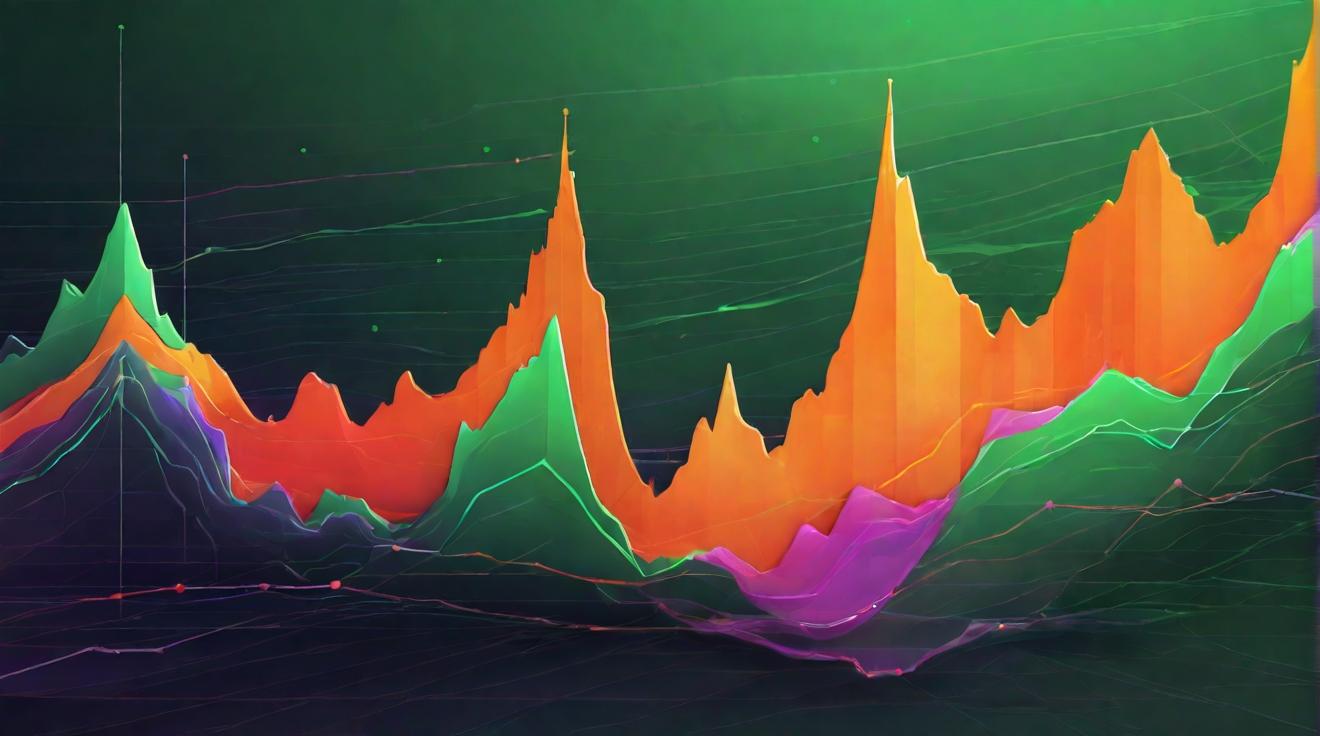

Bitcoin and Ethereum Show Strong Gains

Bitcoin and Ethereum have both seen impressive gains over the past 24 hours. Bitcoin, after initially dropping to $57,600 following MicroStrategy's massive purchase of 18,300 BTC, rebounded strongly to reach $59,700. This marks a 2.2% increase. Meanwhile, Ethereum's ether (ETH) climbed back up to the $2,400 mark, reflecting a 2.7% gain. Such movements highlight the ongoing volatility and potential of the cryptocurrency markets.

Insights from Market Analysts

Renowned chartist Bob Loukas suggests that Bitcoin is poised for further growth, citing the daily cycles theory in technical analysis. This theory posits that asset prices oscillate in predictable waves, with specific intervals between peaks and troughs. Loukas believes that Bitcoin likely hit a local low below $53,000 on September 6 and is still early in its current cycle. If the past cycle patterns hold, Bitcoin could continue to climb before experiencing another downturn.

Market Reactions and Economic Indicators

The broader market, as indicated by the CoinDesk 20 Index, gained 2.5%, buoyed by significant increases in assets like Polygon's MATIC following Binance's trading announcement. This positive sentiment extended to traditional markets, with the S&P 500 nearing record highs. Gold also reached unprecedented levels at $2,600 per ounce, supported by a weaker U.S. dollar.

The Role of the Federal Reserve

A pivotal event for the coming week is the Federal Open Market Committee (FOMC) meeting, where many expect the Federal Reserve to announce its first interest rate cut since 2020. Analysts are divided on whether the cut will be 25 basis points or a more substantial 50 basis points. The outcome could significantly impact risk assets like cryptocurrencies.

Economic Concerns and Future Trends

Despite the optimism surrounding potential rate cuts, there are concerns about the U.S. economy's resilience. Crypto investment firm Ryze Labs underscores the importance of the economic context, noting that if the economy avoids a recession, risk assets like cryptocurrencies could continue their upward trajectory. However, if economic conditions worsen, market volatility could increase, affecting asset prices across the board.

In summary, while Bitcoin and other cryptocurrencies are currently experiencing a bullish trend, the broader economic landscape and upcoming Federal Reserve decisions will play crucial roles in shaping future market movements.