The Changing Landscape of AI Investments

In the world of artificial intelligence (AI), change is constant. While Nvidia has been a frontrunner in providing the necessary computing power for AI platforms, there's a shift happening. Taiwan Semiconductor Manufacturing Company (TSMC) is emerging as a key player, potentially offering better opportunities for investors looking to capitalize on AI's next growth phase.

Behind the Scenes of the AI Revolution

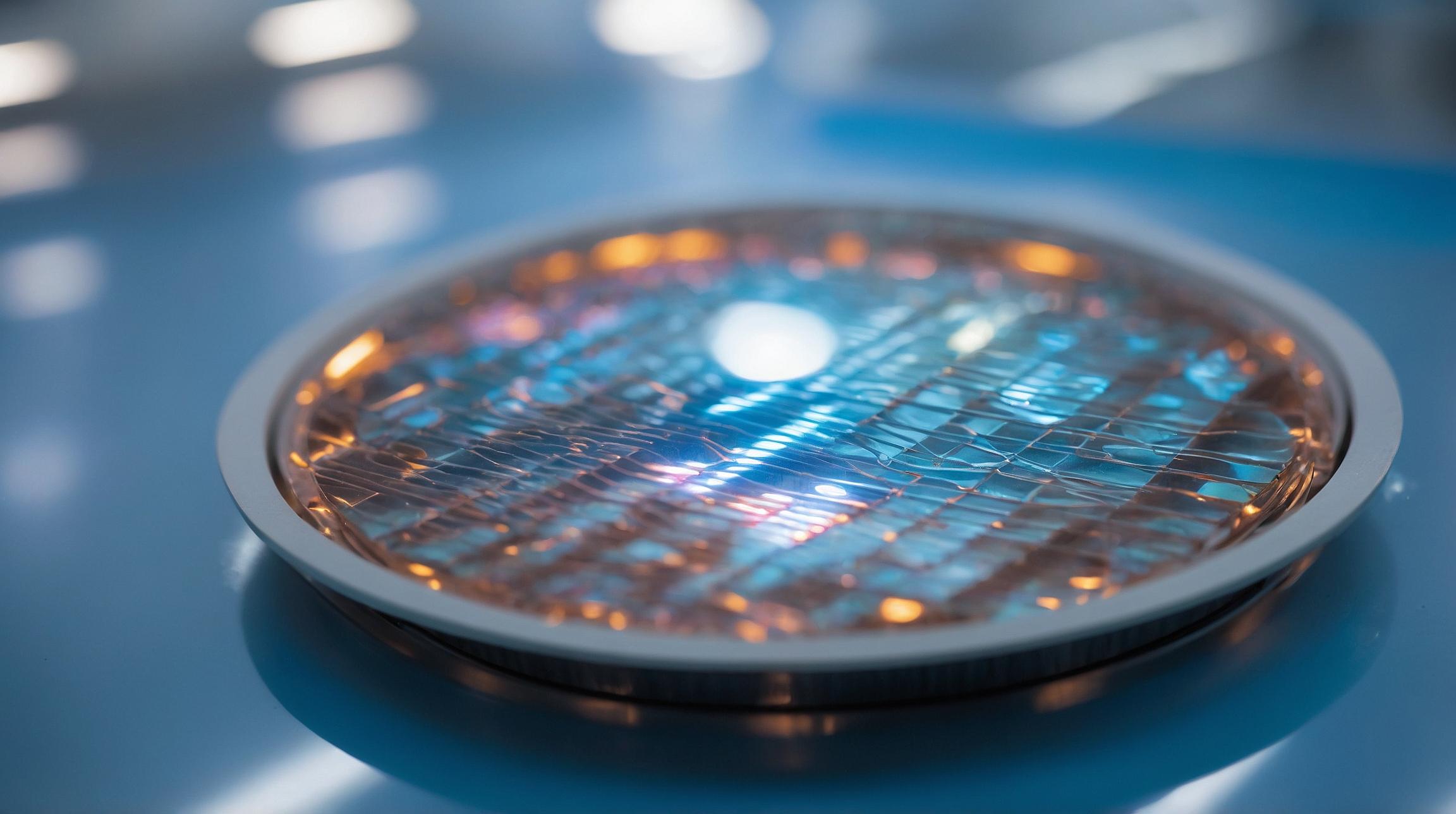

Although Nvidia remains influential, it's crucial to understand the dynamics of the AI hardware business. Many chipmakers, including Nvidia and Advanced Micro Devices (AMD), do not manufacture their own chips. Instead, they rely on third-party manufacturers like TSMC to fabricate their designs.

As the largest contract manufacturer, TSMC produces about two-thirds of the world's semiconductors. This includes high-performance chips essential for AI. Notably, companies like AMD and Nvidia are TSMC's customers. Even Intel, working on its manufacturing capabilities, has partnered with TSMC.

Expanding AI Capabilities

AI isn't confined to data centers anymore. It's reaching end-users, particularly through mobile devices. For instance, Apple's iPhone 15 Pro and Pro Max use AI-capable processors made by TSMC to handle tasks on the device. Similarly, Qualcomm's latest processors offer on-device AI capabilities and also rely on TSMC's services.

Future Opportunities for TSMC

While TSMC doesn't manufacture every AI chip, the growth prospects are significant. According to Skyquest, the AI hardware market is expected to grow annually by 15.5% through 2031, with the mobile AI sector growing at nearly 27% per year. Analysts predict TSMC's revenue could nearly double by 2026 due to the expanding AI chip industry.

Market Fluctuations and Long-Term Outlook

TSMC's stock has dropped over 20% since July, influenced by broader market conditions rather than company performance. Concerns about overvaluation and economic uncertainty have impacted many AI stocks. Nevertheless, the demand for new chips remains, and TSMC's role as a cost-effective foundry remains crucial, especially if economic conditions limit new investments in manufacturing facilities.