Bitcoin’s Declining Volatility Sparks Interest among Traders

Bitcoin’s recent drop below $30,000 has raised concerns and dampened overall sentiment in the cryptocurrency market. However, amidst the turbulence, there are interesting developments that might instill renewed optimism.

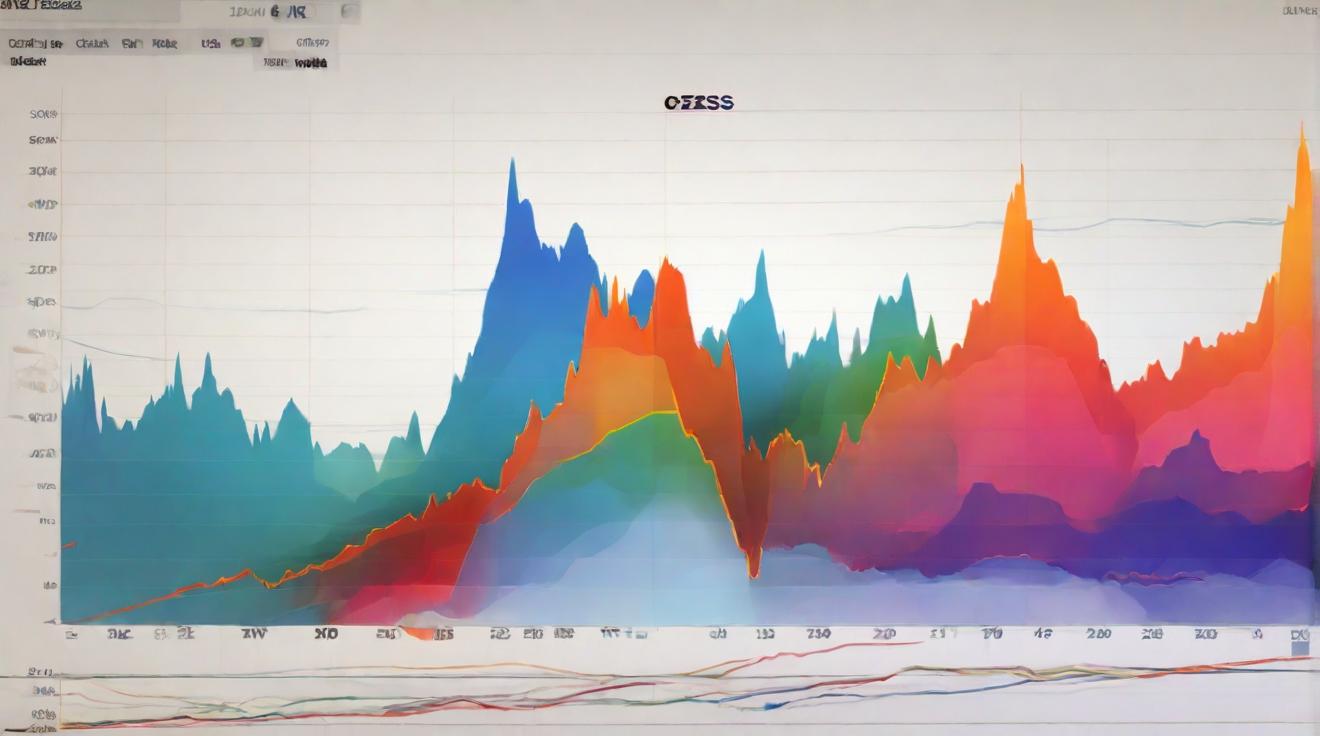

One notable change is the decline in Bitcoin’s volatility. The cryptocurrency, infamous for its rapid price swings, has experienced a period of reduced volatility, causing ripples across the trading landscape. This decline in price fluctuations has caught the attention of several traders and investors, who are now pondering whether a more stable Bitcoin could bring renewed hope.

In fact, the reduced volatility has led to an increase in Open Interest in Bitcoin. Traders are looking to capitalize on price movements that, although tamer, still offer profit potential. This trend indicates a willingness among market participants to explore opportunities in a relatively stable market.

In addition to this, there has been a rise in the supply held by long-term holders of Bitcoin. This shift in behavior suggests that long-term holders believe in the cryptocurrency’s potential for recovery and growth. The increasing supply held by these holders might help dampen selling pressure during price fluctuations, contributing to a more stable market environment.

Despite these positive indicators, Bitcoin’s price is still struggling. At the time of writing, it was trading at $29,062, a significant drop from previous highs. The decline in Bitcoin’s velocity, which measures the rate at which the asset is traded, further adds to the concerns.

However, there are signs of optimism within the Bitcoin community. Weighted sentiment, derived from social media, is on the rise, with an increase in positive sentiment and a decrease in negative comments. This could indicate that despite the recent setback, optimism is slowly returning.

Examining Bitcoin’s Market Value to Realized Value (MVRV) ratio reveals a negative trend. This ratio, which compares the market value to the average realized value of Bitcoin, suggests that the currency may be slightly undervalued at the moment.

Lastly, taking a closer look at Bitcoin miners provides additional insights. Miner revenue has been on a declining trajectory, potentially indicating increased selling pressure from miners. This could be a result of the price drop and the need for miners to cover operational expenses.

Overall, while Bitcoin’s price decline has caused concern, there are underlying factors that still hold promise. The decline in volatility, the rise in long-term holder supply, and the increasing positive sentiment all suggest that there might be a silver lining for the king coin in the near future.

Sources:

Bitcoin’s declining volatility prompted increased trader interest