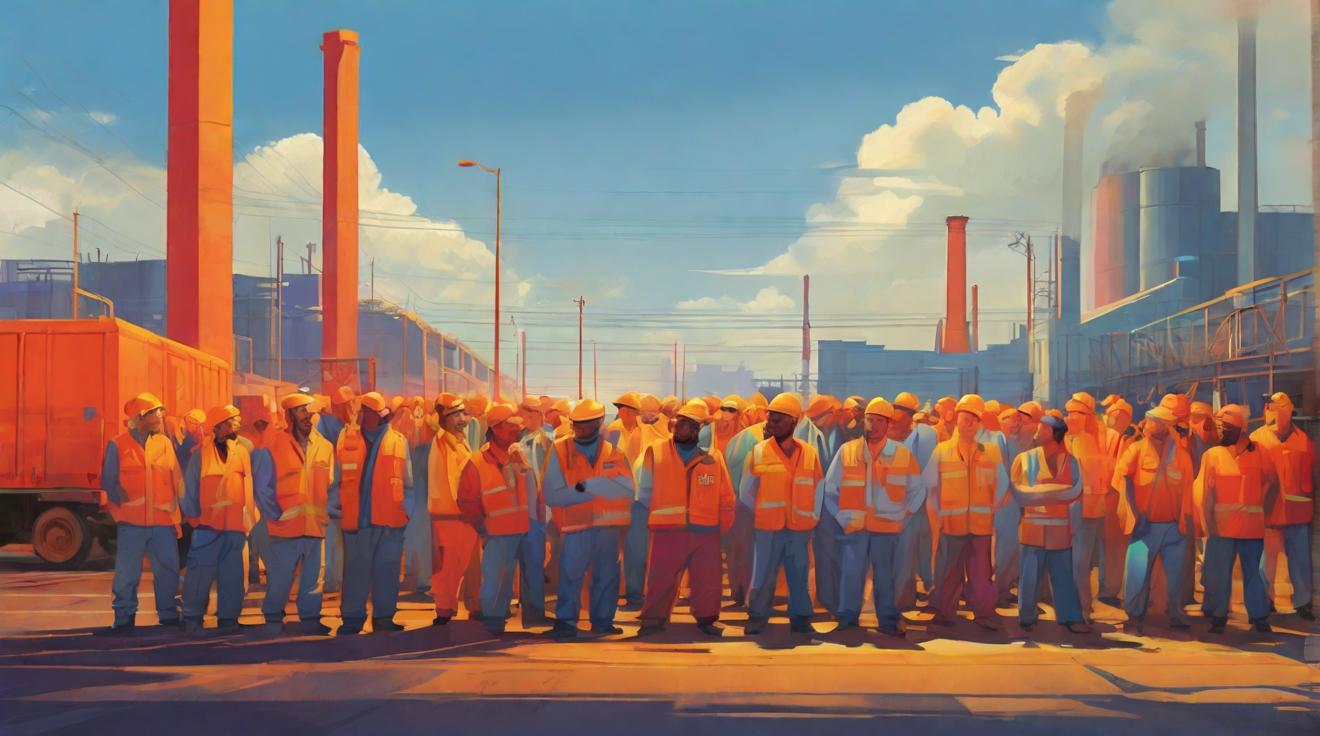

Nearly 9,000 UAW Members at Ford's Kentucky Plant Threaten Strike Over Local Contract Issues

Ford Motor Co.'s biggest and most profitable truck plant in Kentucky could face a strike next Friday if local contract issues are not resolved, the United Auto Workers (UAW) union announced. The union's statement caused a 1.2% drop in the company's shares. The contract talks are separate from the agreements reached last year between the UAW and the Detroit Three automakers – Ford, General Motors, and Stellantis – which will result in unprecedented wage increases for around 150,000 union members.

Local negotiations at the Kentucky plant have focused on health and safety concerns, including minimum in-plant nurse staffing levels. The UAW members have been negotiating specific issues related to the plant, in addition to the national contracts they have with the automakers. However, Ford has not provided an immediate comment on the matter.

Ford's Kentucky truck plant plays a crucial role in the company's financial success, generating approximately $25 billion in annual revenue. This accounts for around one-sixth of the company's total global automotive revenue.

This strike threat occurs at a time when U.S. labor unions are striving for improved wages and working conditions, seizing the opportunity presented by current worker shortage and favorable public opinion. These unions are eager to regain benefits lost during the COVID-19 pandemic.

It remains to be seen whether Ford and the UAW will be able to reach a resolution before the strike deadline, but this situation could have significant implications for both parties involved.

Analyst comment

Negative news. The strike threat at Ford’s Kentucky truck plant raises concerns about potential disruptions to production and revenue. If the contract issues are not resolved, the market could see a further decline in Ford’s shares and a potential impact on the company’s overall automotive revenue.