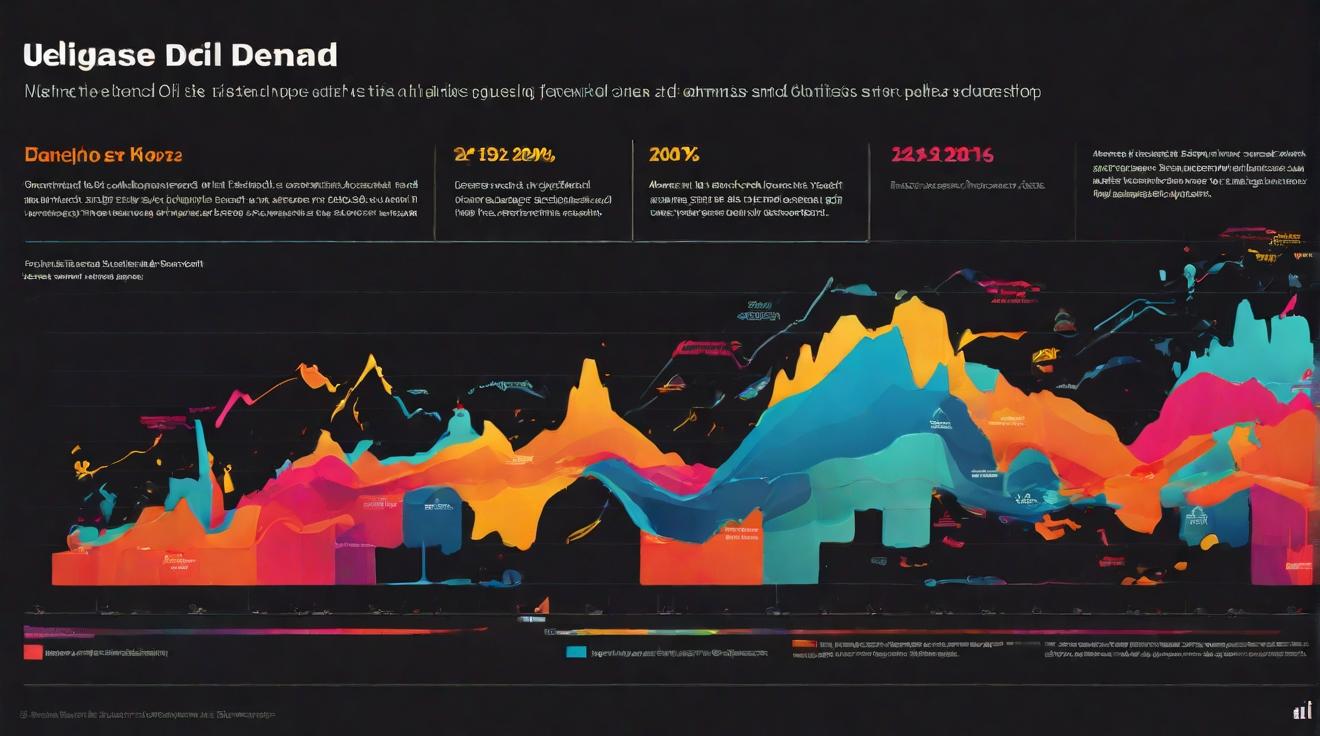

Historical Crises: Valuable Lessons for Today’s Finances

As the saying goes, history has a way of repeating itself. This holds true for financial crises as well. Throughout history, we have witnessed numerous economic disasters that have left lasting impacts on global markets. However, these crises have also provided valuable lessons and insights that can be applied to navigate the challenges of today’s finances. By studying the past, we can gain a deeper understanding of the financial strategies that have proven effective in times of crisis.

Applying Insights from Past Crises to Navigate the Present

The world has faced various crises over the years, including the Great Depression of the 1930s, the financial crisis of 2008, and more recently, the COVID-19 pandemic. Each of these events has highlighted the importance of being prepared and having a diversified portfolio. During the Great Depression, for example, those who had spread their investments across different sectors fared better than those heavily invested in a single industry. Similarly, the 2008 financial crisis revealed the dangers of excessive leverage and the need for stricter regulations to prevent such risks.

Analyzing Financial Lessons from Historical Disasters

By analyzing past financial disasters, we can identify patterns and trends that can help us make informed decisions in the present. One key lesson is the importance of liquidity. During times of crisis, access to cash becomes crucial. This was evident during the Great Recession, when many individuals and businesses struggled due to a lack of liquidity. Another lesson is the significance of risk management. The collapse of Long-Term Capital Management in 1998 showcased the importance of properly assessing and managing risk to avoid catastrophic losses.

Unearthing Past Wisdom: How Crises Illuminate Financial Strategies

Crises have a way of highlighting the strengths and weaknesses of different financial strategies. For example, during the dot-com bubble in the late 1990s, many investors were drawn to tech stocks with high valuations, only for the bubble to burst, leading to significant losses. This serves as a reminder to carefully evaluate investment opportunities and not get caught up in speculative frenzies. On the other hand, the success of value investing strategies during times of crisis, as exemplified by Warren Buffett, highlights the importance of a long-term perspective and a focus on fundamental value.

Journalistic Investigation: Applying Historical Insights to Modern Finance

To truly benefit from the lessons of historical crises, journalists and analysts must conduct thorough investigations into past events and their impact on financial markets. By examining the causes and consequences of previous disasters, journalists can shed light on the warning signs and red flags to watch out for in the present. This investigative work can provide valuable insights for investors, policymakers, and the general public, helping them make informed decisions and avoid repeating the mistakes of the past.

In conclusion, historical crises offer valuable lessons and insights that can be applied to navigate today’s financial challenges. By studying the past, we can learn from the mistakes and successes of previous generations. From diversification and risk management to the importance of liquidity and a long-term perspective, these lessons can help us make more informed financial decisions and better prepare for future crises. Journalistic investigations into past events are crucial in unearthing these insights and ensuring that they are effectively communicated to the public.