Ethereum Price Surges to $2,400 Ahead of Bitcoin ETF Approval

Ethereum’s price briefly broke through the $2,400 mark on January 10th, marking a 10% increase within the week, as anticipation grows for the approval of a Bitcoin ETF. The cryptocurrency market experienced significant volatility on January 9th when the U.S. Securities and Exchange Commission (SEC) falsely announced the approval of a Bitcoin ETF in a post that has since been denounced.

Ethereum Outperforms Bitcoin in Crypto Derivatives Trading

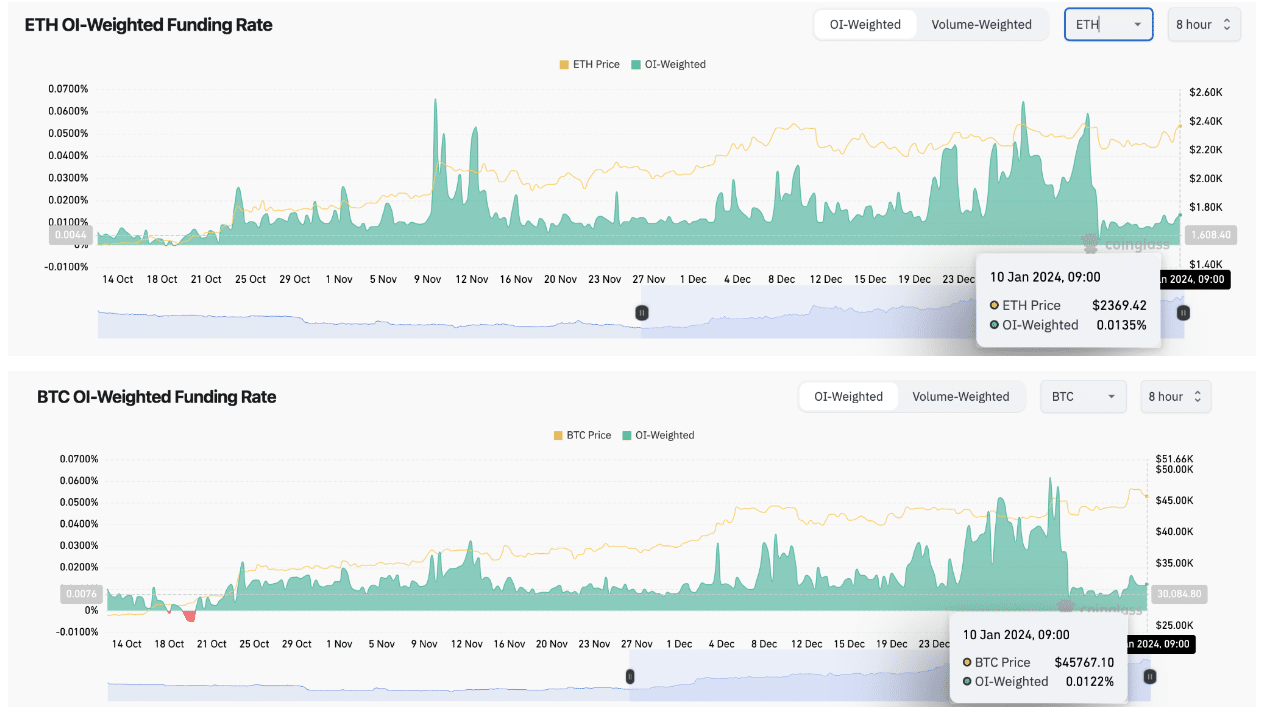

While controversy surrounds the SEC’s announcement, Ethereum’s price has maintained a steady upward trend, trading as high as $2,440 on January 10th. Interestingly, important metrics in the derivatives market now suggest that Ethereum’s price could potentially outperform Bitcoin if the SEC issues a timely positive verdict on Bitcoin Spot ETFs. Data shows that Ethereum’s funding rate, which represents the interest paid by bullish traders to inverse traders to keep their LONG futures contract positions open, currently exceeds that of Bitcoin’s.

A higher positive funding rate in Ethereum compared to Bitcoin indicates increased demand for long positions in the ETH derivatives market and potentially reflects a more optimistic sentiment.

