Bakkt, Crypto Firm Once Backed by Starbucks and Mastercard, Faces Cash Crunch in Rapidly Evolving Industry

Digital asset firm Bakkt, which counts Starbucks and Mastercard as former partners, revealed in a recent SEC filing that it is facing financial difficulties. The company stated that the rapidly evolving environment in the crypto industry has led to uncertainty and a potential shortage of cash to sustain operations over the next year. The revelation comes as Bakkt recently announced plans for international expansion and shifted its strategy to focus on providing crypto trading and custody services to financial institutions and fintech companies. The company is now seeking additional financing to meet its needs and overcome the challenges posed by market downturns and regulatory scrutiny.

Bakkt’s Strategic Shift and Expansion Efforts Introduce Uncertainty

Bakkt, which began as a crypto platform developed by Intercontinental Exchange, has undergone significant changes in its business approach. Initially targeting consumers through partnerships with major brands, the company later shifted its focus to offering crypto services to financial institutions and fintech companies. Bakkt’s new “business-to-business-to-consumer approach” aimed to embed crypto solutions into client environments. However, the company also made acquisitions in the consumer crypto sector and announced an international expansion plan, leading to increased risks and uncertainties.

Regulatory Scrutiny and Market Downturn Pose Challenges for Bakkt

The crypto industry’s regulatory landscape has placed pressure on Bakkt, leading the company to delist several crypto assets acquired through an acquisition. Regulatory scrutiny over whether certain tokens count as unregistered securities has forced Bakkt to remove Solana and Cardano from its platform. Additionally, the overall downturn of the crypto market and the collapse of major players like FTX have created headwinds for Bakkt. These challenges, combined with the company’s strategic shift and expansion efforts, further exacerbate the uncertainty surrounding its operations and financial stability.

Bakkt Shares Plummet as Financial Concerns Mount

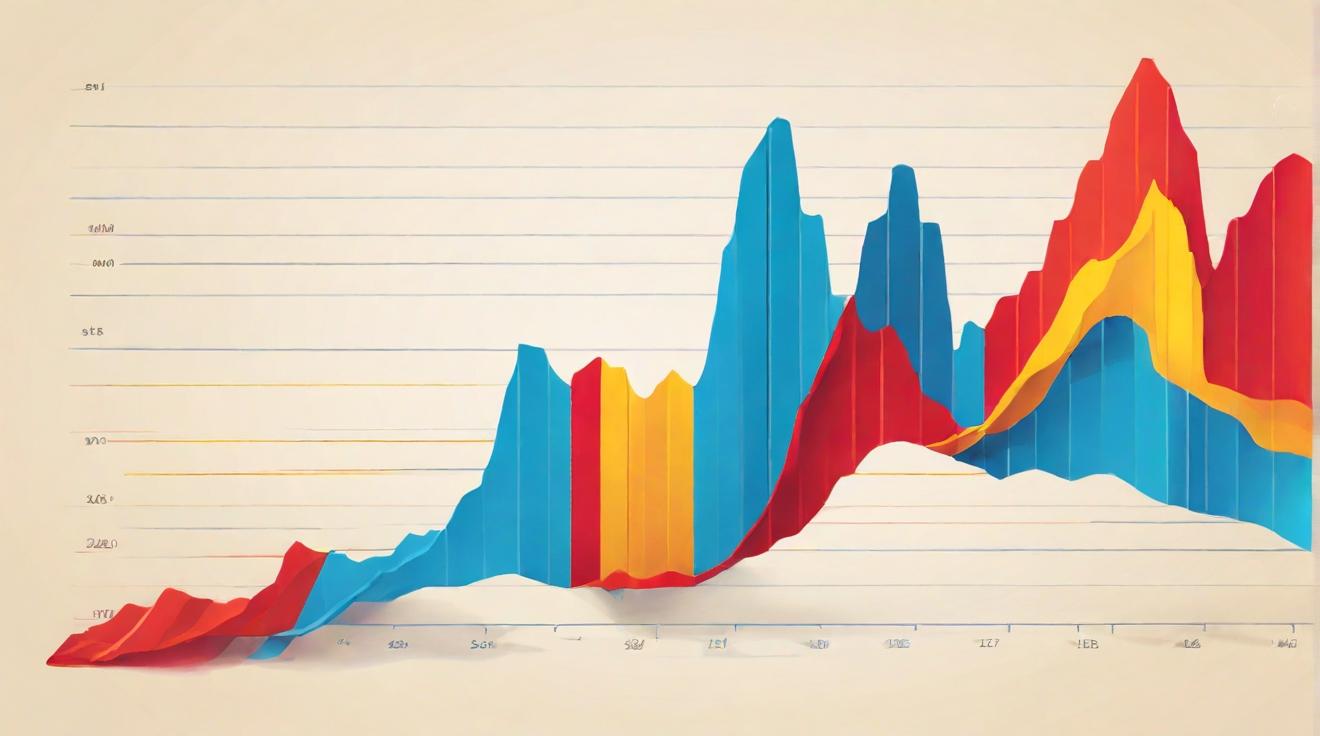

Bakkt’s struggles have had a significant impact on its stock price, which has experienced a sharp decline of nearly 90% over the past year. Following the disclosure of its financial difficulties, the stock price dipped even further shortly after the revised SEC filing. This downward trend reflects investors’ concerns about Bakkt’s ability to generate sufficient revenue and secure additional financing to sustain operations. As Bakkt seeks to address its cash crunch and navigate the rapidly evolving crypto industry, the future remains uncertain for the once-promising digital asset firm.

Seeking Additional Financing to Support Operations

In light of its financial challenges, Bakkt is actively seeking additional financing to ensure its ability to continue operations in the coming year. The company recognizes the need to raise more money in order to increase revenues substantially and avoid running out of cash. Bakkt’s efforts to secure funding reflect its commitment to overcoming the current obstacles posed by market conditions and regulatory uncertainties. The success of these financing endeavors will play a crucial role in determining the future trajectory of Bakkt and its ability to thrive in the competitive crypto industry.

Analyst comment

Negative news: Bakkt, a once-promising crypto firm backed by Starbucks and Mastercard, is facing financial difficulties due to the rapidly evolving industry. The company’s stock price has plummeted, and it is seeking additional financing to sustain operations. The challenges posed by market downturns, regulatory scrutiny, and its strategic shift and expansion efforts make the future uncertain for Bakkt. The success of its financing endeavors will determine its ability to thrive in the competitive crypto industry.