Musk’s Tesla Board Decision Draws Backlash from Retail Shareholders

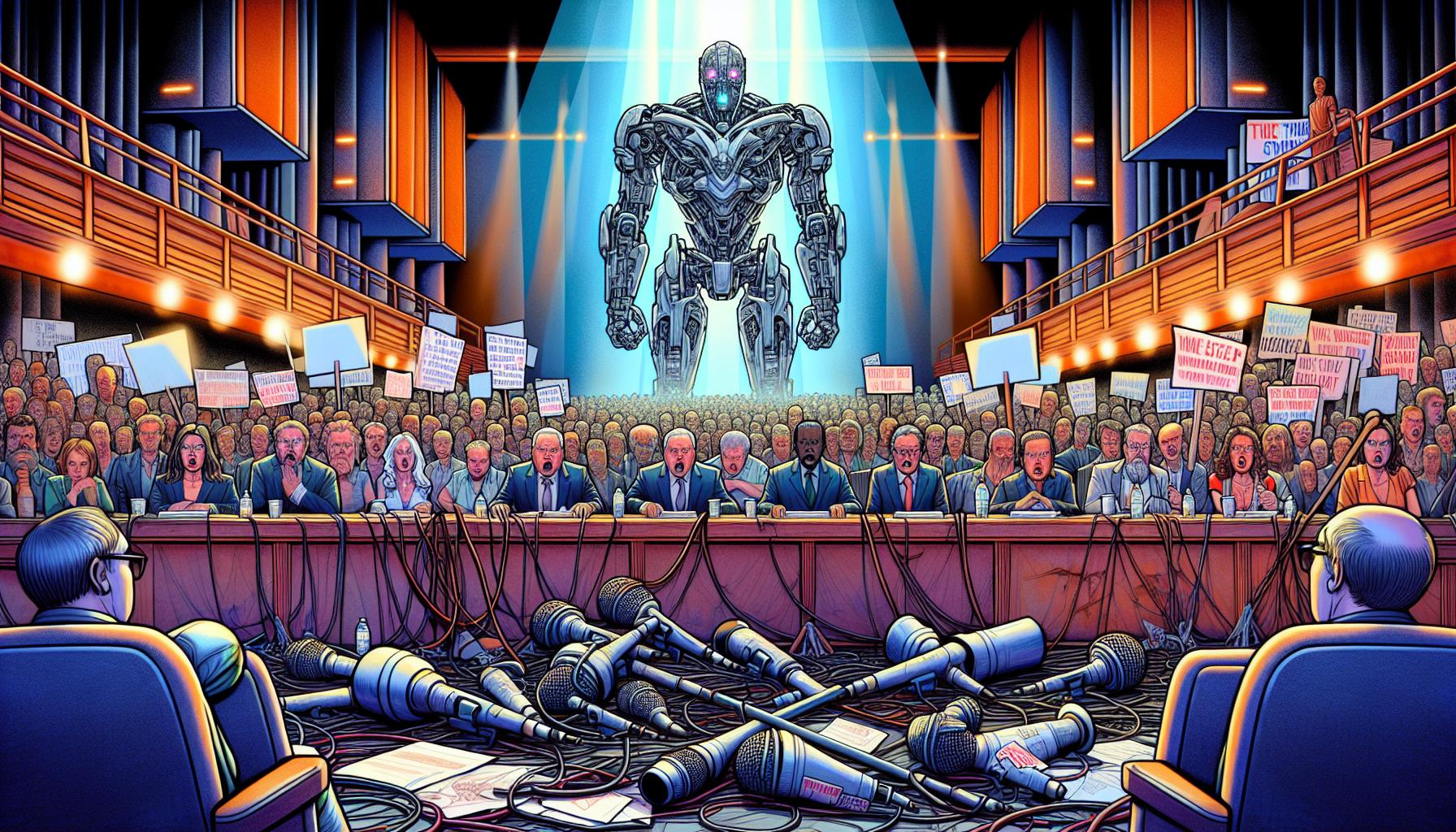

Elon Musk and Tesla’s board are facing criticism over a recent decision that nullified a controversial compensation package for Musk. This decision has not only upset the board and Musk himself, but also Tesla’s army of retail shareholders.

Amy Steffens, a retail Tesla shareholder since 2010, expressed her concerns about the nullification, stating, “Above all else, it’s the sanctity of shareholder rights…we selected [the board and Judge McCormick] obliterated shareholder rights with one stroke of a pen.” Steffens, along with fellow shareholder Alexandra Merz, organized a retail shareholder petition opposing the judge’s decision. The petition garnered 5,800 signatures from investors representing more than 23 million Tesla shares, equivalent to Fidelity’s Tesla holding.

The success of the petition can be attributed in part to Merz’s substantial following of over 100,000 on X. Moreover, Tesla’s shareholding base, with retail shareholders holding about 44% of Tesla stock, plays a significant role. In contrast, other major tech companies such as Microsoft and Apple only have retail shareholders accounting for roughly 20% of their stocks.

While both Steffens and Merz acknowledge the imperfections within Tesla’s board, they emphasize their support for Musk’s leadership. They compare it to the situation with Apple’s board when they removed Steve Jobs, expressing their fear of a similar outcome. However, not all retail investors share their perspective. Leo KoGuan, Tesla’s third-largest individual shareholder, views the compensation package as “outrageous” and supports the Delaware court’s decision.

Musk’s compensation package has drawn attention due to its size and goals. To earn all the stock-based compensation, Tesla had to significantly increase its sales and profit, as well as its market capitalization. In comparison, Microsoft CEO Satya Nadella received approximately $400 million in compensation over a decade, while Musk’s recorded compensation reached $2.3 billion in just one year.

Despite the differences in compensation, both Tesla and Microsoft have seen substantial growth. Microsoft’s market capitalization has increased by $2.8 trillion over the past decade, while Tesla’s has surged by almost $600 billion. The final decision regarding Musk’s pay package rests with the Delaware Supreme Court, as the ruling can be appealed. Vanguard, BlackRock, and State Street have not commented on the Delaware decision so far.

As the legal process unfolds, Tesla’s board may have to address CEO pay in its upcoming proxy statement. Whatever decision the board makes, it will undoubtedly attract attention and make headlines. Concerns about slowing demand growth and increased competition for electric vehicles remain key concerns for investors, contributing to Tesla stock’s underperformance, down approximately 22% year to date compared to the Nasdaq Composite.

Analyst comment

Negative news.

As an analyst, the market could be impacted by the backlash from retail shareholders. There may be increased scrutiny on Tesla’s board and CEO pay, potentially leading to further controversy and volatility in the stock price. Concerns about slowing demand and competition in the electric vehicle market could also contribute to underperformance of Tesla stock.