Nvidia's Market Dominance in AI Chips

Nvidia has been at the forefront of the artificial intelligence (AI) revolution, significantly benefitting from the massive investments tech companies have made in generative AI. Over the last two years, Nvidia's market cap has surged by $2.5 trillion, driven by the skyrocketing demand for its GPUs (Graphics Processing Units). These chips are essential for AI computations, and this demand has led to a remarkable expansion of Nvidia's gross margins, now in the upper 70% range. Such financial success is indicative of Nvidia's strategic prowess in the tech landscape.

The Role of TSMC in Chip Manufacturing

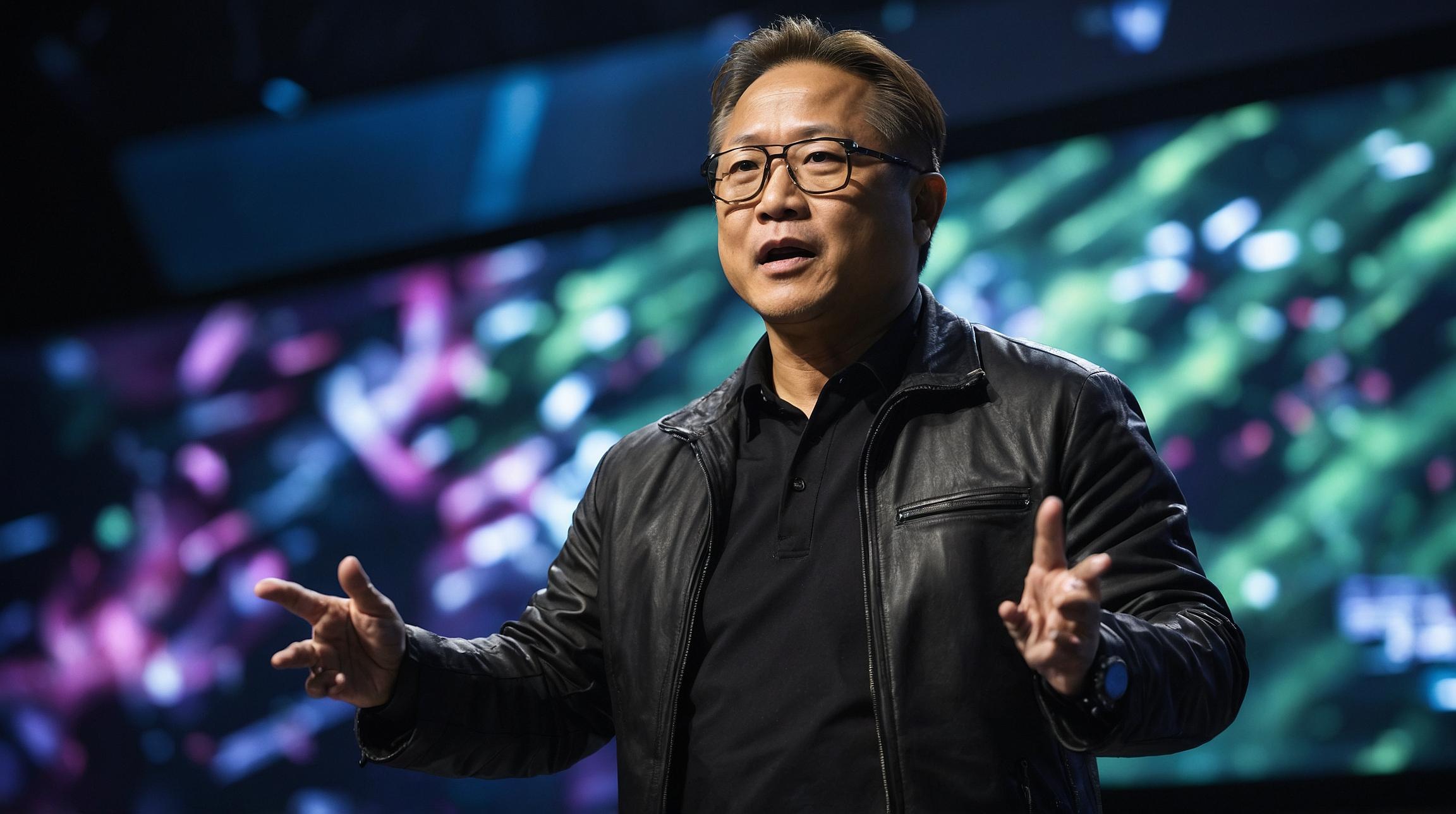

During a recent investor conference, Nvidia CEO Jensen Huang extolled the virtues of Taiwan Semiconductor Manufacturing Company (TSMC), labeling it as the "world's best" foundry with a significant margin over rivals. TSMC is the largest semiconductor foundry globally, specializing in the precise production of silicon wafers for chips designed by companies like Nvidia. TSMC's ability to execute complex designs has made it the preferred choice for many leading chip designers.

Why TSMC Stands Out

Huang emphasized that TSMC's dominance stems from its unique capability to scale operations efficiently. This was crucial for Nvidia, especially when there was a sudden spike in chip demand. TSMC's extensive scale and technical prowess ensure that it meets the evolving needs of tech companies. With over 60% of global spending at chip foundries attributed to TSMC, its leadership position is undisputed.

Future Growth Prospects for TSMC

Despite its current size, TSMC has substantial growth opportunities. The forecasted increase in AI systems spending, which is expected to reach $193.3 billion by 2027 from $117.5 billion in 2023, provides a fertile ground for TSMC's expansion. This growth is not limited to Nvidia; it encompasses all major clients, highlighting TSMC's role as a neutral player benefiting from industry-wide advancements.

Investment Appeal of TSMC

Analysts predict robust growth for TSMC, with earnings projected to increase over 20% annually for the next five years. Despite this optimistic outlook, TSMC's current stock valuation remains accessible, trading at just over 20 times the expected earnings for 2025. This combination of growth potential and attractive pricing makes TSMC a compelling investment opportunity.

In summary, while Nvidia remains a dominant force in the AI chip market, Jensen Huang's endorsement of TSMC underscores its critical role in the semiconductor sector. TSMC's unmatched capabilities and strategic positioning make it a top contender for those looking to invest in the future of AI technology.