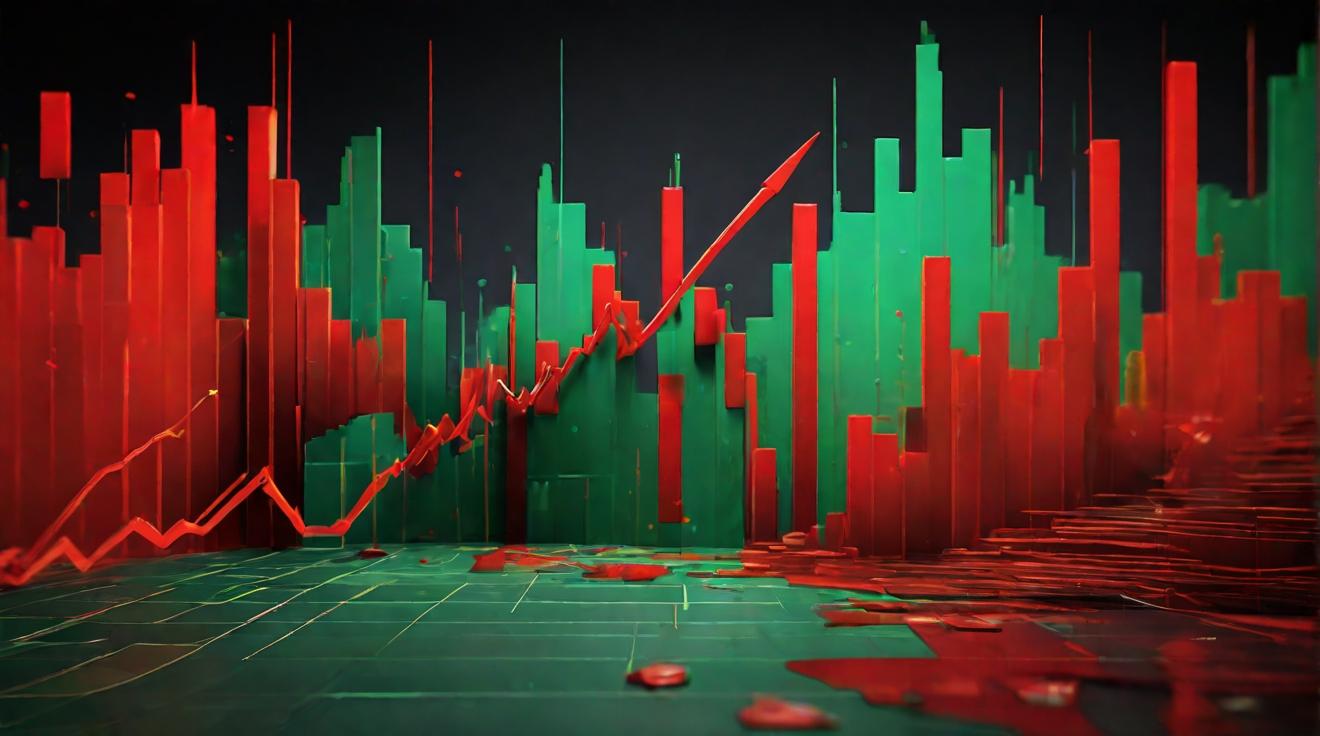

Ethereum is approaching a critical moment in its trading as it forms a bearish triangle pattern, indicating a possible significant breakout. A bearish triangle pattern is a chart pattern that shows a downward trend, formed by drawing two converging trendlines on a price chart. If Ethereum breaks below the lower boundary of this triangle, it could lead to a sharp decline towards the $2,160 target. Let's explore how this pattern might affect Ethereum's price.

Analyzing Current Price Actions Within The Bearish Triangle

In the last day, Ethereum's price has risen by 2.11% to about $2,642. Its market capitalization—the total value of all its coins—now exceeds $317 billion with a trading volume over $21 billion. Market capitalization and trading volume are crucial indicators used to assess the market’s activity level.

Looking at the 4-hour chart, Ethereum is trading below the **100-day Simple Moving Average (SMA)**—a line that shows the average price over the last 100 days—and is nearing the lower boundary of the bearish triangle. The presence of several bearish candlesticks—red bars that indicate price drops—suggests a negative market sentiment, hinting at potential price declines.

The Composite Trend Oscillator (CTO) on the 4-hour chart shows both the signal line and the SMA line are in the overbought zone, meaning they have gone higher than usual and may fall soon. The signal line trying to cross below the SMA line suggests increasing bearish pressure.

On the 1-day chart, Ethereum also remains below the 100-day SMA and is moving towards the triangle's lower boundary. A single bearish candlestick indicates growing bearish momentum, possibly leading to a price breakout.

The CTO on the daily chart confirms the potential for continued bearish movement, with both the signal and SMA lines in the oversold zone—indicating they may rise soon—and not showing signs of crossing upwards.

Potential Scenarios For Ethereum Following A Breakout

If Ethereum breaks below the bearish triangle, the price may drop towards the $2,160 support level. Support levels are prices where a declining asset might stop falling due to increased buying interest. Breaking this level could lead to more decreases.

Conversely, if Ethereum doesn't break below, it might move towards the upper boundary of the triangle. If it breaks above, it could rise to test the $2,816 resistance level—a point where selling interest might prevent price increases—and possibly advance further if this resistance is surpassed.