Cerro de Pasco Receives Easement for Peru Drilling Project

Cerro de Pasco Resources Inc. has received a definitive resolution from the independent Mining Council, confirming the company’s right to an Easement for its El Metalurgista Concession and Quiulacocha Tailings Project (QT Project) in Peru. This resolution comes after an appeal by Activos Mineros (AMSAC) was addressed during a special session on November 30, 2023.

Mining Bureau Drafting Resolution for Cerro de Pasco’s Project

The General Mining Bureau (DGM) is now set to draft the Supreme Resolution, which is expected to be finalized in the first quarter of 2024. This will enable Cerro de Pasco to start a 40-hole sonic drilling program during the Andean dry season, with the aim of completing the drilling and the first phase of the QT preliminary economic assessment (PEA) by the third quarter of 2024.

Cerro de Pasco Plans Technical Report on Mineral Resources

The company plans to prepare a technical report on Mineral Resources for the Quiulacocha tailings, compliant with NI 43-101 standards. CEO Guy Goulet expressed gratitude towards the Peruvian authorities for recognizing the merits of the project and securing the company’s rights.

Cerro de Pasco Secures Funding for Exploration Program

Under the terms of the Easement, Cerro de Pasco will pay AMSAC approximately US$1 million for the right to access and perform drilling within its concession area over two years. Following the confirmation of study results, the DGM may assess the company’s request for a Supreme Decree, which would grant Cerro de Pasco the rights to reprocess the entire tailings resource.

Quiulacocha Tailings Storage Facility Key to Cerro de Pasco’s Concession

The Quiulacocha Tailings Storage Facility, containing approximately 75 million tonnes of tailings, is a significant part of the company’s concession. Cerro de Pasco Resources is committed to the highest standards in community relations and environmental stewardship.

The exploration program includes drilling, geophysical studies, laboratory testing, minerology studies, resource estimation, and economic assessment. Funding for the program is secured through a $2 million loan from Glencore International Ag, with no off-take commitments from Cerro de Pasco on the QT Project.

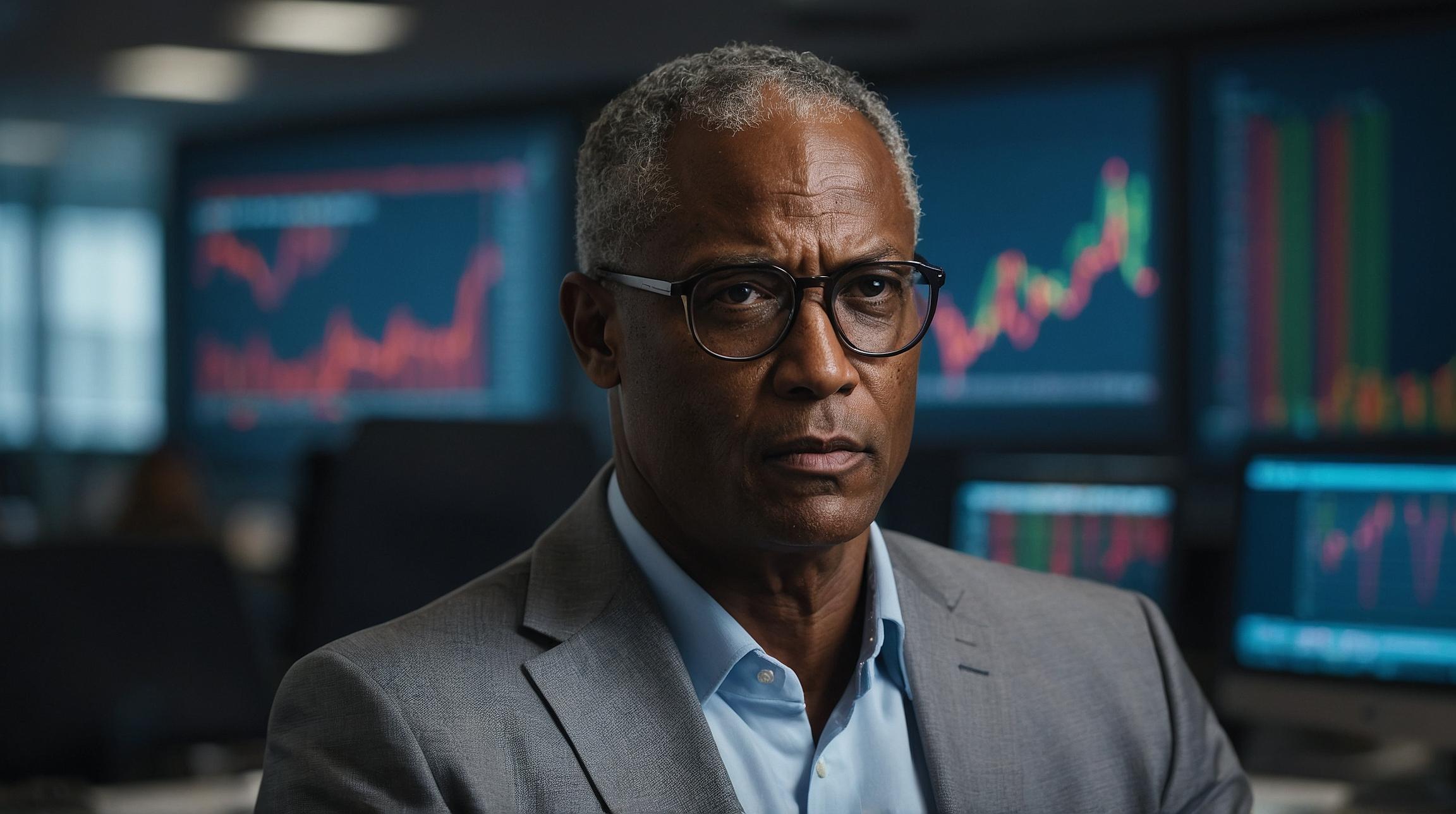

Analyst comment

Positive news: Cerro de Pasco Resources Inc. has received a definitive resolution confirming their right to an Easement for their drilling project in Peru. They plan to start drilling in the first quarter of 2024 and complete the preliminary economic assessment by the third quarter. They have also secured funding for their exploration program.

As an analyst, I predict that this news will have a positive impact on the market for Cerro de Pasco Resources Inc. The confirmation of their rights and the progress they are making towards their drilling project and exploration program will increase investor confidence and potentially attract new investors. This could lead to an increase in the company’s stock price and overall market value.