The Current Drop and Market Reactions

The cryptocurrency market, known for its ups and downs, has seen a significant decline in Bitcoin's value recently. While some see this as a chance to buy at lower prices, others are cautious about investing in such a volatile asset.

Gracy Chen, CEO of BitGet, views this drop as a buying opportunity. She suggests that price levels around $43,000 to $47,000 could be good entry points to enhance a Bitcoin portfolio. "I am in the camp of buyers during dips," she stated, noting that she has continued to buy even when Bitcoin's price was as high as $60,000.

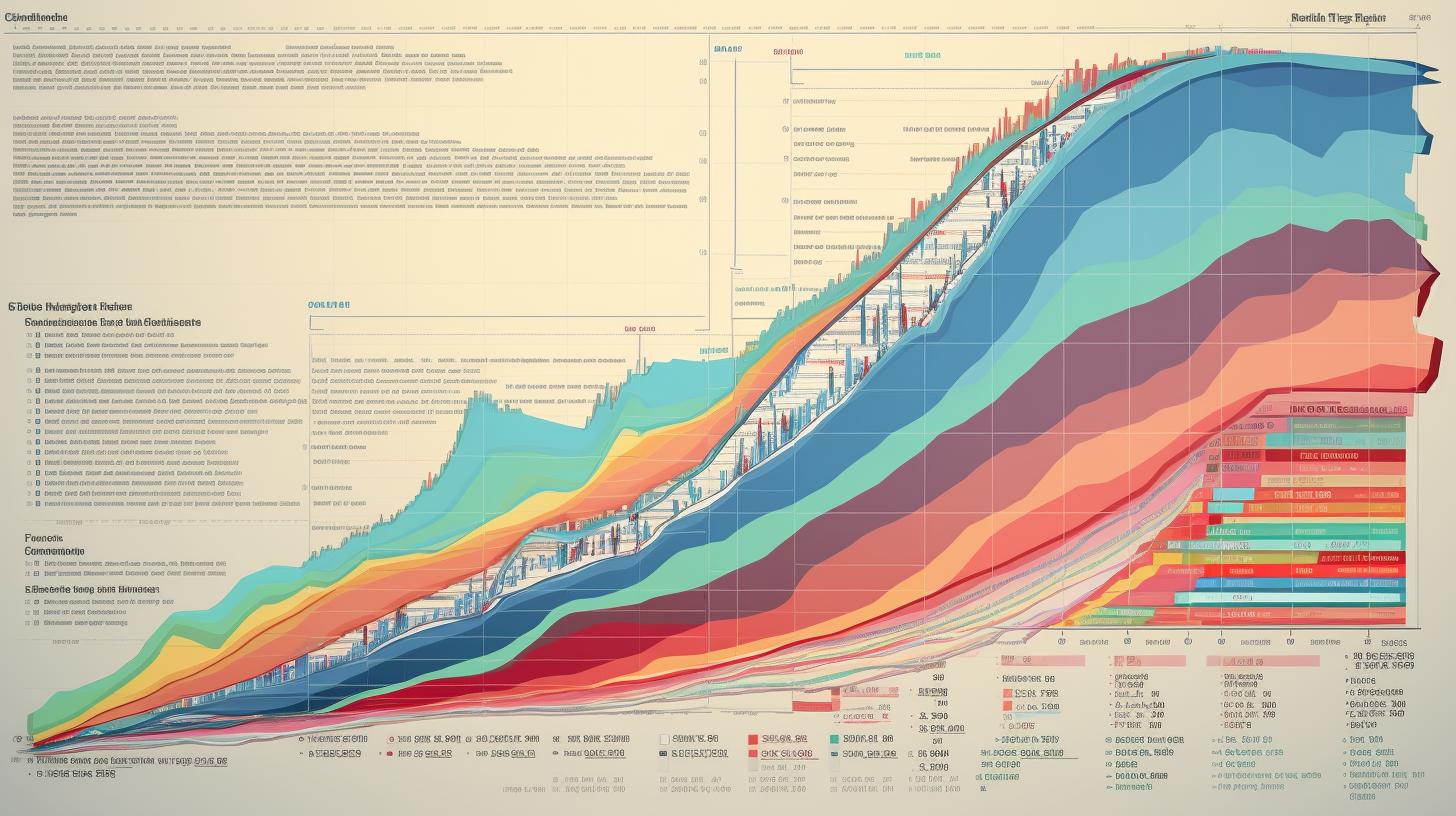

The recent decline saw Bitcoin's price fall from $60,000 to $49,000 in less than a day, catching many investors off guard. Volatility is a well-known characteristic of Bitcoin, and it often triggers strong market reactions. Yet, major players like MicroStrategy view such drops as buying opportunities. Historically, Bitcoin has experienced significant corrections followed by recoveries, suggesting that these drops could be strategic buying chances for those with a long-term outlook.

Bitcoin's past performance also fuels the debate on whether to buy during drops. For instance, in April 2020, Bitcoin fell by over 40% before bouncing back and surpassing previous highs. This resilience supports the idea that current drops could be good buying opportunities for savvy investors.

Bitcoin’s Strong Fundamentals Despite the Price Drop

Despite the recent correction, Bitcoin's fundamental strength remains unchanged. As the most decentralized crypto, it exhibits resilience against censorship and external control, key for investor confidence. The Bitcoin network, supported by a large community of miners, is highly secure and reliable.

Rising inflation and increasing public debt worldwide highlight Bitcoin's appeal as a store of value. With a fixed supply of 21 million coins, Bitcoin contrasts with traditional currencies, which can be created in unlimited amounts. This scarcity attracts those looking to guard against inflation and aggressive monetary policies.

Bitcoin's institutional adoption hit a milestone with the approval of spot Bitcoin ETFs in January. This recognition allowed large investors to include Bitcoin in their portfolios, indicating its growing integration into the traditional financial system. This, along with wider acceptance, shows Bitcoin's increasing legitimacy among traditional investors.

Ultimately, while market corrections like the current one can be alarming short-term, they may present attractive buying opportunities for informed and patient investors.