Investing in Stocks: Understanding the Realities of Risk and Reward

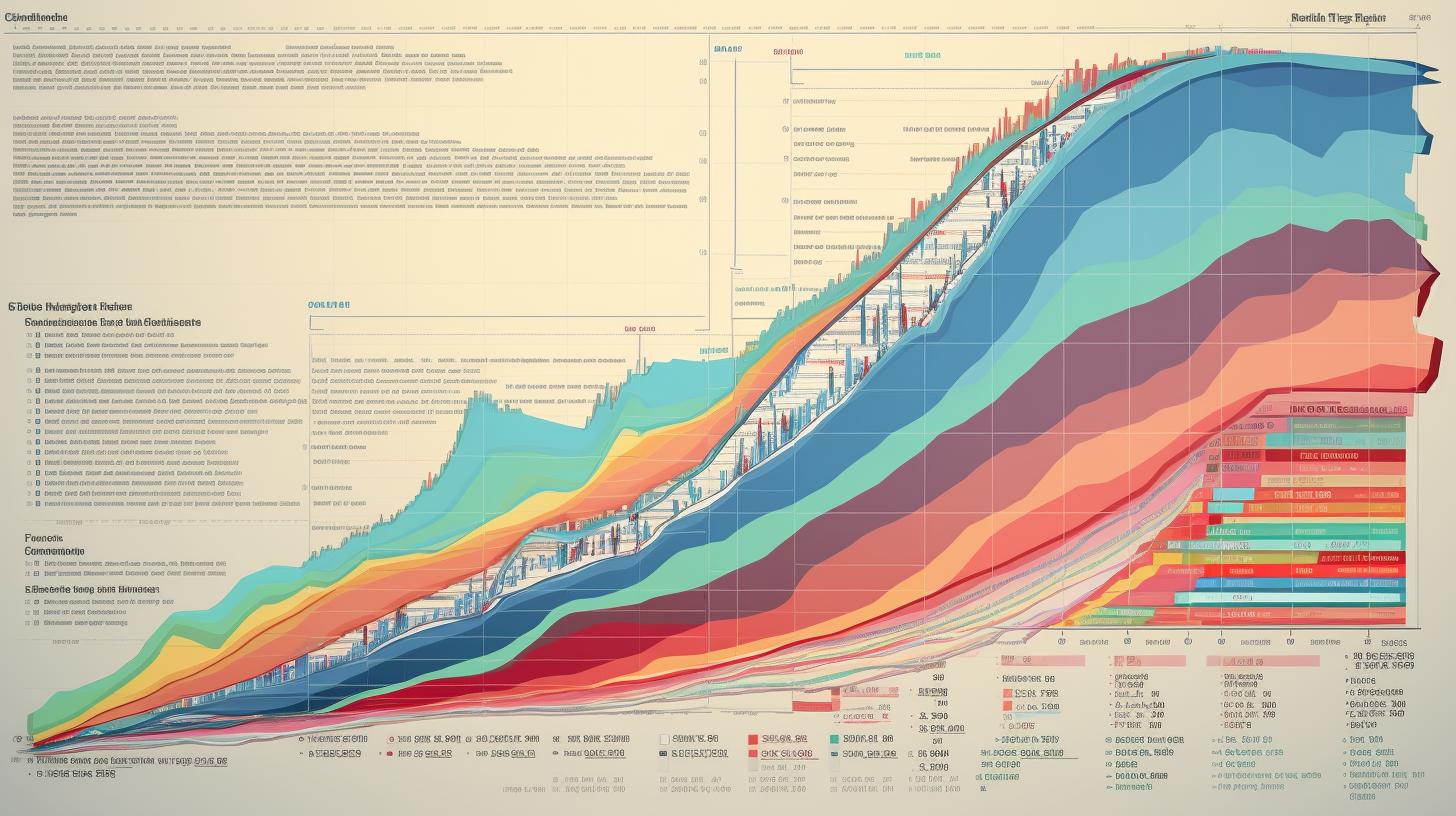

When it comes to investing in stocks, there’s no denying the allure of the potential rewards. After all, who wouldn’t want to see their wealth grow exponentially? However, a recent study has shed some light on the harsh realities of the stock market, revealing that the majority of stocks do not reward investors, leaving a mere 2.4% of stocks responsible for the creation of $75.7 trillion in global wealth between 1990 and 2020.

The study, conducted by researchers from Arizona State University, Tulane University, and Hong Kong Polytechnic University, found that a small group of just 159 stocks accounted for half of the world’s stock-market wealth during the time period analyzed. This represents a mere 0.25% of the total 63,785 companies included in the study, as detailed in the publication of the Financial Analysts Journal.

Within the United States specifically, the study revealed that the majority of stocks failed to provide investors with returns that justified the risks associated with buying them. In fact, over 55% of U.S. stocks analyzed had compound returns lower than that of the risk-free one-month Treasury bill over the span of 31 years.

Despite these disheartening findings, it’s important to note that the broader stock market did perform better than short-term Treasury bills, thanks to a select few stocks that outperformed the rest. Notably, tech giants Apple and Microsoft were among the five stocks responsible for generating 10.3% of the total global wealth created. Apple alone contributed a staggering $2.67 trillion to the $75.66 trillion wealth pool in the U.S. market.

According to the researchers, the concentration of stock-market wealth among a small number of stocks highlights the importance of investing in market leaders and identifying them early on during price uptrends. Fortunately, there are tools available, such as those provided by IBD, that utilize chart analysis to identify these leaders and pinpoint opportune buy and sell price areas.

It’s worth noting that several well-known companies made the list of top wealth generators, including Facebook parent company Meta Platforms, electric vehicle manufacturer Tesla, and Chinese e-commerce giant Alibaba. Additionally, traditional giants such as Walmart, JPMorgan Chase, Walt Disney, and Coca-Cola also secured spots in the top 50.

In the healthcare sector, stocks such as Johnson & Johnson, Merck, and Swiss-based Roche Holding were found to be rewarding investments. Other notable companies included Taiwan Semiconductor, Novartis, ASML Holding, and Nestle.

While these findings may be discouraging for investors hoping to strike it rich with stocks, they serve as a sobering reminder of the realities of the market. Investing wisely requires careful consideration and research, and it’s crucial to understand that the potential for high rewards comes hand in hand with significant risk.

In conclusion, the study’s findings emphasize that buying and holding superior market leaders during price uptrends can significantly increase the chances of realizing meaningful returns. By utilizing tools such as those provided by IBD, investors can identify these potential winners early on and make informed decisions about when to buy and sell. Remember, successful investing requires patience, strategic thinking, and a willingness to accept and navigate the inherent risks of the market.