McCormick & Company, Incorporated (MKC) Shareholders Concerned as Investment Declines

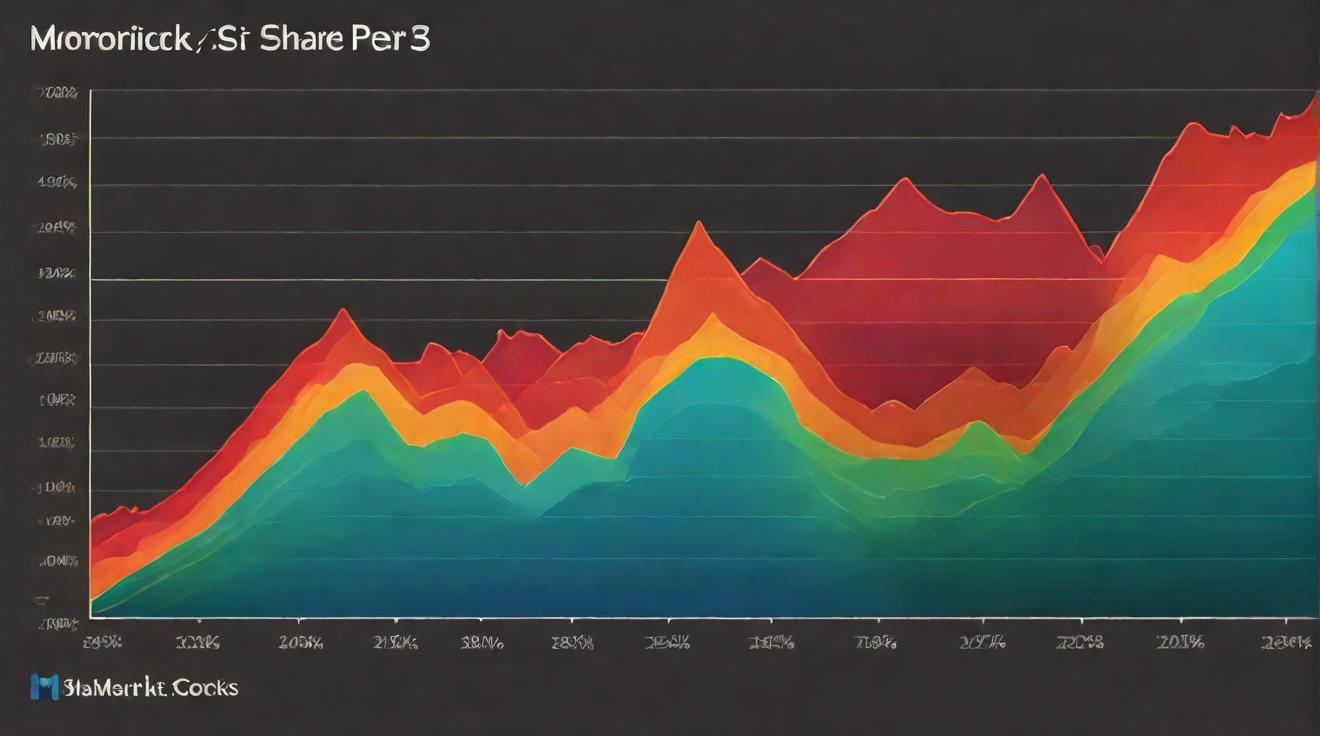

McCormick & Company, Incorporated (MKC) shareholders have seen their investment decline by 28% over the last three years, significantly underperforming the market return of around 16%. This continued decline in share price has raised concerns about investor sentiment for the company.

By comparing the earnings per share (EPS) with the share price, it becomes evident that the EPS decline of 10% is steeper than the decline in share price. This suggests that the market has been disappointed by the decline in earnings and is currently hesitant to buy the stock.

CEO Pay and Growth Prospects

It’s worth noting, however, that McCormick’s CEO is paid modestly compared to CEOs at similarly capitalized companies. While CEO pay is an important factor to consider, the focus should be on whether the company will be able to grow its earnings in the coming years.

Total Shareholder Return and Dividends

The total shareholder return (TSR), which includes spin-offs, discounted capital raisings, and dividends reinvested, gives a more comprehensive picture of the return generated by a stock. McCormick’s TSR for the last three years was -24%, exceeding the decline in share price. Dividend payments largely explain this divergence.

Performance Relative to the Broader Market

Although the broader market has gained around 23% in the last year, McCormick shareholders have lost 11%, even including dividends. However, it’s important to consider that even the best stocks can underperform the market in a twelve-month period. On a longer-term basis, McCormick has delivered a 1.8% annual return over five years, which may be more appealing to long-term investors.

Factors to Consider

While the current sell-off may present an opportunity, it’s crucial to consider various other factors when evaluating McCormick as an investment option. Valuation can be complex, but a comprehensive analysis, including fair value estimates, risks and warnings, dividends, insider transactions, and financial health, can help determine whether McCormick is potentially over or undervalued.

Please note that the market returns mentioned in this article reflect the average returns of stocks currently traded on American exchanges. It’s also important to remember that the analysis provided is based on historical data and analyst forecasts, and should not be considered as financial advice. Investors should make decisions based on their own objectives and financial situation.

Analyst comment

Neutral news. The market decline for McCormick & Company, Inc. over the past three years has raised concerns about investor sentiment. However, the decline in earnings per share (EPS) is steeper than the decline in share price, indicating disappointment in earnings. Total shareholder return (TSR) exceeded the decline in share price due to dividend payments. While the stock has underperformed in the short term, it has delivered a modest annual return over five years. Investors should consider various other factors, including valuation and financial health, before making an investment decision.