Nvidia's Stock Performance and Financial Highlights

Nvidia's stock experienced a downturn, trading about 2.9% lower premarket on Thursday. This shift comes in the wake of Nvidia's impressive "beat and raise" quarterly results announced on Wednesday. The company reported July-quarter sales of $30 billion, which were at the top end of their guidance range of $29-$30 billion. Moreover, Nvidia's guidance for the October quarter suggests a midpoint of $32.5 billion, aligning with market expectations of $32-$33 billion.

Citi's Analysis on Gross Margins

Citi analysts pointed out that Nvidia's gross margins are currently under pressure due to the increased costs associated with the H200 GPUs and High Bandwidth Memory (HBM). This product mix is expected to affect the company's non-GAAP gross margins over the upcoming quarters. As a result, while Nvidia's January-quarter earnings per share (EPS) estimate remains steady, there might be a downward revision in market expectations due to these margin pressures.

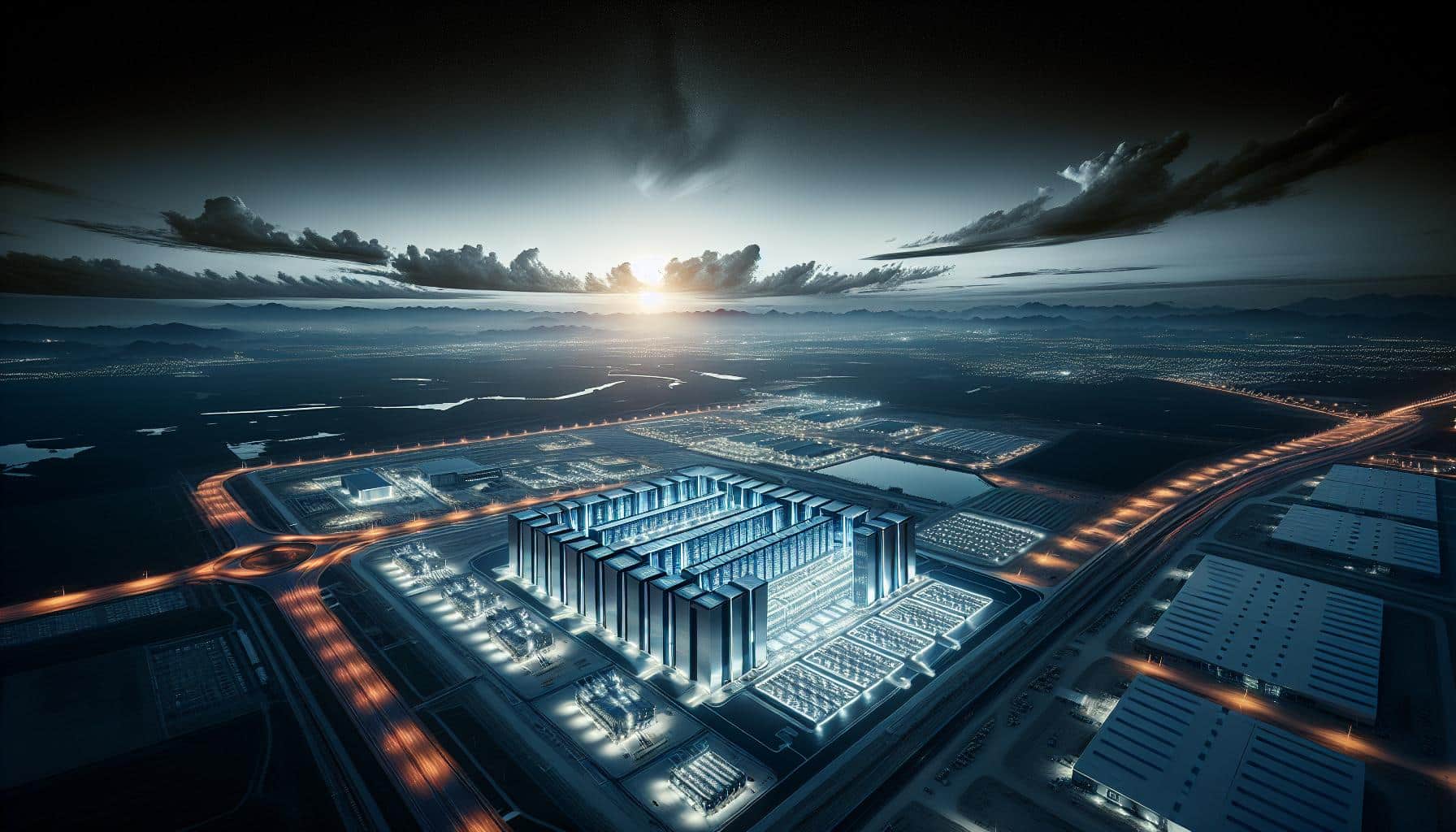

Anticipated Market Trends and Stock Outlook

Despite the current margin concerns, Citi maintains a Buy rating on Nvidia's stock, setting a price target of $150. Their long-term confidence is fueled by Nvidia's leadership in the AI and data compute sectors. Analysts expect the stock to remain "range bound" over the next two quarters. However, they anticipate a significant inflection in both year-over-year sales and gross margins starting in the April quarter, driven by the Blackwell GPUs' full-scale production and sales.

Future Catalysts and Industry Leadership

Citi identifies the upcoming CES in January as a major catalyst for Nvidia's stock. The bank underscores their long-term confidence in Nvidia's strategic positioning and technological advancements in AI and data computing, essential drivers for the company's sustained growth and market leadership.