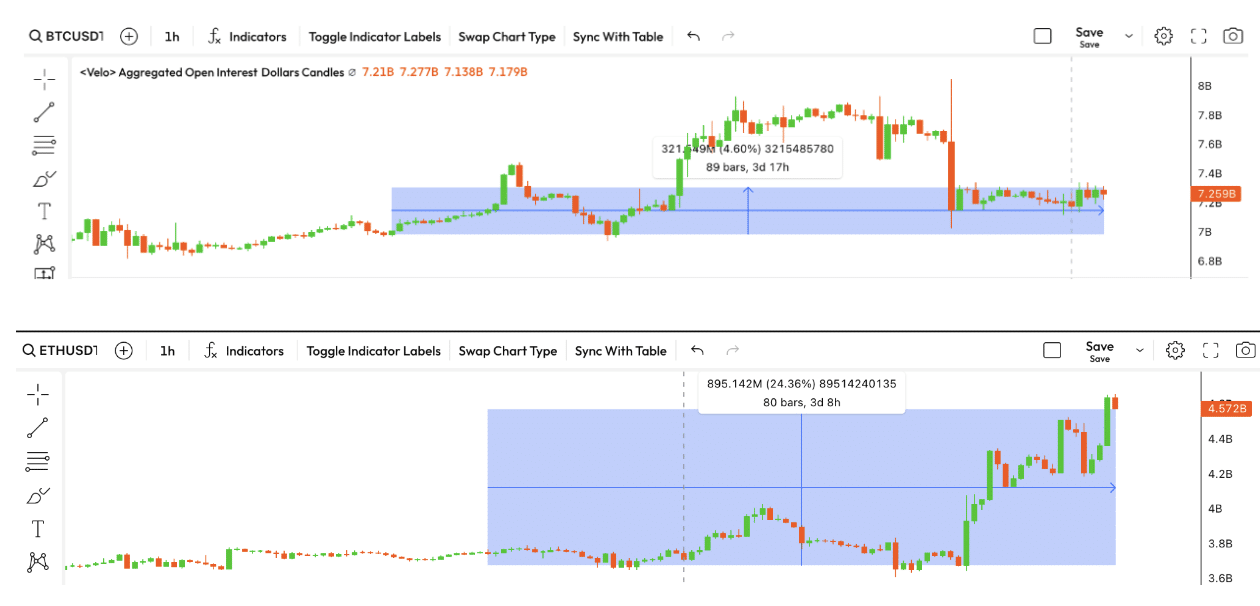

ETH Open Interest Growth Signals Bullish Sentiment

In further confirmation that Ethereum’s price could outperform Bitcoin, open interest dynamics in the derivatives market have also shown similar signals since the turn of the week. ETH open interest has increased by 14.6% from $3.71 billion on January 7th to $4.57 billion on January 10th, while Bitcoin’s open interest has only seen a 5% boost during the same period.

Open interest represents the dollar value of all active futures contracts for a specific cryptocurrency. The increase in ETH open interest implies that more new entrants are bringing fresh capital to the market compared to those closing out their positions. This suggests that crypto traders are betting on Ethereum to deliver larger price gains in the days ahead.

Will ETH Hit $3,000 After BTC ETF Approval?

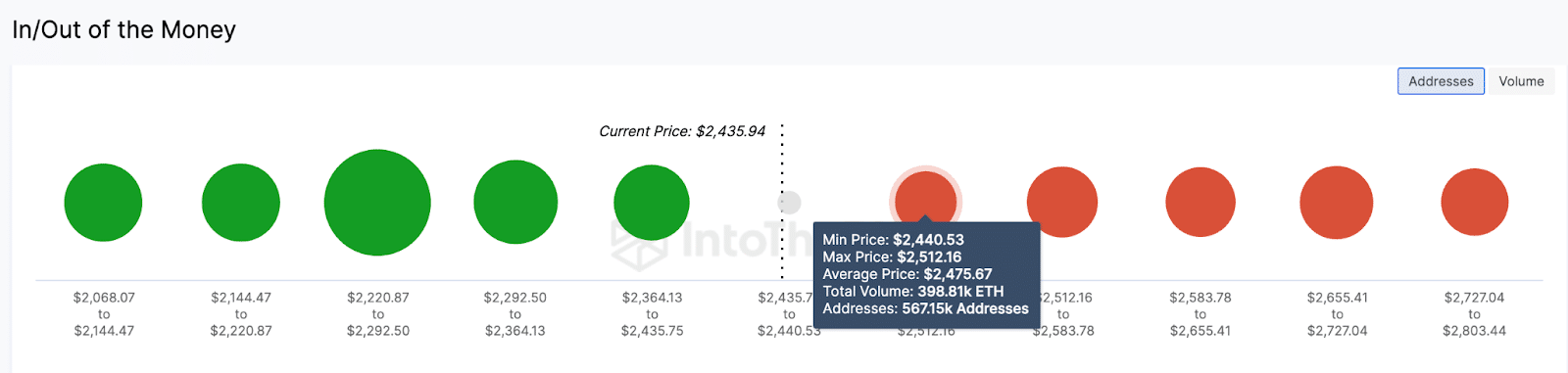

Despite Bitcoin garnering more media attention, the current ETH funding rate and open interest trends indicate that crypto traders anticipate higher price gains in Ethereum after a positive ETF verdict. If this scenario continues, Ethereum’s price will likely reclaim the $2,500 territory. However, the in/out of the money around price (IOMAP) data provided by IntoTheBlock shows a major resistance sell-wall around the $2,475 range.

The IOMAP data reveals that 567,150 addresses have acquired 398,810 ETH at an average price of $2,475. These holders have been holding their positions at a loss for nearly two years, and they may quickly book profits once the ETH price approaches their break-even point.

However, if derivative traders continue to increase their bullish positions as indicated by the elevated ETH funding rates, Ethereum’s price could break above $2,500 for the first time since May 2022. Conversely, if significant market events send the ETH price into a downtrend, the $2,200 support level could be crucial. In that case, the 2.85 million addresses that acquired 7.7 million ETH coins at the minimum price of $2,220 could provide substantial buying support to prevent a prolonged Ethereum price decline.

These latest developments in the Ethereum market highlight the growing interest and confidence in the cryptocurrency, as well as its potential to outperform Bitcoin in the near future. Investors and traders are closely watching for the SEC’s decision on the Bitcoin Spot ETF, as it could have significant implications for Ethereum’s price movement.

Analyst comment

Positive news: Ethereum price surges to $2,400 and outperforms Bitcoin in derivatives trading. Open interest and funding rates indicate bullish sentiment. Market forecast: ETH could reach $3,000 if ETF approved, but faces resistance at $2,475. Strong buying support at $2,200. Investors closely monitoring SEC decision.