Real Estate’s Invisible Revolution: The Rise of Data Centers

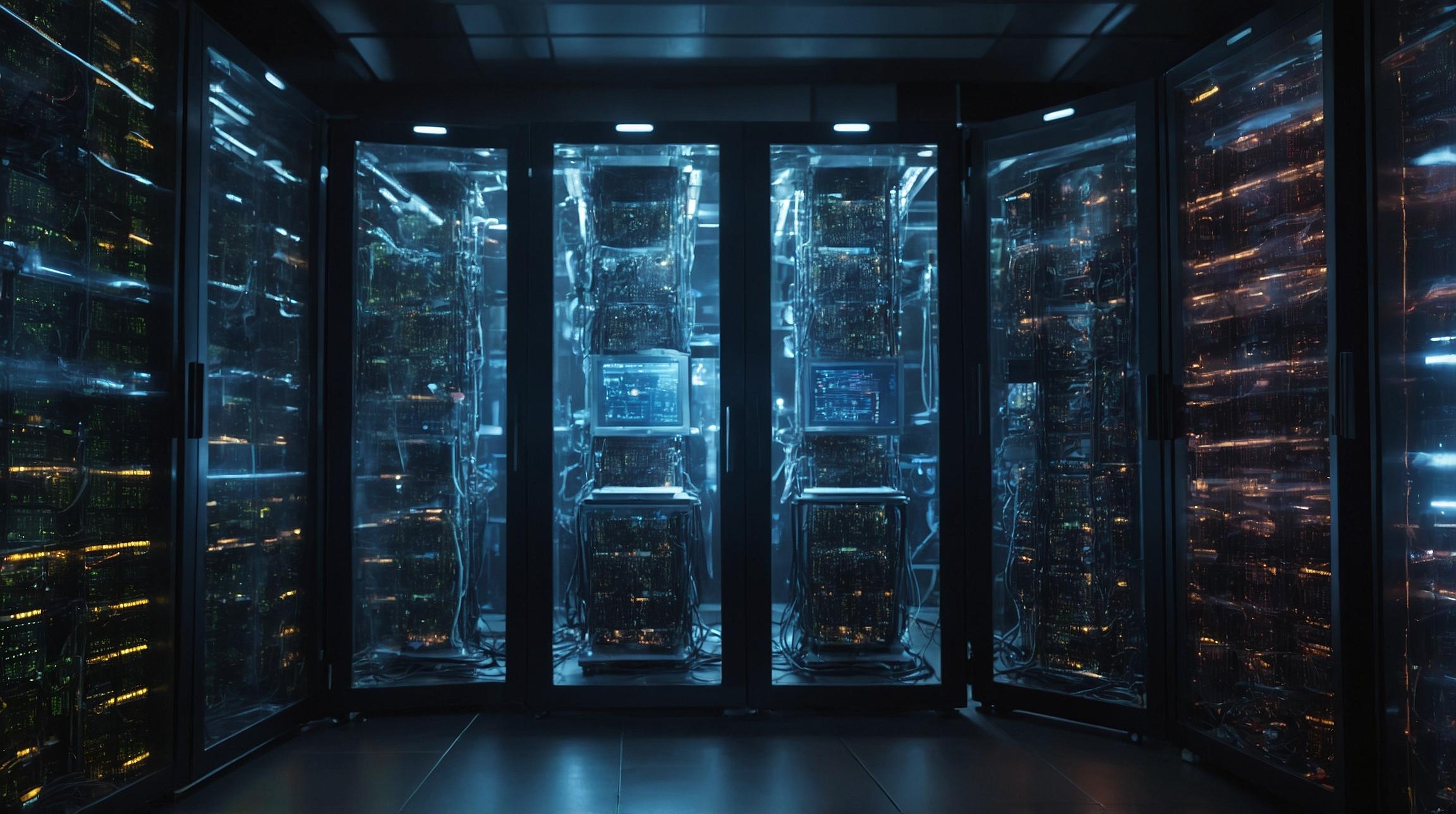

For decades, global real estate investment centered on tangible assets—office towers, shopping malls, and luxury hotels. However, a profound transformation is underway as the focus shifts to “invisible” properties: cloud and data centers that power the digital economy.“The world of real estate is changing from what I’d call the ‘visible’ to the ‘invisible.’ Everything we can’t see but we use: the cloud, as we like calling it, lives in the data center,” said Kishore Moorjani, CEO of CapitaLand Investment’s alternatives and private funds team, at the Milken Institute Asia Summit in Singapore.

Investor Appetite for Data Centers Soars

A recent 2025 survey by real estate services firm CBRE reveals that 95% of major global investors intend to increase their data center investments this year. Among 92 surveyed investors, 41% plan to allocate $500 million or more in equity to the sector, up from 30% in 2024. This surge reflects the escalating demand fueled by artificial intelligence workloads, which require extensive computing power, electricity, cooling, and network infrastructure.AI-Driven Demand and Power Consumption

Goldman Sachs forecasts that global power demand from data centers will increase by 50% by 2027 and up to 165% by 2030. Hyperscale data centers, which can range from 150 to 300 megawatts, are becoming the norm, with some AI-focused facilities expected to exceed 1 gigawatt in capacity, requiring multi-billion-dollar investments.“A hyperscale facility costs approximately $12 million per megawatt to build,” explained Moorjani. “Banks are increasingly strained by the volume and cost of these builds.”

Funding Challenges Amid Rapid Expansion

Despite robust investor interest, the scale and speed of data center development are stretching traditional financing models. Banks face challenges accommodating the sheer capital requirements of hyperscale projects. Boston Consulting Group estimates hyperscalers will need to invest approximately $1.8 trillion between 2024 and 2030 to satisfy AI and cloud demand, raising concerns about whether sufficient capital is available to support this growth. “The biggest question mark for the real estate community is: is there enough capital at the moment?” noted Stuart Crow, CEO of APAC capital markets at JLL.Broader Implications for Real Estate

The rise of AI and cloud infrastructure is also expected to reshape traditional real estate sectors. Companies are reevaluating office space requirements as automation and workforce reductions alter their physical footprint needs. A recent report from Savills forecasts a slower rebound in global commercial real estate investment, projecting an 8% increase in 2025 compared to the previous forecast of 27%. Challenges include rising construction costs, financing difficulties, labor shortages, and regulatory hurdles. Nevertheless, significant pools of undeployed capital remain, and institutional investors continue to view real estate as a core asset class, increasingly targeting alternative infrastructure such as data centers and battery storage.FinOracleAI — Market View

The data center sector is at a pivotal juncture, driven by exponential AI growth and the consequent surge in infrastructure demand. While investor enthusiasm is high, the capital-intensive nature of hyperscale developments reveals a funding bottleneck that could slow expansion.- Opportunities: Strong investor interest, technological advancements fueling demand, diversification of real estate portfolios toward high-growth alternatives.

- Risks: Financing constraints due to high capital requirements, potential delays from regulatory and construction challenges, and evolving office space demand reducing traditional real estate values.