV2 tokens, as well as to start earning staking rewards (paid out in $SPONGEV2) with a minimum APY of 40%.

$SPONGEV2’s main advantage over $SPONGE is that it will power a new play-to-earn game, the details of which are yet to be released.

But we do know that there will be a free version and paid version of the game.

*Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.*

Ether (ETH) Pushing Higher on the First Day of 2024

Ether (ETH), the native cryptocurrency of the layer-1 smart contract-enabled Ethereum blockchain, is pushing higher on the first day of 2024, up around 2% in the past 24 hours and trading in the mid-$2,300s, as per CoinMarketCap.

Ether (ETH) Holds Steady as Trading Volumes Stay Subdued

In recent days, Ether has been able to hold to the north of its 21DMA, which has acted as solid near-term support in the mid-$2,200s.

The past few days has also seen subdued trading volumes, with many major market participants absent given Christmas/New Year’s celebrations – less than $7 billion in ETH/USD changed hands on Monday as per data presented by Yahoo Finance.

But these volumes are expected to significantly pick up as the week continues and traders return.

Traders Anticipate Key Market Events for Ether (ETH) This Week

They will be monitoring various upcoming key market events, such as the potential approval this week of spot Bitcoin ETFs (which would open the door to spot Ethereum ETFs), fresh news on the upcoming Ethereum Dencun upgrade and macro data, including the widely anticipated US jobs report on Friday.

Analyst comment

Positive news: Ether (ETH) Price Prediction – Next Leg Up Starting Soon?

Analysis: Ether remains in a medium-term uptrend, with support levels holding and a potential target of $3,500 in the coming months. 2024 is expected to be a year of catch-up for Ether compared to Bitcoin, and there is potential for a 50% rally. The market may already be starting the next major upward movement.

Neutral news: Ether (ETH) Pushing Higher on the First Day of 2024

Analysis: Ether is up around 2% on the first day of 2024, trading in the mid-$2,300s. No major analysis or predictions are provided, just a statement of the current price movement.

Neutral news: Ether (ETH) Holds Steady as Trading Volumes Stay Subdued

Analysis: Ether has maintained its position above the 21DMA support level, with trading volumes remaining low due to holiday celebrations. Volumes are expected to increase as the week progresses and traders return.

Neutral news: Traders Anticipate Key Market Events for Ether (ETH) This Week

Analysis: Traders are keeping an eye on upcoming market events, including potential approval of Bitcoin ETFs, news on the Ethereum Dencun upgrade, and macro data such as the US jobs report. No specific predictions or analysis are given.