China Dominates Chipmaking Equipment Spending

In a bold move to dominate the semiconductor industry, China has emerged as the leading spender on chipmaking equipment, investing a whopping $25 billion in the first half of 2024. This figure surpasses the combined investments of key players like South Korea, Taiwan, and the U.S., showcasing China's strategy to localize chip production and lessen dependency on foreign technologies amid growing trade tensions.

Strategic Investments Towards Self-Sufficiency

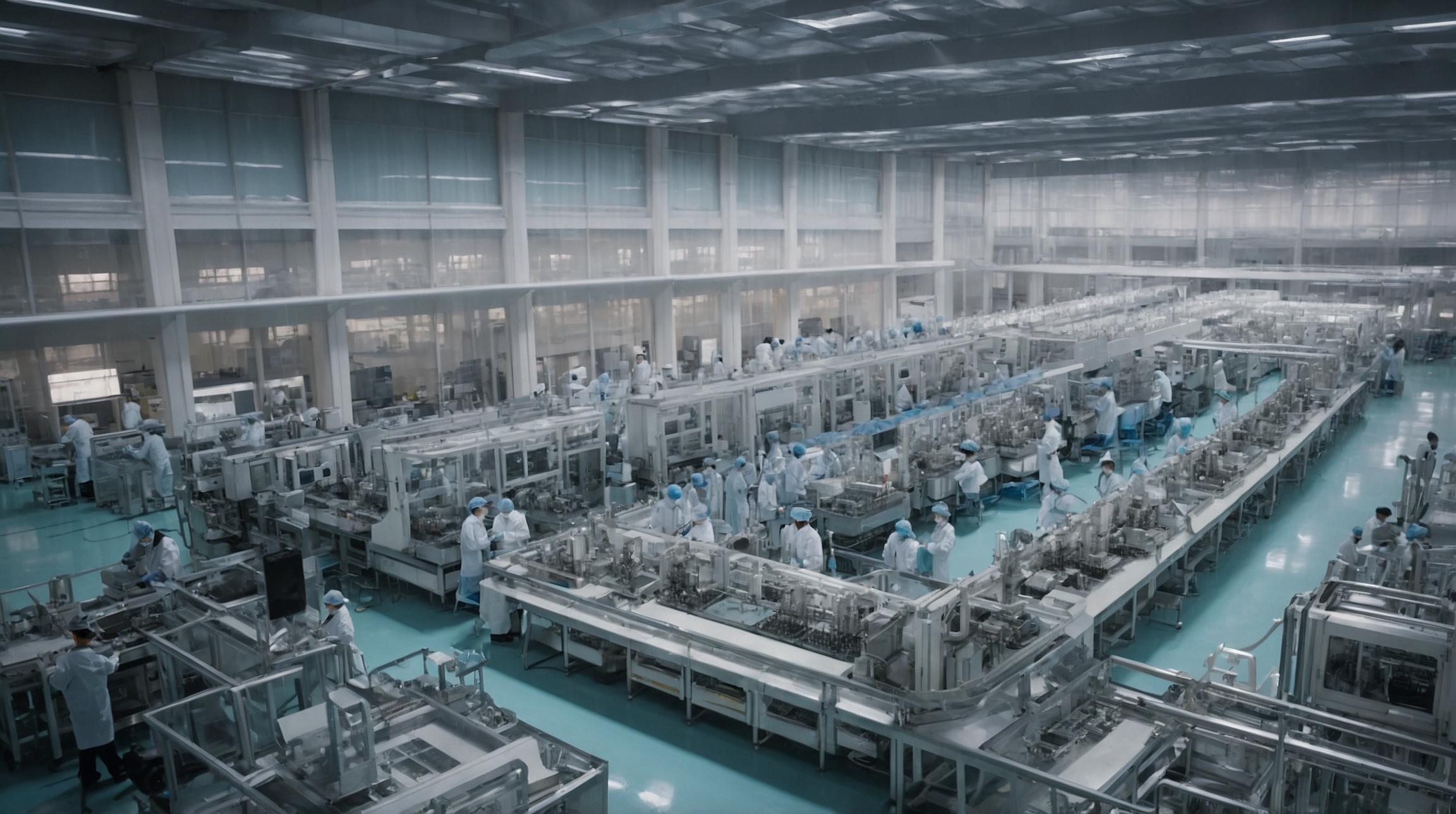

China's spending splurge, anticipated to reach $50 billion by the end of 2024, underscores the country's commitment to ensuring a stable chip supply. Chips are crucial to industries ranging from electronics to automobiles. As a result, over a dozen new Chinese fabrication plants (fabs) are set to commence operations between 2024 and 2025. This expansion includes not just giants like Semiconductor Manufacturing International Corp. (SMIC) and Hua Hong but also smaller and mid-sized manufacturers.

Focus on Trailing Nodes

Interestingly, the new fabs in China predominantly focus on trailing nodes. These are older chip-making technologies that are easier to produce domestically given the challenges in acquiring advanced equipment. Despite a global economic slowdown, China stands out as the only major market to increase its spending on fab tools from the previous year. In contrast, regions like Taiwan, South Korea, and North America have scaled back their investments.

Impact on Global Equipment Suppliers

The ripple effect of China's investments has significantly boosted revenues for global chipmaking equipment firms. Companies such as Applied Materials, Lam Research, KLA, Tokyo Electron, and ASML have reported substantial revenue contributions from China, with ASML attributing nearly 49% of its revenue to Chinese demand.

Sustaining Industry Growth

China's aggressive purchasing strategy has pushed the industry's capital intensity, a measure of the ratio of capital expenditures to sales, to exceed 15% annually over the past four years. This trend mirrors the robust growth in global semiconductor sales, driven chiefly by the demand for memory chips and AI-related semiconductors. Conversely, sectors like automotive and industrial chips are adjusting to current market conditions with moderate growth.

Looking Ahead: Global Expansion

As China's investments continue to stabilize, other regions including Southeast Asia, America, Europe, and Japan are expected to boost their semiconductor capabilities. This global shift hints at a competitive landscape, with each region striving to enhance its chip production resilience and meet rising demand.