SoundHound AI Stock Skyrockets Amid Nvidia Stake

The artificial intelligence sector has once again captured the market's attention with SoundHound AI experiencing a meteoric rise in its stock value, surging by an astonishing 295%. This surge was triggered by a regulatory filing revealing that Nvidia, a giant in the tech industry, holds a stake in SoundHound AI. Subsequently, this association has propelled SoundHound into the spotlight, making it a focal point for investors fascinated by the burgeoning AI space.

Investors are keenly observing SoundHound's movements in the rapidly evolving artificial intelligence market.

Moreover, SoundHound AI reported a significant uptick in its financial performance, with an 80% increase in year-over-year revenue in its fourth-quarter results. The company also managed to dramatically reduce its losses, signaling a potentially promising trajectory.

Controversies Surrounding SoundHound AI's Capabilities

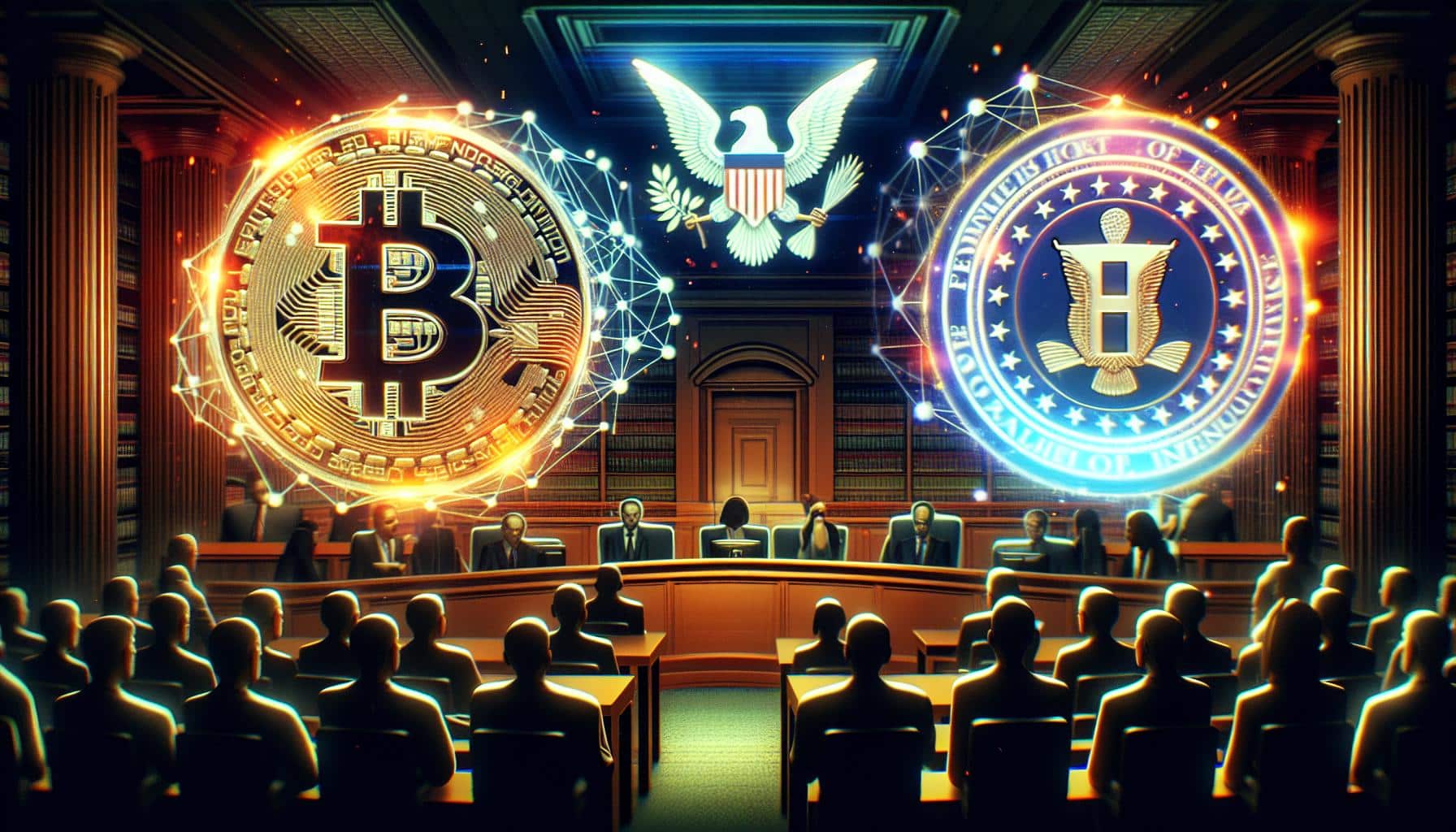

However, the company's recent triumphs have been clouded by a short report titled "Lies, Damned Lies, and Cheeseburger 'AI'". The report launches scathing accusations at SoundHound AI, claiming deceptive practices regarding its AI capabilities. Furthermore, it alleges that the company has seen a departure of several major customers, including Mercedes-Benz, Deutsche Telekom, and Netflix. The removal of customer names from its 2023 annual report and failure to disclose its retention rate has raised eyebrows and concerns among investors and analysts alike.

The controversy over SoundHound's AI capabilities and customer retention could impact investor confidence.

Following the contentious report, Cantor Fitzgerald analysts downgraded SoundHound stock and lowered its price target. The downgrade stems from concerns over decelerating growth, loss of key customers, and a lack of financial transparency. Further scrutiny revealed material weaknesses in SoundHound's internal financial reporting. The practice of mixing contractually obligated revenues with those based on management assumptions has been particularly criticized.

Investor Risks and Recommendations

Given these revelations and the subsequent downgrade, the risk associated with investing in SoundHound AI stock appears to have increased significantly. Potential investors are advised to proceed with caution or consider avoiding the stock altogether.

The financial and reputational challenges facing SoundHound may pose a considerable risk to both current and prospective investors.

The unfolding situation with SoundHound AI underscores the complexities and volatilities inherent in the AI technology market. It serves as a reminder that while the potential for growth is substantial, so too are the risks. Investors are urged to exercise due diligence and approach such high-stake investments with a balanced view of both the opportunities and pitfalls.

Analyst comment

Positive news: SoundHound AI’s stock value skyrockets by 295% due to Nvidia’s stake and impressive financial performance.

Neutral news: Investors are observing SoundHound’s movements in the AI market.

Negative news: Accusations of deceptive practices and loss of major customers cast doubt on SoundHound’s capabilities.

Market prediction: The controversy and downgraded assessment may lead to a decline in investor confidence and increased risk for SoundHound AI stock.