Bitcoin ETFs Attract Record Inflows

Spot Bitcoin (BTC) exchange-traded funds (ETFs) have seen significant investment this year, with over $19.3 billion in net inflows. This trend, analyzed by Eric Balchunas, a Bloomberg ETF analyst, highlights the growing interest and confidence in Bitcoin as a digital asset.

Understanding Bitcoin ETFs

An ETF (Exchange-Traded Fund) is like a mutual fund that can be traded on a stock exchange. It allows investors to buy shares that represent a collection of assets like bonds or stocks. In this case, Bitcoin ETFs allow investors to indirectly invest in Bitcoin without needing to buy it directly.

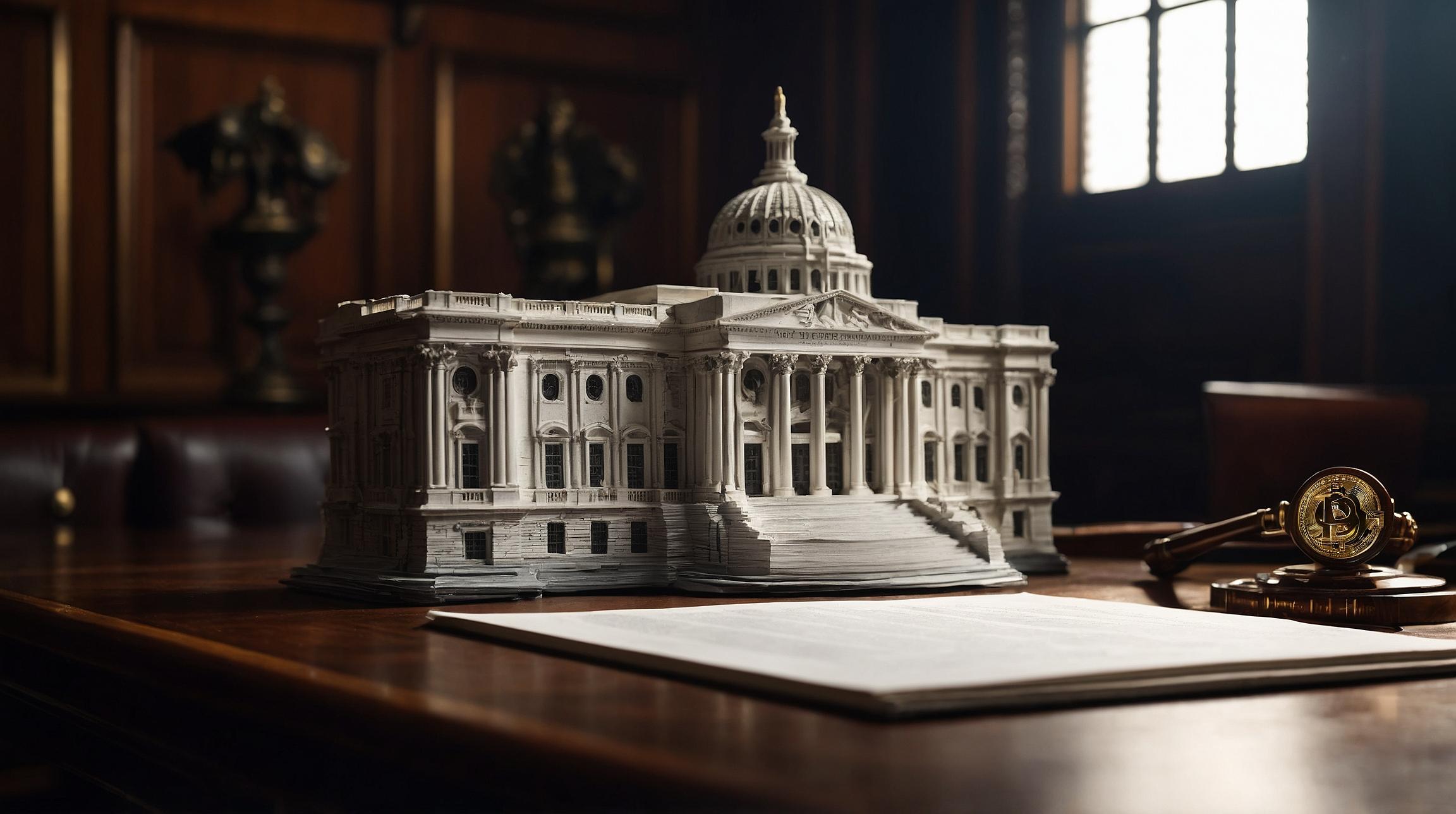

BlackRock's Rising Influence

BlackRock, a major player in investment management, has emerged as the third-largest holder of Bitcoin, according to Balchunas. It is on track to surpass the anonymous creator of Bitcoin, Satoshi Nakamoto, in BTC holdings. This highlights the institutional adoption of cryptocurrencies, signaling enhanced confidence and stability in the market.

Stability Amidst Volatility

Balchunas emphasizes that ETF holders provide a stabilizing effect on Bitcoin amidst its notorious price swings. For example, during recent market declines, BlackRock's iShares Bitcoin Trust (IBIT) investors remained steady, without significant panic-induced sell-offs. This contrasts with more reactive traders in the crypto market, depicting ETF investors as a stable force.

Current Bitcoin Market Dynamics

As of the latest reports, Bitcoin is trading at $60,719, reflecting a 1.5% increase in the last 24 hours and an 8% rise over the week. These movements present a robust picture of Bitcoin's current market performance.

Conclusion

The influx of billions into Bitcoin ETFs and BlackRock's ascending status as a major BTC holder underscore the evolving landscape of cryptocurrency markets. This development offers a blend of institutional confidence and potential stability, crucial for the future of digital assets and decentralized finance (DeFi).